QuiCQ 03/02/2026

Quick QuiCQ

“Don’t trust your own opinion and back your judgment until the action of the market itself confirms your opinion.”

— Jesse Livermore

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Today’s QuiCQ will be so quick, I shouldn’t even be writing it. However, there was one data point released on the US economy yesterday, which may have gone largely unnoticed, given all the excitement surrounding the precious metals space and the new Fed Chair nominee.

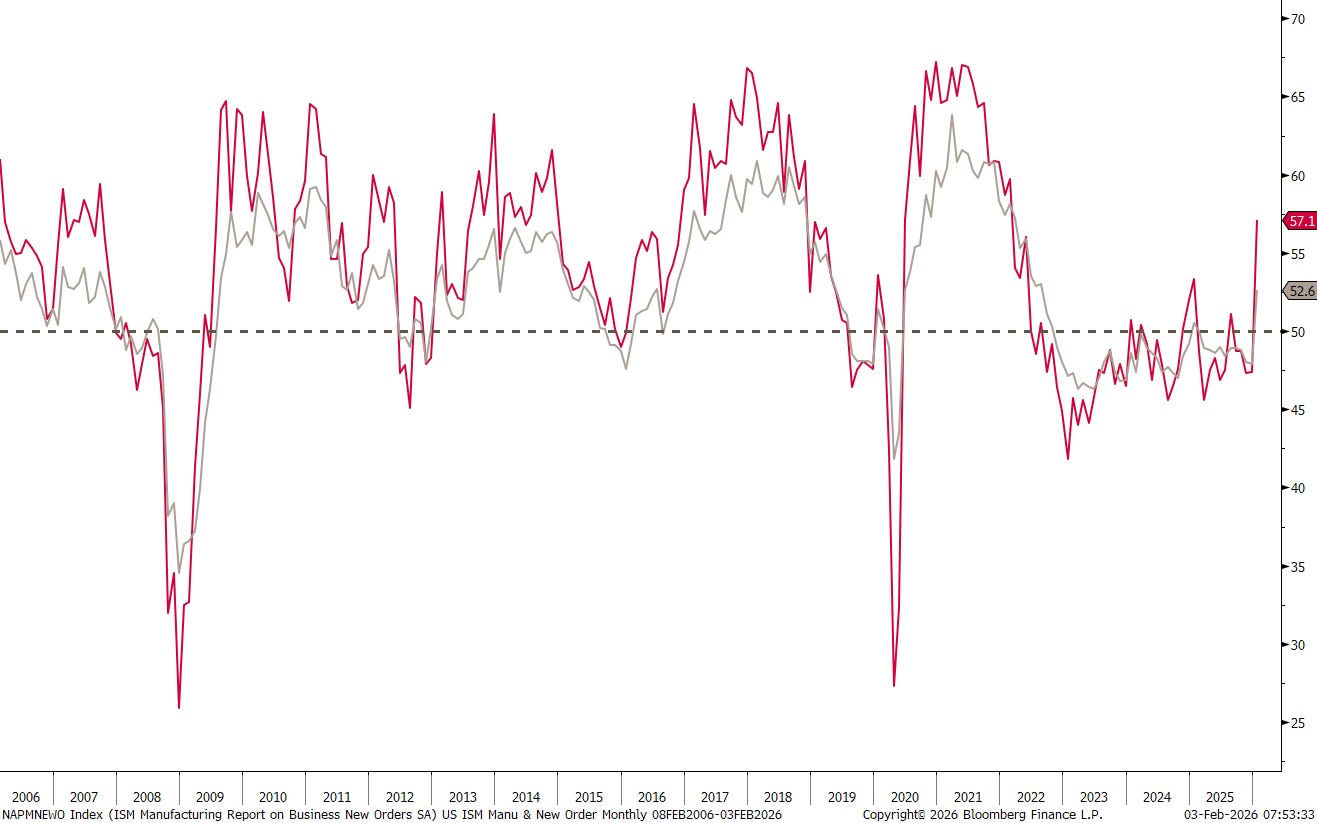

Yes, of course I am talking about the ISM Manufacturing PMI and ISM Manufacturing New Orders surveys:

As a reminder, any reading above 50 means expansion, below 50 contraction.

Now, not only did the PMI see a solid reading for a first time above 50 since 2022, but especially new orders hit its highest level since the post-pandemic recovery in 2020/2021.

This, of course, fits very well with our 2026 outlook (click here), which foresees an economic recovery post the mid-cycle slowdown last year (which eventually will lead to overheating, but that’s a story for another day.

These ‘surprise’ readings were then probably also responsible, with the permission of Fed Chair nominee Warsh, for US bond yields to press higher yesterday, rebounding from what previously resistance (dashed line), now turned support:

That’s all for this morning - have fun out there.

André