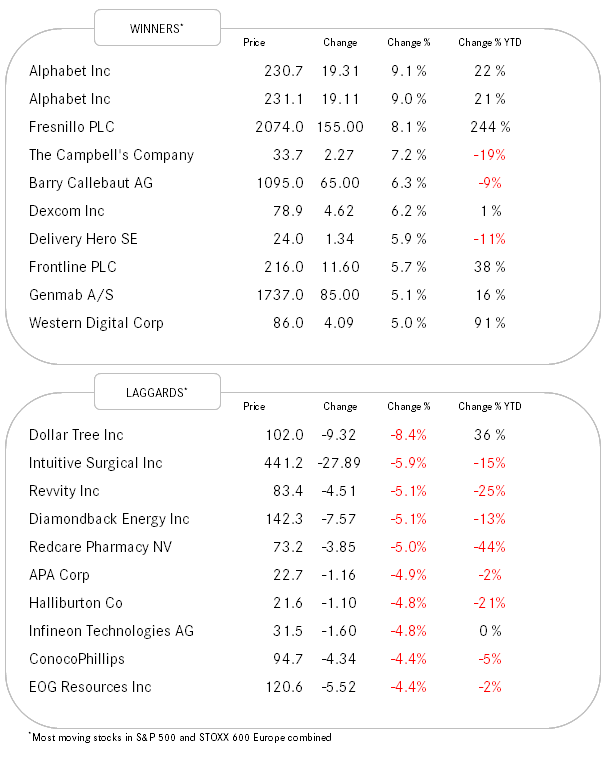

QuiCQ 04/09/2025

We're back! (nearly)

"The stock market is the creation of man that has most humbled him."

— Alan Shaw

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Dear QuiCQ-Fellowship,

We’re nearly there, we’re nearly back. The initial plan was to restart this week, but several large projects and client meetings have kept me from re-launching the QuiCQ in the manner and quality you deserve. Today is a quicq 😉, officially the new season now starts next week on Tuesday, September 9th, with a partial make-over.

