QuiCQ 04/09/2024

Seasonal Greetings

“If you must panic, panic early. Be scared when you can, not when you have to.”

— Nicolas Taleb

Prefer to read today’s QuiCQ in PDF? No prob, download it here, but don’t you dare complain about the formatting!

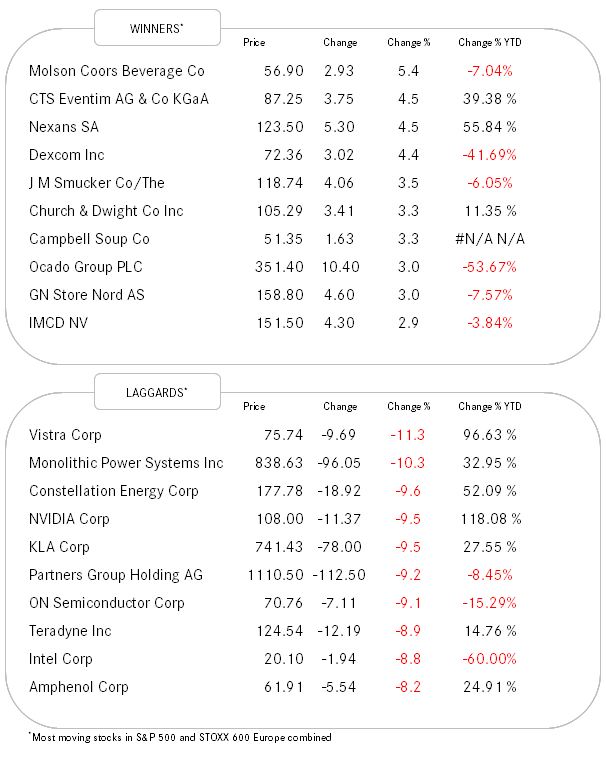

Ouch! (US) investors came back with a clear “risk off” attitude from their long “labour day” weekend. The S&P dropped over two percent, whilst the Nasdaq added another (negative) percentage point on top of that. Spoiler Alert: A quick glance at the ‘Laggards’ table above will reveal that this was a semiconductor stock led sell-off. An indeed, was the Philadelphia Semiconductor index (SOX) down a whooping 7.75%

Given the constellation of the graph above (recovered exactly 61.8% of August losses only to turn lower again), there is likely some more downside here (please read Quote of the Day again).

Not trying to be the eternal optimist here, but rather looking for a silver lining, the stocks up/down ratio was ‘only’ about 1-to-2.4, and still ten times more stocks (71) hit a new 52-week high, as compared to seven hit a new 52-week low. Nevertheless, be cautious before jumping the bullish bandwagon to early, as today’s Chart of the Day would suggest.

There is more nastiness coming out of Asia this morning, with the Nikkei slipping more than four percentage points as I type, though losses on other APAC markets are a bit more muted.

Across other asset classes a relative calm prevails, with maybe only an 8 bps drop in the US 10-year Treasury and the Bund yield of note, as some bond safe haven buying seems to take place.

Markets will probably remain in a nervous state until Friday’s payroll number - be opportunistic.

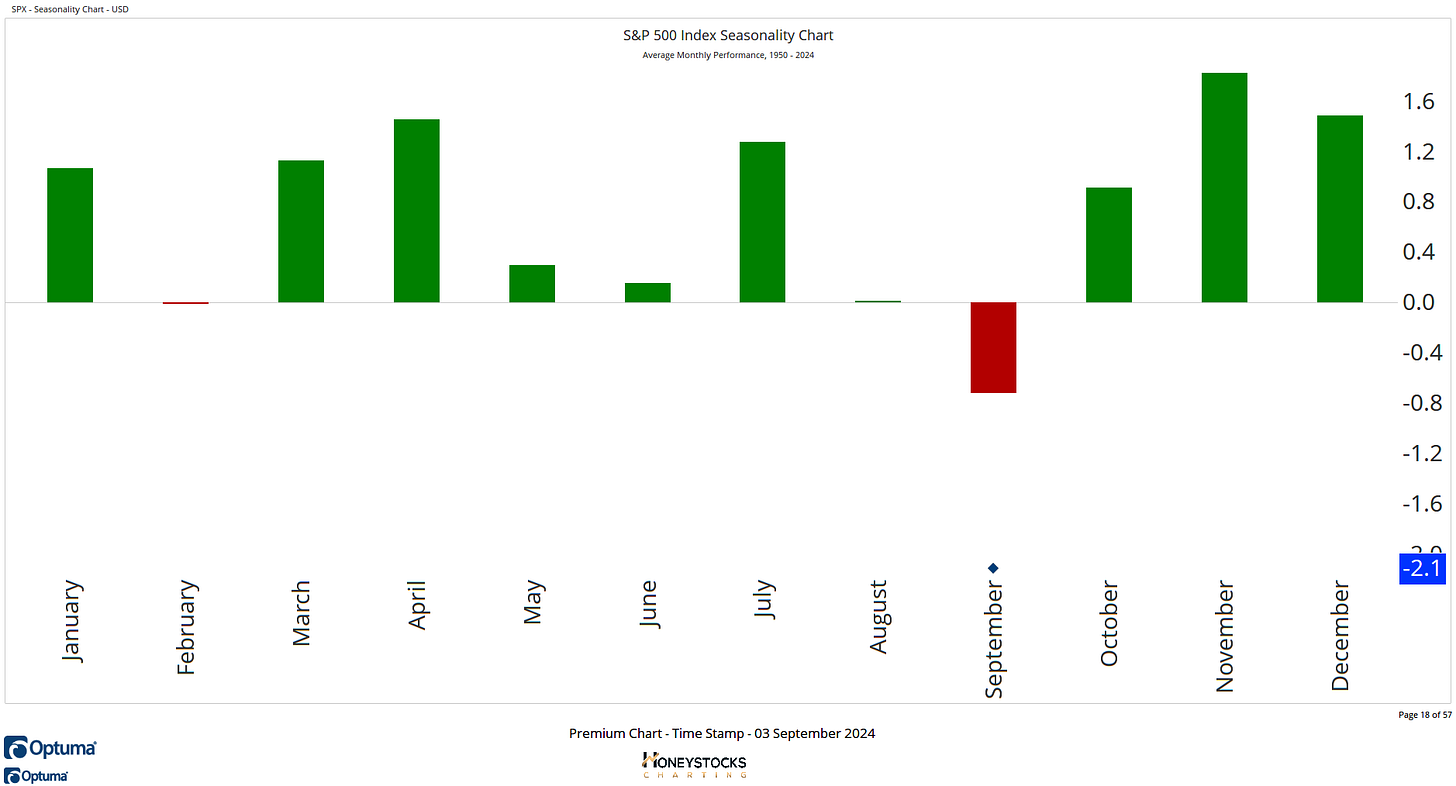

Below are a series of different charts to look at stock market seasonality. All of them are US focused, but as we know that this dog still wags the tail …

The message is clear: “Use weakness to build up position in stocks you like!” (you didn’t see that one coming, eh?).

Stay tuned …