QuiCQ 01/04/2025

April's Fool Day

“Let us be thankful for the fools. But for them the rest of us could not succeed.”

— Mark Twain

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Today is April’s Fools day, but I am not sure whether it is coming day too late or a day too early…

A day too late, as most non-US markets were fooled into a mayhem sort of believe that market were melting down ahead of Wednesday’s much loathed “Liberation Day”.

A day too early, has many may still hope that exactly this “Liberation Day” may turn out to be just a bad joke/prank.

Regarding tomorrow, and I am sure we’ll have more to write it tomorrow and many days after, it would be important that the US administration comes over as clearly as possible with what their (tariff) plans are, to at least remove uncertainty. This could lead to a “sell the rumour, buy the fact” situation. But beware, I assign a low to very low possibility to such an outcome. I would expect the message coming out of the Rose Garden to be as ambiguous and nebulous as ever …

Back to yesterday’s session for a moment …

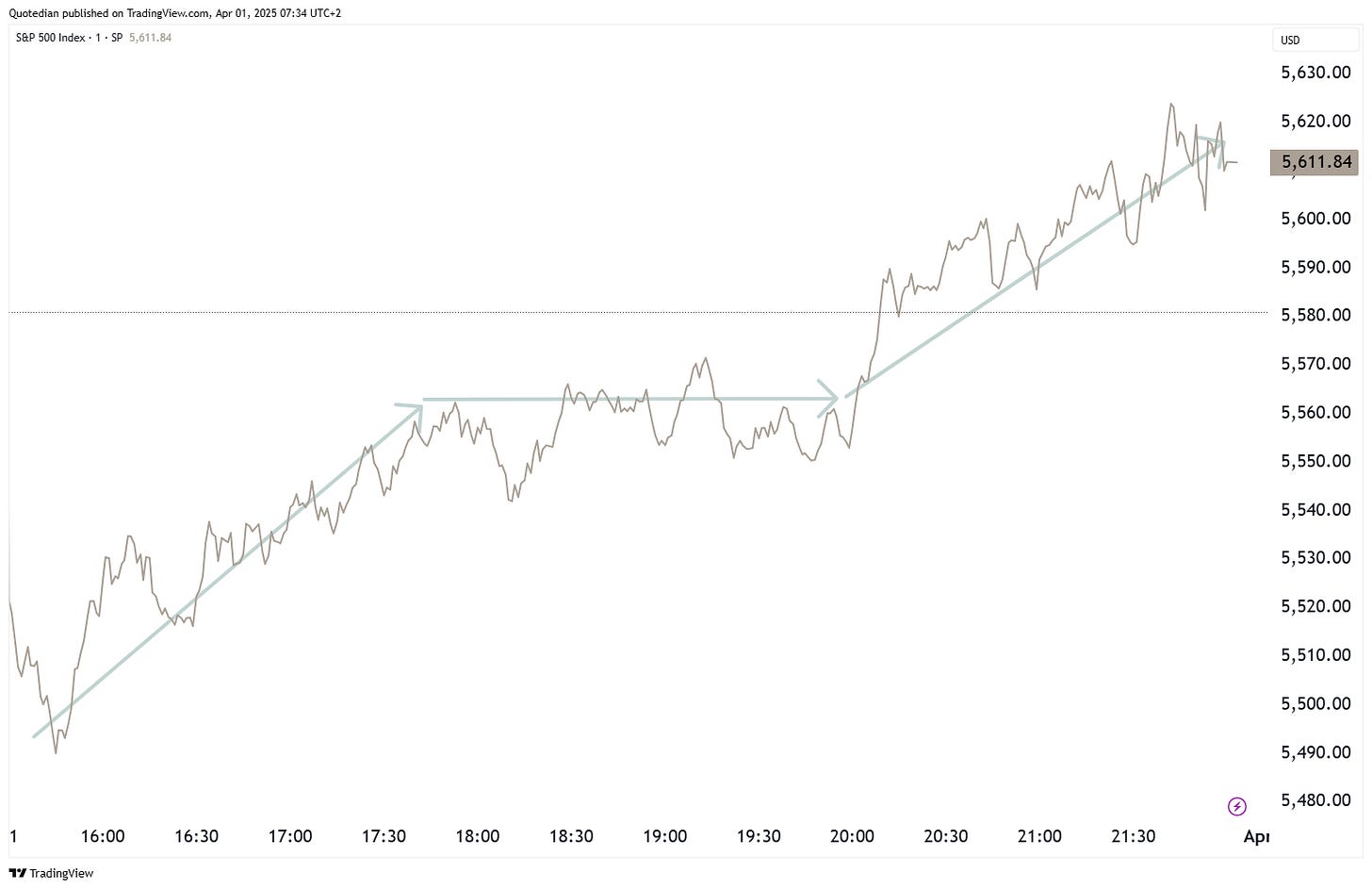

US stocks hit the session’s low shortly after the opening bell, probably due to massive JP Morgan options whale (JHEQX) induced month-end repositioning/hedging adjustments. The initial weakness was followed by a recovery roughly into the European closing bell, some sideways mumbling until 8 pm CET, followed by a renewed uptrend acceleration in the last two trading hours:

Hence, after the Nikkei’s 4% early Monday drop and European equities (SXXP) hitting a down nearly two percent session low, the S&P and the Dow closed up, whilst the Nasdaq flat.

Not only that, but also did ten (!) out of eleven sectors close up on the day, consumer discretionary (-0.18%) being the only exception and in the S&P 500 market breadth was strong with nearly four stocks up for every stock down.

Movement in bond markets were relatively benign in comparison to equity markets and currencies markets did not shift too much either, so let me just highlight one more asset class move from yesterday, which is none other than Gold!

Our blow-off top ‘prediction’ back in February (click here) is happening - now comes the tricky part … where or when to take profit?!

Clearly, quarterly rebalancing helped equity markets to recover and we may get some more upside today, thanks to 401k inflows at the beginning of every quarter. Tomorrow, expect volatility to increase again.

Today is a triple witching day for me here, with publishing of this QuiCQ, the month-end Quotedian and our NPB Quarterly Outlook and Global Asset Allocation all planed for the next few hours. Hence, I am keeping this purposedly short, but make sure to sign up to the Quotedian for some monthly & quarterly performance insights out later today:

Time's up, more tomorrow - May the trend be with you!