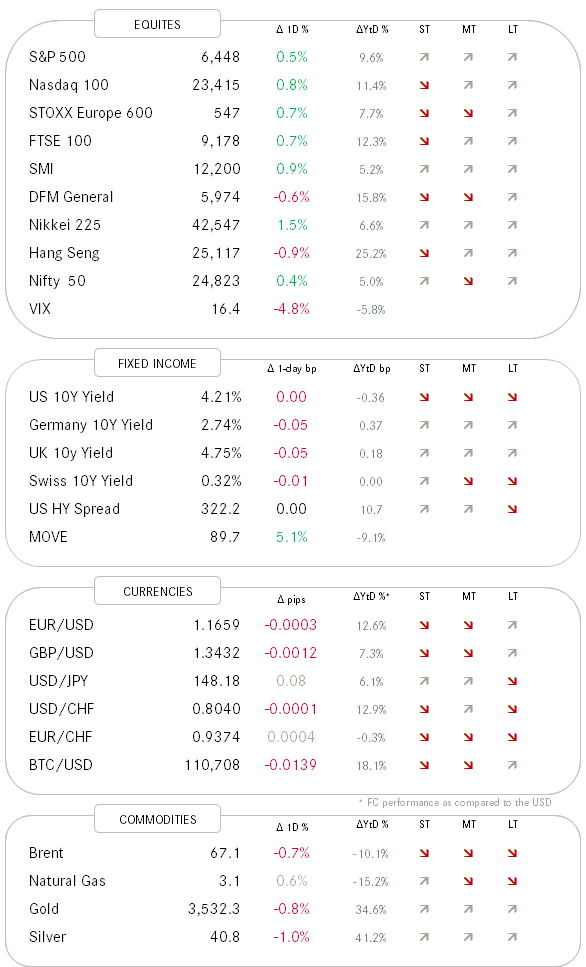

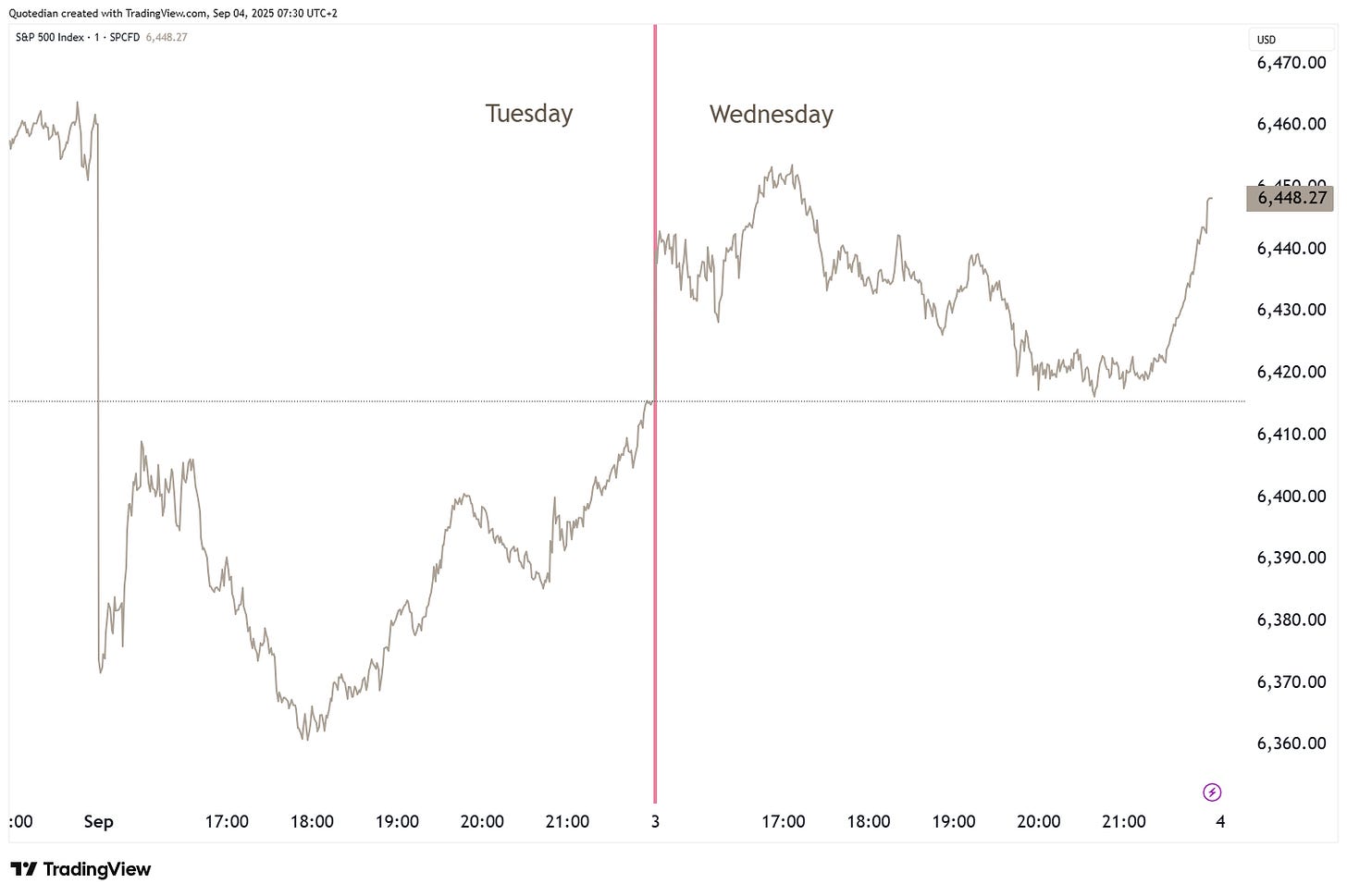

After a rocky start to the month on Tuesday, the S&P 500 saw a decent recovery yesterday, followed-by a fading away of the early gains achieved, but finalizing the day with a fulminant rally into the close:

The ratio between advancing and declining stocks was roughly equal, maybe with a slight slant to the latter, which in turn means that the heavy-swingers in the index probably did well:

Bingo! Apple and Google seemed to have been the saviours of the day.

