QuiCQ 03/12/2025

Stay tuned!

“When it comes to staying tuned: if you rest, you rust.”

— Helen Hayes

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

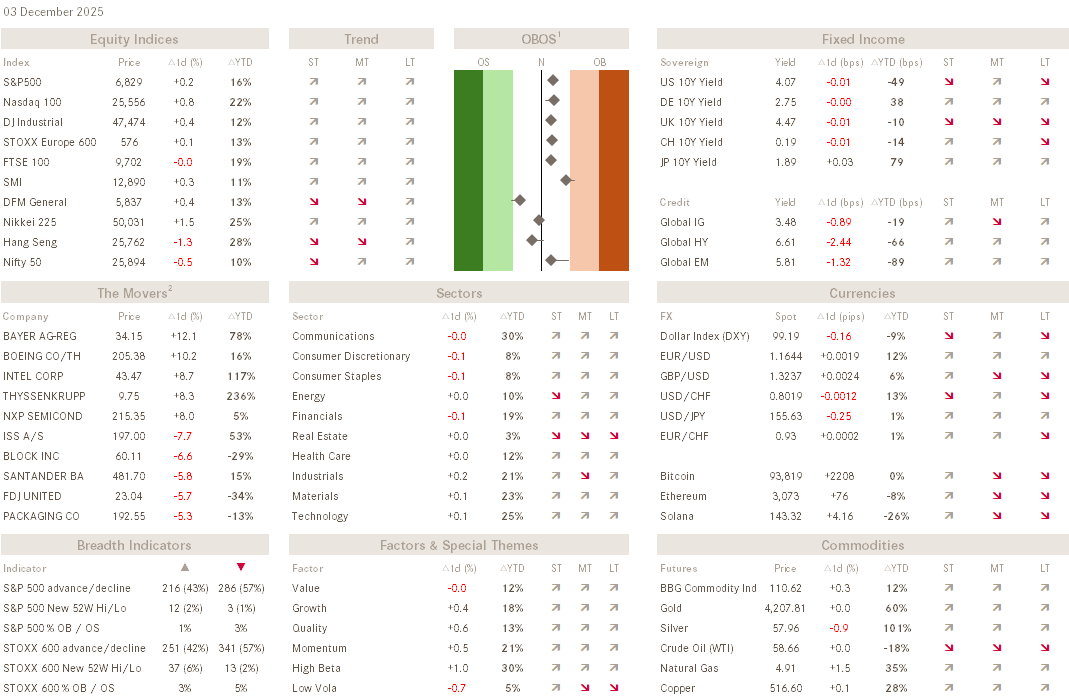

After a roller-coaster-style November for stocks, December has started with a decisively more relaxed tone. Stocks a bit down on Monday, stocks a bit up on Tuesday …

The S&P 500 eked out a quarter of a percentage gain in yesterday session, though it is to note that more stocks were lower (286) on the day than those closing higher (216), leaving us with a colourful heatmap:

Noticing that the largest cap stocks (Mag 7) above saw some good advances, we may deduct that the S&P 500 equal-weight index may have closed lower on the day:

Bingo!

Turning back to the ‘normal’ cap-weight version of the same index, there is one pattern we must heed some attention too:

For now, the S&P 500 has been putting in a series of lower highs (arcs) and lower lows (pointing hands), i.e. the most simple definition of a downtrend! Little upside is needed to break that pattern, but failure to do so … stay tuned!

Asian equity markets are very mixed this morning, with maybe a one percent move higher in Japan’s Nikkei 225 deserving an extra mention:

Despite this move higher this early Wednesday, the index continues to trade within a consolidating triangle - stay tuned for resolution out of it either side (two third chances for a move higher).

Little to write about from fixed income markets, with the not neglectable exception of yields on JGBs (Japanese Government Bonds), where the 10-year version just hit a nearly 20-year high:

This theme will not go away in 2026, but rather gain importance … stay tuned here too!

The US Dollar index (DXY) continues to move lower, away from our line in the sand (aka resistance) at 100:

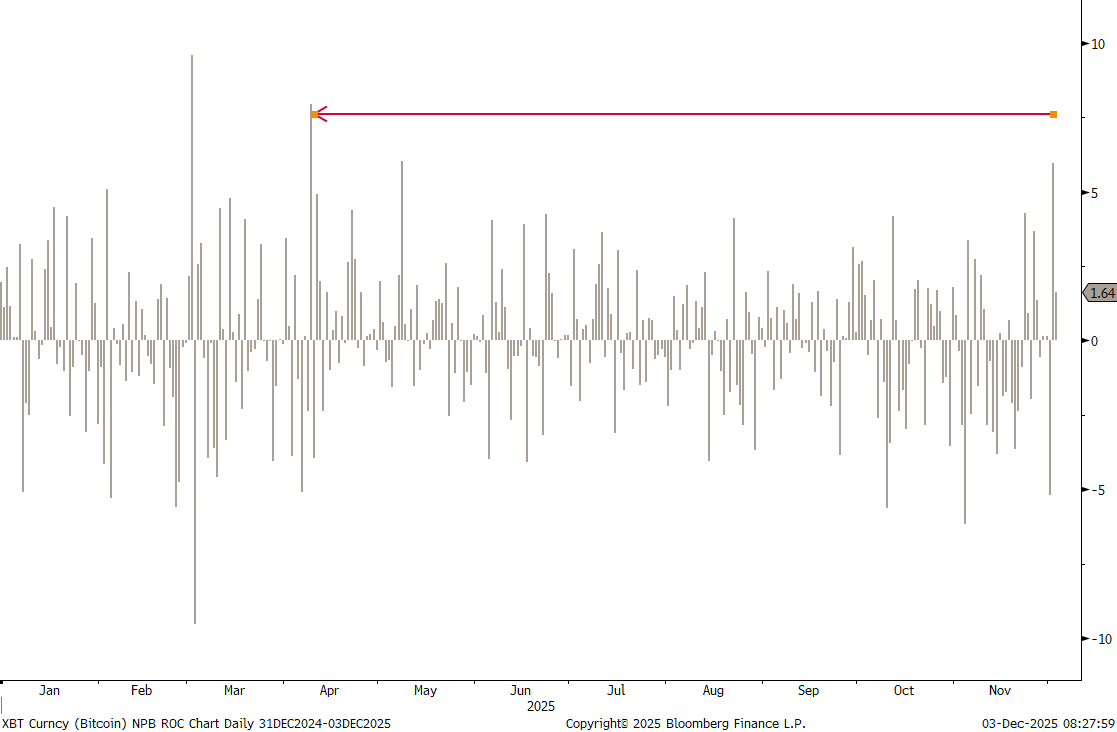

Maybe more of focus in the currency realm are cryptos, where Bitcoin had one of its best sessions since April if we add up 24 hours of trading, which is indicated by the red arrow:

Suddenly, the outlook for this cryptocurrency looks substantially more constructive - and a move above 95k would further dramatically improve the outlook:

I would suggest, you … stay tuned!

Finally, in the commodity space, DO NOT stay tuned on Silver:

Act!

And in case you did really miss the upmove, despite our manyfold suggestions to ride the rally, maybe here’s your catch-up chance in Palladium:

That’s all for today - have a great day!

Andray (ha, ha)

Gold tends to be inversely correlated with the S&P 500 on a cyclical basis. But their trends on a long-term basis have been nearly identical:

Is the end of decade target for both 10,000? Stay tuned…