“I am a man of principles, and one of my most important principles is flexibility.”

— Mahatma Gandhi

Prefer to read today’s QuiCQ in PDF? No prob, download it here, but don’t you dare complain about the formatting!

The macro trade on rising geopolitical tension remains the main focus of the market as we head into the last trading day of the week.

The US Dollar for example is up for four consecutive sessions and the entire oil complex (Crude, Heating Oil, Gasoline, Natural Gas) is up at least 5% since Monday, with most of them providing that return yesterday alone.

Equity volatility is, as could be expected, also up over 30% since last Friday and spiked more than 8% yesterday alone. The only missing pieces then are a weaker stock market, which so far has been suspiciously resilient. Not only because equity investors seem to be ignoring geopolitical tensions, but yesterday’s ISM print was also lavishly higher than expected, especially on the ‘New Orders’ side. This resulted in bond yields moving higher, but as mentioned, failed to shine really through on equity indices.

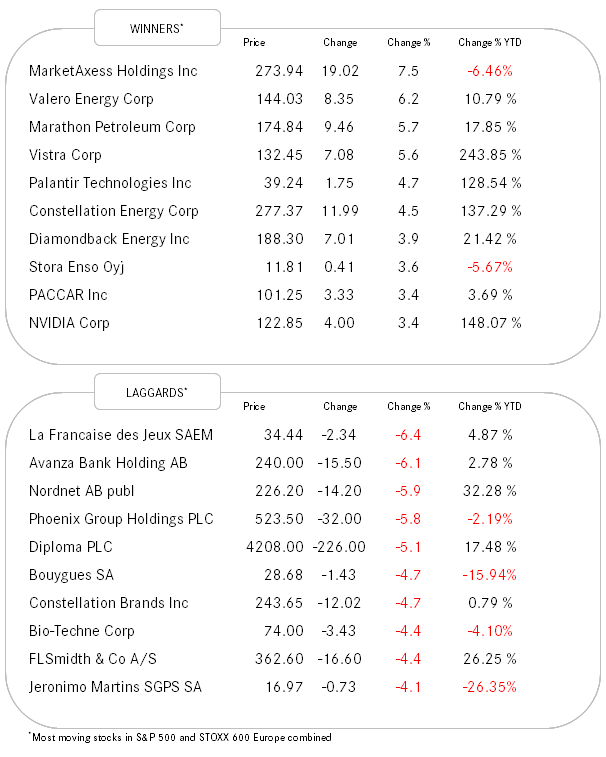

Nevertheless, the S&P 500 did close slightly lower, with the advancing-declining ratio about 1:3 and only three out of eleven sectors printing green on the day. Still, you would expect more nervousness amongst equity investors, but let’s see how that unfolds after today’s NFP later this afternoon.

Energy stocks are the clear winners in this environment and coming from a very inexpensive base, the SPDR Energy Select ETF (XLE) was up 1.8% yesterday and is up over eight percent since Friday a week ago.

Buckle up for what could be an interesting Friday and then see you at the other end of the weekend via The Quotedian on Monday.

One of our key assumptions in our most recent Q4 outlook to be published next Monday is that the US Dollar will weaken over the coming months.

HOWEVER, it seems we are being thrown a wrench in the works by the escalating geopolitical situation in the Middle East, which is provoking a flight to safety into the Greenback.

As the chart below shows, we were about to break lower last week, however the USD has now recovered. Was that break another oops? If so, will this oops also take us as high at 106-107?

Stay tuned …