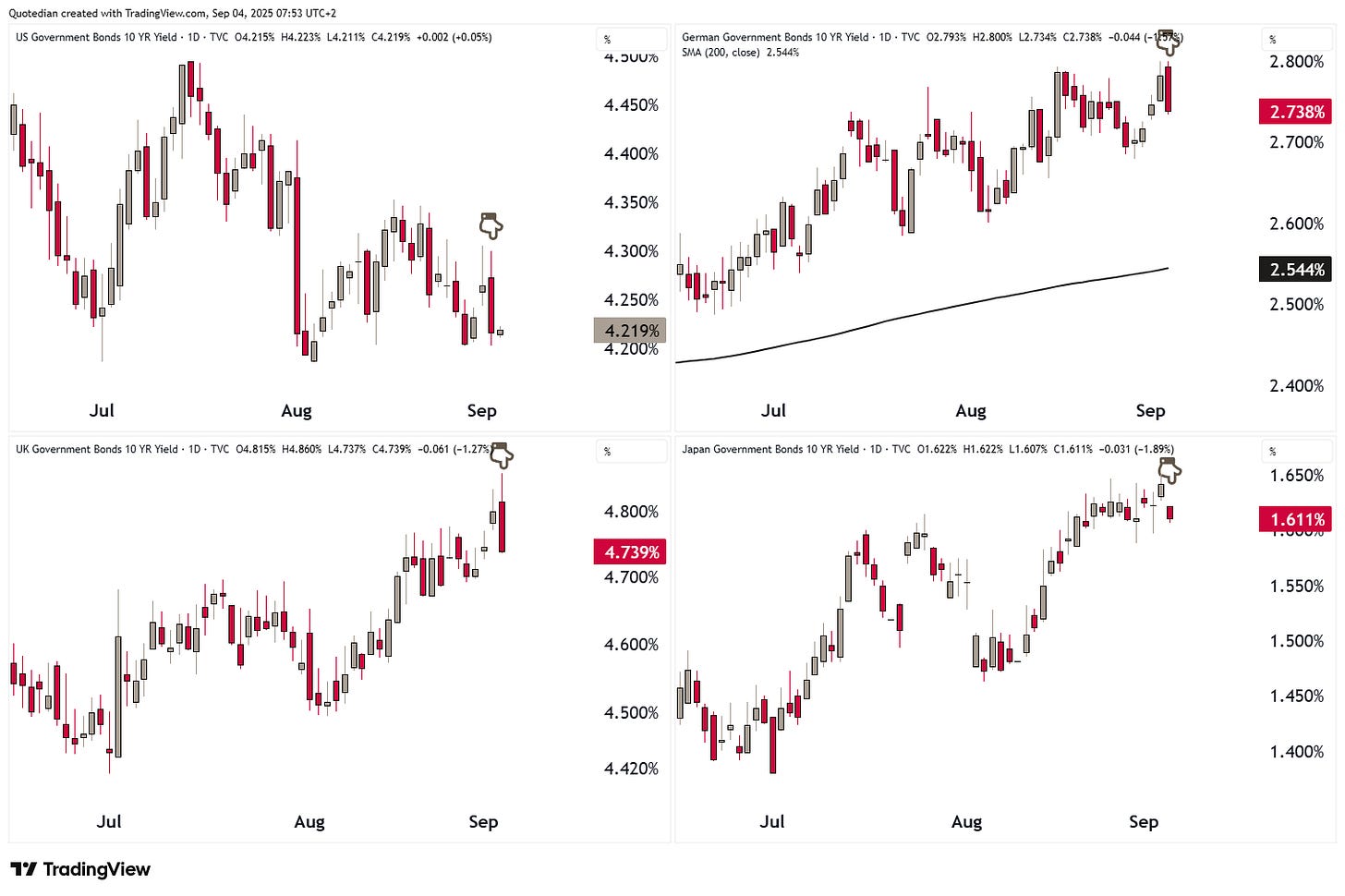

Bond markets continue to be in focus, with yesterday bringing a slight relief after a weak job numbers reading (JOLTS) further increased the odds for the Fed to resume its easing cycle. Major government bond markets all saw their yields drop on the day,

but the longer-term trend remains pretty clear IMHO:

Not much to report back from (fiat) currency markets, where the Dollar continues to consolidate losses from earlier this year. Looking at the EUR/USD chart and the triangle forming, it does however feel that the fall in Greenback is rather a pause, than an inflection point for a reversal:

Gold had its seventh consecutive up day, making its longest winning streak since March 2024:

The breakout on the longer-term gold chart is very evident and as we showed in these week’s Quotedian “Shake It Off” (click here), the price target count is now to 4,200ish:

Similarly, Silver has broken above key resistance too, and we ask ourselves if the blow-off tops can from 1980 (Hunt Brothers) and 2011 (EU Sovereign Debt crisis) can be repeated:

That’s all for today (and likely this week). Thank you for your patience - I am confident the wait for the ‘new’ QuiCQ is worthwhile it.

We spoke above how bond markets are somewhat in jitters at the moment, which is not least projected also by an increase in THE bond volatility measure - the MOVE (red line).

For now, and equity bulls keep your fingers crossed it stays that way, the uptick in MOVE has largely failed to provide an equivalent rise in the equity market’s volatility measure - the VIX (grey).

Stay tuned…