QuiCQ 05/03/2025

Turnaround Tuesday - several times ...

"If you’re not confused, you don’t understand what’s going on."

— Howard Marks

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

It is not easy to be a daily newsletter writer these days, and even less so if you try to cover the US session already whilst it is still running. Yesterday was a ‘beautiful’ point-in-case thereof: Weak start, major (tech) rally after European market close, and important sell-off into the close. Here’s the Nasdaq intraday example of this:

I am seriously starting to consider writing an hourly newsletter … NOOOT!

But back to the beginning …

Mind you, the set-up for a relief rally yesterday was there, given that intraday the CBOE Put-Call Ratio (a contrarian indicator) hit levels that usually mean a ratio top/market (at least short-term) bottom:

The S&P had a similar down-up-down sequence than the Nasdaq, though it managed to climb back into positive territory only for about 12 minutes (black box):

The sell-off broadend away yesterday from a tech/discretionary stock focus to the rest of the market, as the S&P’s heatmap shows:

As a matter of fact, the Mag Sevens (MAGS) were up on the day, for what seems a first in a long time, albeit still below support:

This smells a bit of a dead cat’s bounce…

German stocks finally had a ‘massive’ down-day yesterday, with the DAX down over three and a half percent. But the bears’ joy will not last long, with futures up over two percent this early Wednesday. The following Tweet explains why:

This is probably also why Asian stocks had a very decent session so far today, led as so often recently, by Hong Kong’s Hang Seng Index (+2.5%).

A good indication that a short-term bottom for stocks may be at hand are bond yields, which climbed of the 4.11% (US 10-year Treasury) intraday lows of yesterday, to now trade around the 4.25% handle.

Stunning volatility? So, thinks the MOVE, the US treasury bond markets CBOE VIX index:

But what we really need to pay attention to in the interest rates space, is the hopes-for-fiscal-stimilus induced steepening of the European yield curve (proxied via German 10 and 2 year yields):

There’s a very clear message here …

And that message should probably also be strong enough to push the EUR/USD back to 1.09/1.10 minimum over the coming weeks:

In the commodity space, crude oil (WTI) briefly violated key support yesterday, but was able to recover by session end:

And finally, if in doubt, buy gold:

There was much more to yesterday’s session, but due to an internet failure early this morning it has gotten late and I prefer to hit the send button. Also, Substack tells me that this is a four minute read, which is getting dangerously close to TL;DR territory.

Take care,

André

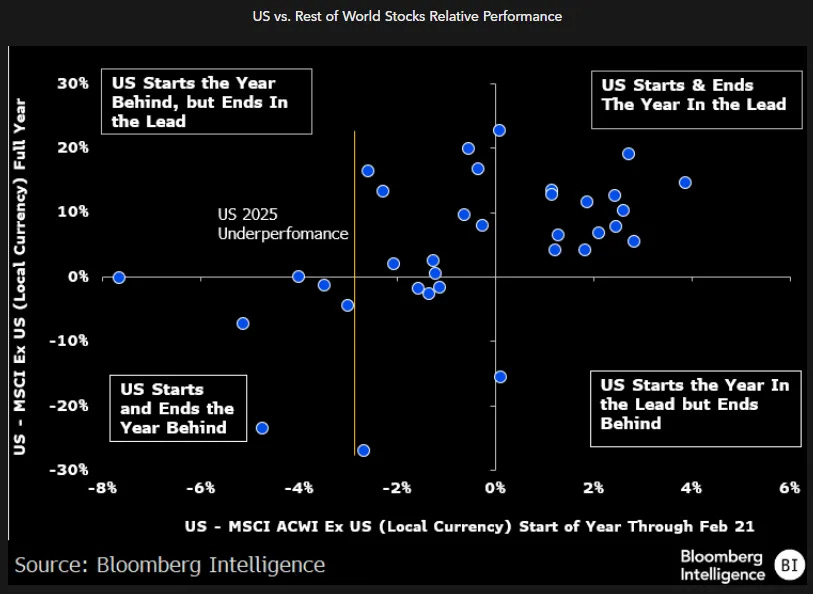

The chart below shows the relative performance of the US equity market to the rest of the World over the past 35 years. When this study was created in the second half of February by the fine folks at Bloomberg Intelligence, the MSCI US index was underperforming the MSCI World by close to 3%.

Underperformance of the US market versus the rest of the world (bottom left quadrant) has been rare enough over those three and a half decades, but even rarer, or better said never, has the US underperformed at the beginning of the year to then outperform by the end of the year (top left quadrant):