QuiCQ 03/04/2025

Economic World War III (🐫 + 🌾 = 💥)

“When written in Chinese, the word 'crisis' is composed of two characters—one represents danger, and the other represents opportunity.”

— John F. Kennedy

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

So, hear we are, with that silly Liberation Day thingy out of the way. However, turns out it was not that non-event many had been hoping for. I will be really lazy and copy Bloomberg’s John Authers’ bullet points from his letter this morning to highlight the most important takeaways:

The blanket versus reciprocal tariffs debate has been resolved: Both.

10% blanket tariffs on all imports, starting April 5.

Tariffs of 54% on China, 20% on the EU, 24% on Japan, 26% on India, from April 9.

Mexico and Canada avoid new tariffs for now.

The UK escapes with a 10% tariff — a Brexit dividend at last.

China and small Asian countries like Vietnam seem the worst affected.

We are here to observe markets and that’s what we’ll do also in today’s letter, leaving some deeper deliberations for Sunday’s Quotedian (sign up here), but also not forgetting our innate sense of humour. Hence, we are not sure if yesterday Mr Trump wanted to appear a gameshow host,

or Charlton Heston in the Ten Commandments:

Onwards.

We can largely forget yesterday session, though we should mention that the ADP Employment figure was substantially better than expected. Correlation to Friday’s non-farm payroll (NFP) numbers is usually pretty low, but still …

This is what equity futures are reading at about 7:30 this morning:

Should we get countermeasure to the reciprocal tariffs (this is getting complicated) already today,

which would surprise me (but hey …), then the above futures numbers should double. To the downside of course.

Global bond yields are massively lower, with the Tens at 4.04% right now having been catapulted out of its trading range and well below any reasonable support:

The US Dollar, as could be expected, trades lower versus most its major adversaries enemies trading ‘partners’:

The EUR/USD cross is closing in on the 1.10 level:

It is still early hours, and everything could reverse by market close as it so often has, but in the current constellation, it looks like the Euro could still move substantially higher versus the USD:

Gold had it’s hay-minutes, but has come down again a bit over the past few moments:

I am sure there are thousand more market moves to comment, but in order not to overheat reader (nor writer!), let’s leave it at this.

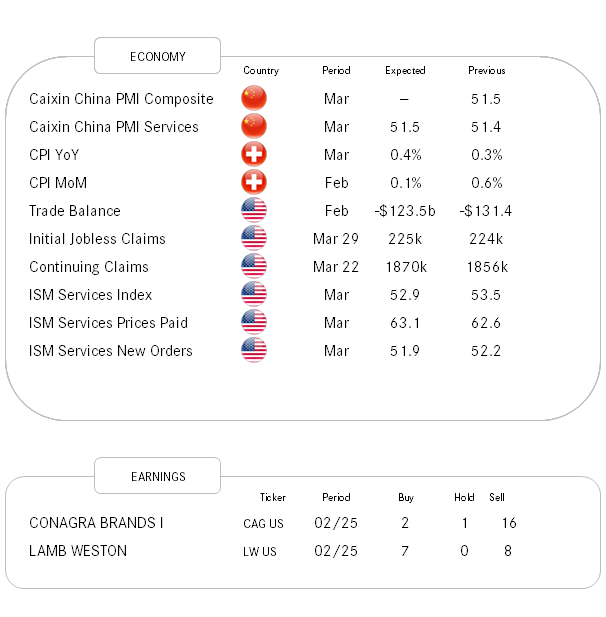

It’s seems utterly irrelevant given the current context, but we get global services PMIs today, as well as the ECB’s account of its March meeting, then initial jobless claims and the ISM services survey.

Time's up, more tomorrow - May the trend be with you!

So I will end today’s QuiCQ not with a Chart of the Day, but with the questions:

“Have we entered Economic World War III? Was yesterday the straw that broke the camels back?”