QuiCQ 02/10/2025

What, me worry?

“What you do makes a difference, and you have to decide what kind of difference you want to make.”

― Jane Goodall

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

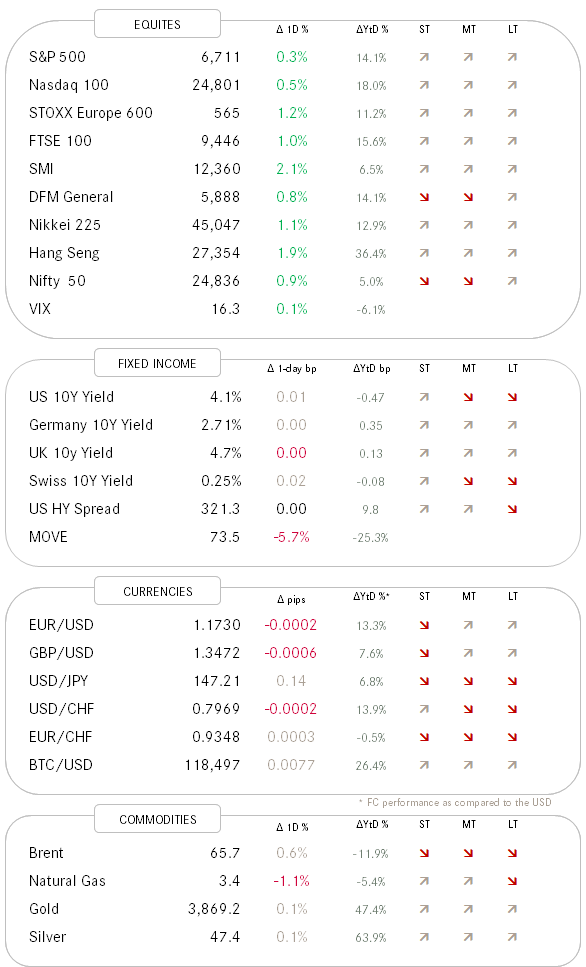

As Alfred E. Neuman, the fictional character in the American humour magazine “MAD”, famously asks “What, me worry”, the market is continuing to shrug of any (bad) news and continues to stampede higher.

In its latest edition, Mr. Market (I personalise ALL investors around to globe here because its easier to demonise) decided that the US government shutdown, which could give the current administration excuse for permanent layoffs instead of only temporary furloughs, does not matter and sent all three major US large cap indices (Dow, S&P and Nasdaq) to new all-time highs. Here’s the Nasdaq 100 for example:

HOWEVER, it was not all fun and fireworks, as on the S&P 500 more stocks fell than advanced on the day, meaning that the rally was once again led mostly by the Mag 7:

One trend to watch is the weakness in financials, which amongst the largest (XLF)caps is not alarming yet,

but in some subsegments, such as in Business Development Companies, better know as BDCs, and which can be used as a proxy to private debt, is pretty worrying already. Here’s an ETF (BIZD) to proxy that sector:

Closing in on those April lows quickly … I will probably write a bit more about this in an upcoming Quotedian, so … stay tuned!

Bond markets don’t seem to be missing the government either, or maybe it is the sudden removal of government-massaged economic data previously planned to be release (point-in-case Friday’s NFP), that got the vigilantes relaxed, but 10-year yields in the US dropped by 5 basis points for example yesterday:

For currency markets, the yesterday was a big, fat nothing-burger and even worthwhile putting up a chart.

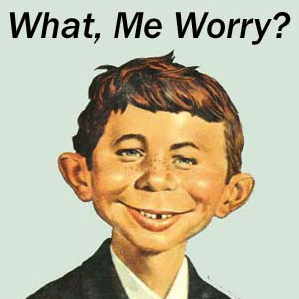

STOP! Maybe one yes, even though it is probably less important to most of us (for now). The Argentina Peso is on the move again, as investors are becoming concerned about the lack of any details regarding that USD20 billion swapline promised indicated by US Treasury secretary Bessent last week. Here’s the USD/ARS chart:

