QuiCQ 03/07/2025

Goooood Morning, Vietnaaaaam!

“Good morning, Vietnam! Hey, this is not a test. This is rock and roll.”

— Adrian Cronauer (played by Robin Williams)

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

So many things to write about, so little time … Speedround!

1)

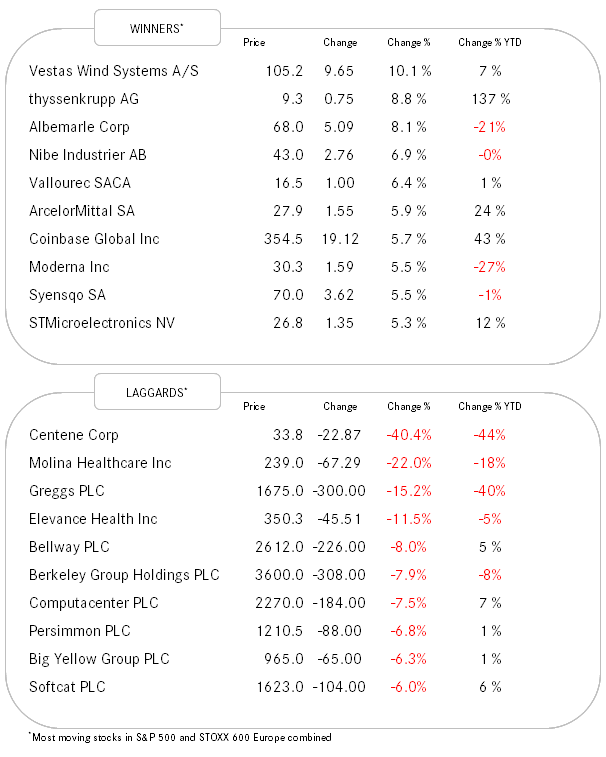

Equities were nearly the sideshow yesterday, despite a solid performance around the globe. The S&P 500 edged half a percentage point higher, with more or less solid participation. Highflyers were commodity related sectors (spoiler alert - this will likely be the central theme of the Quotedian coming out next week):

but,

2)

the real stars of yesterday’s show were small cap stocks, which were able to close for a second consecutive session above their 200-day moving average, confirming a second breakout:

The odds for a continued (and investable) rally have just been increased substantially.

3)

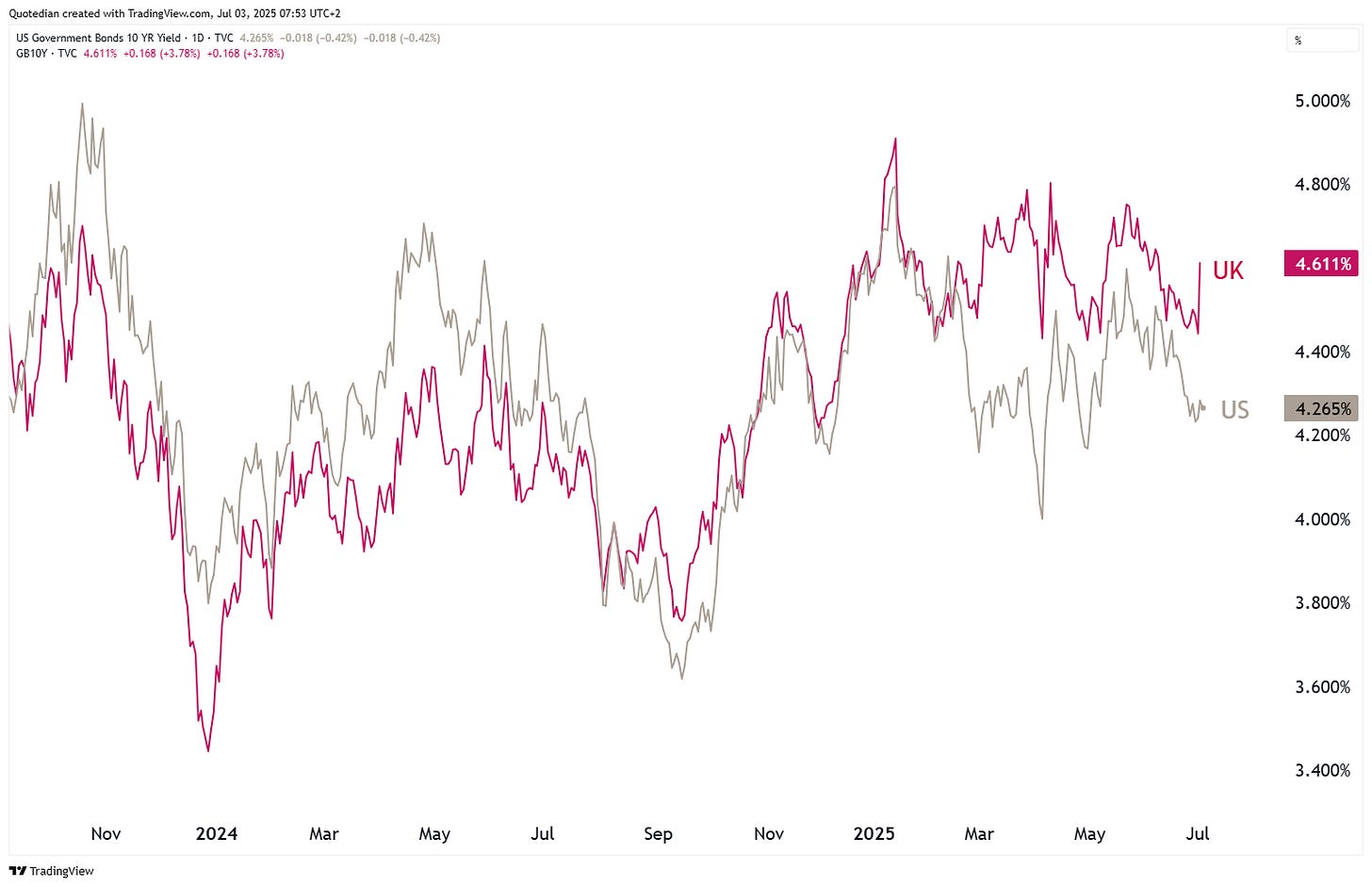

Yields in the US picked up a tad over the past two session, either in response to a slew of not-that-shabby employment data, OR,

4)

due to being dragged higher by UK bond yields, with which they show a historic close correlation,

as UK yields jumped intraday 25 basis points,

awakening memories of the “Truss moment” three years ago. This after Prime Minister Keir Starmer failed to confirm that Chancellor Rachel Reeves would be in her post at the next general election. Reeves has focused on fiscal stability during her tenure in office and concerns about her future left investors anxious that any replacement would be more lax with spending. To be continued …

5)

And then there is of course that potential trade agreement between the US and Vietnam. The news is lifting the Ho Chi Minh stock index to new cycles highs:

6)

Finally, with the US closed tomorrow for independence day (let’s all cross our fingers that Trump spends more time golfing than tweeting), a bunch of US data is due today, with one to rule them all of course. The monthly NFP.

Given the absence of any extreme reading (and Trump tweets), today’s and tomorrow’s session could turn out to be quiet and mildly positive.

Time's up, more tomorrow - May the trend be with you!

We already discussed further up that the Russell 2000 (small cap stocks) has finally been able to move above its 200-day moving average and that the outlook has just improved substantially. But will momentum be enough to propel small cap stocks to new all-time highs, ending the third longest streak with no new ATH?