QuiCQ 01/10/2024

Here we go!

“History Doesn't Repeat Itself, but It Often Rhymes”

— Mark Twain

Prefer to read today’s QuiCQ in PDF? No prob, download it here, but don’t you dare complain about the formatting!

A true quick QuiCQ today, as we are fully tied up in our investment committee and end-of-month/beginning-of-month portfolio and reporting activities.

Firstly, the Chinese stock market did not rise another 8% today. Nor did it fall 8%. Mainly due to the fact that it was closed in celebration of the Golden Week and will remain so until Tuesday of next week. Good, something less to worry about ;-)

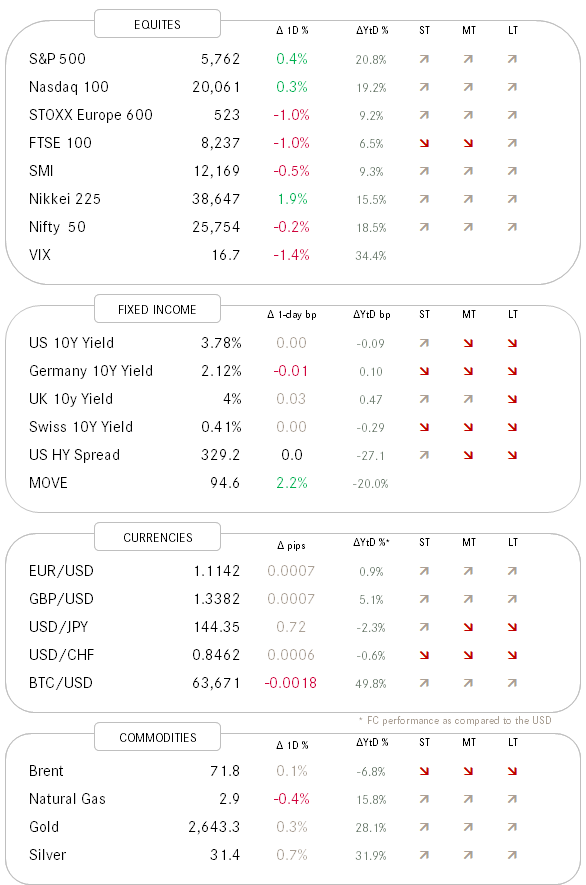

Major indices in the US all eked out literally last 15 minutes gains as stocks rallied into the closing of the month. The S&P 500 advanced two percent during September, which is not bad given the very bumpy start we had to the month:

Already August so a similar pattern of very negative beginning to the month, followed by a recovery rally and then some. Is the same in store again for October?

Not necessarily from a seasonal point of view, as today’s COTD shows, but so far little regarded headlines as the following could always lead to some turbulences:

Or the same, differently:

Or, of course the following:

Aaahh, that tall, tall Wall of Worries …

Anyhow, stocks were pressured during most of yesterday’s session, as Federal Reserve chairman Jerome Powell insinuated he expects to see two more quarter-point rate cuts this year. That was a disappointment to investors who have silently hoping guessing betting on deeper cuts to round out 2024. However, as forementioned, by session end optimism reigned and stocks closed in the green.

Whilst Powell’s comments did not massively impact interest rates, it did provoke a recovery rally on the US Dollar, through which that view of larger rate cuts had mainly been expressed.

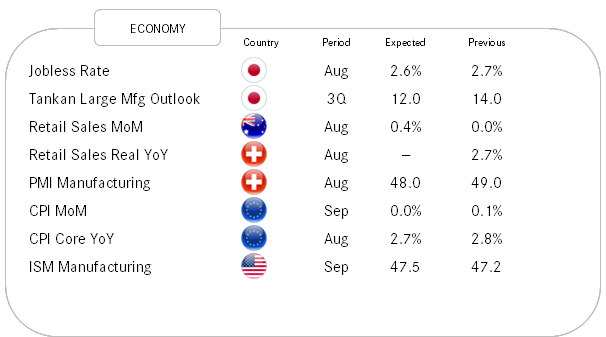

Early this morning some positive economic news out of Japan pushed the Nikkei two percent higher (or maybe it was just bounce back from the previous’ day nearly five percent slump). ISM manufacturing reading in the US later this afternoon could also get some attention.

Have a great day!

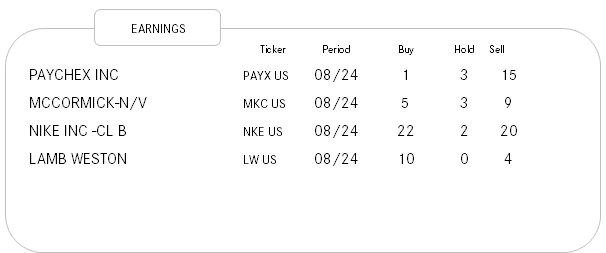

Spoiler Alert! This is one of the 100+ charts we are going to use in our Q4 outlook. It shows the seasonality of the 4th year in the US presidential cycle since Clinton was voted into office for a first time.

A) it demonstrates that we have successfully navigated the most difficult period of the cycle (September) and B) we are heading now into what should be the best period for stocks during this 4th year.

Now, go back to the top of this document and read Mark Twain’s quote again.