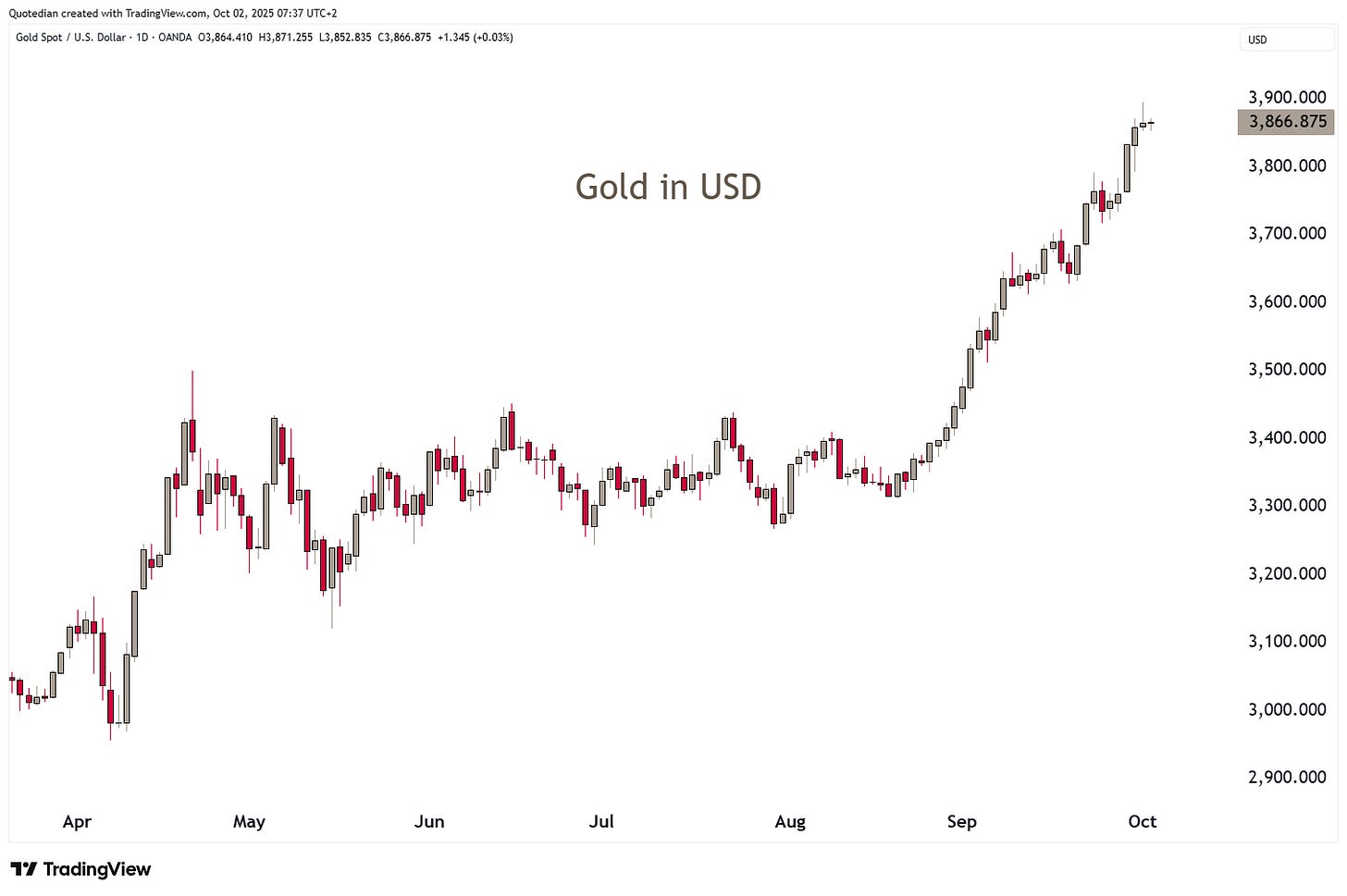

At lastly, the only chart you probably need to listen to, is continuing to tell us that we are continuing to head for trouble, either economically or geopolitically ……………………… or both!

The good: Silver (top clip) is close to its highest level since 2010/2011.

The bad: However, it is also about as overbought (bottom clip) as it has been since then.

The hope: Silver got overbought in mid-2010 and stayed overbought for nearly a year.

We continue to think: ROCKS OVER STOCKS.

Stay tuned!

If the bond market is shrugging off the shutdown while yields slide, that disconnect seems like a risk waiting to be repriced.