QuiCQ 05/12/2024

Touchdown!

“If you don’t build your dream, someone else will hire you to help them build theirs.”

— Dhirubhai Ambani

56th new ATH for the S&P 500 and the 4th consecutive one and the index up 11 out of the past 12 sessions… but it was on low volumes, so it probably doesn’t count:

And yes, I am just kidding regarding the volume.

What probably IS of more importance is that once again the new highs were reached with more stocks falling than advancing on the day. Concerning? Nah, to be watched though. But what is means that the Mag 7 and their closest allies have taken over the lead once again. Here is the S&P 500 ‘normal’ (SPY) versus the S&P 500 equal-weight (RSP):

Europe’s session in the meantime was mesmerized by the French confidence vote, which had the absolutely expected outcome. Barnier is out, Macron has to look for a new Premier and is himself approaching the end to his political career rapidly. Stocks don’t care, with CAC futures up solidly pre-market opening. But we need to watch the OAT-Bund spread, which so far has not reacted in either direction:

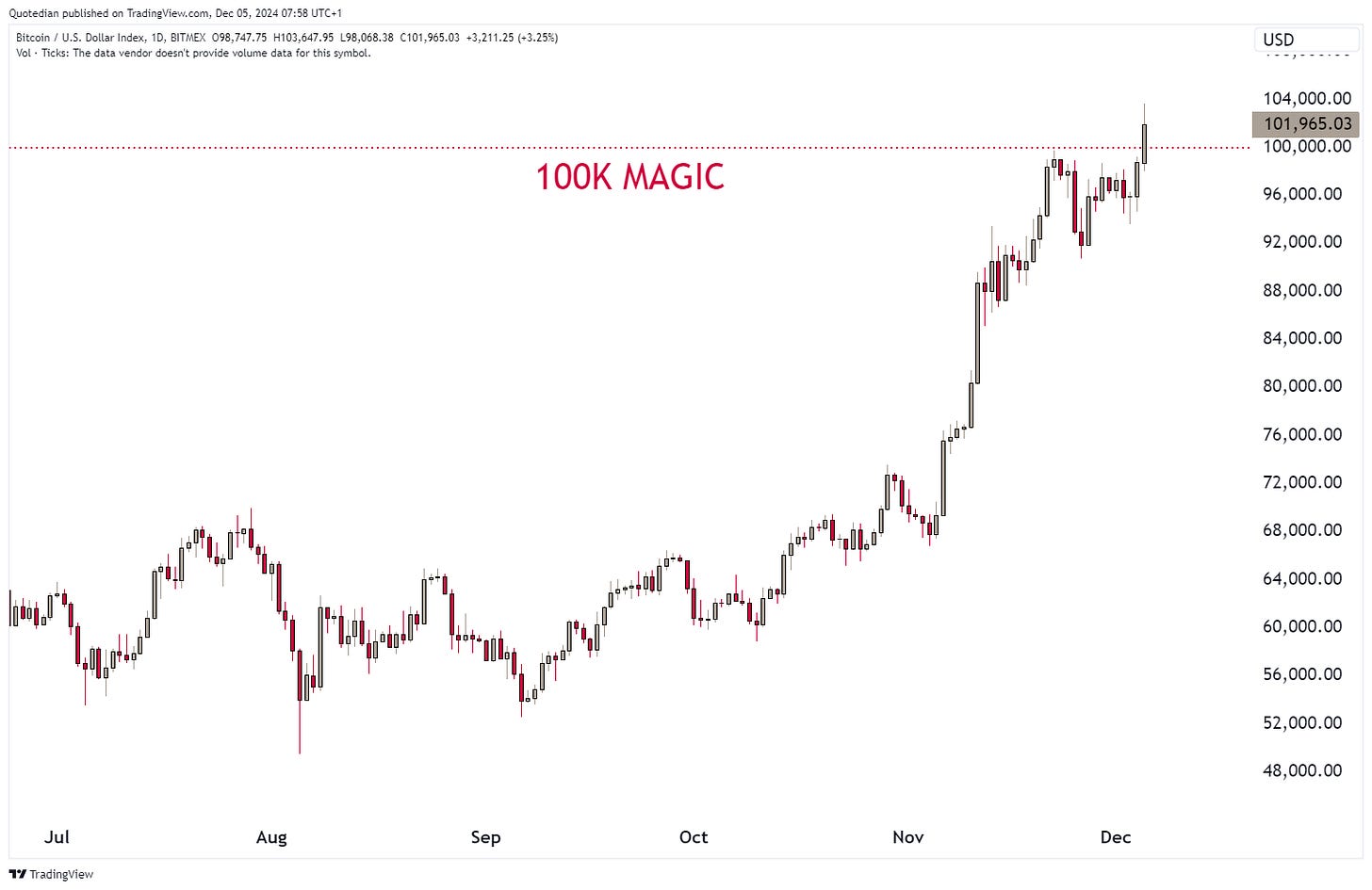

The other topic “du jour” we need to talk about of course, and which we advertised would happen in due course in our long-form essay (The Quotdian - 100K Magic) on November 25th, is the break of Bitcoin above 100,000!

But, I have to type fast, as we already nearly hit 104K a few hours ago. BTC/USD 200,000 here we come?

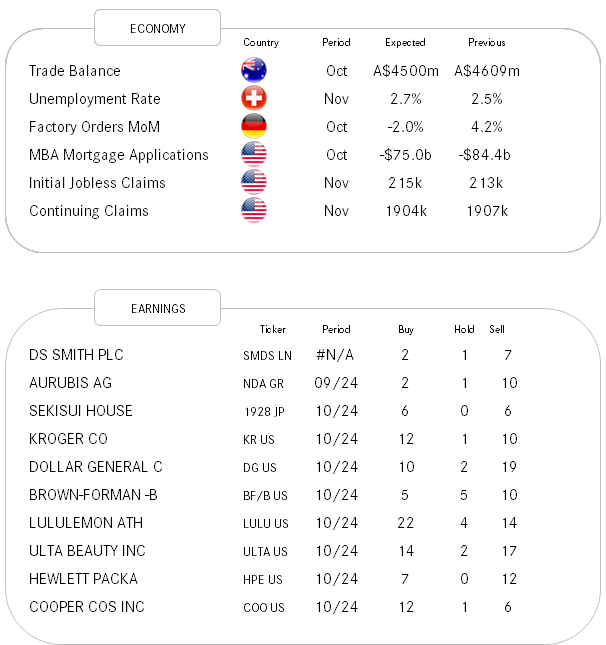

A more quiet economic agenda today, with all eyes on tomorrow’s non-farm payroll number in the US. Was the previous reading really only a strike- and weather-related glitch or is there more to it?

Stay tuned …

As discussed, Bitcoin (XBT) hit that magical round number of 100k this very eery morning hours. Ripple (XRP) already ripped (yes, yes, I know, cheap pun) 400% higher. So, for those of you with FOMO out there, is there anything that has lagged, is just breaking out of a one-year consolidation but is still 25% away from a new ATH? Yes, yes and Yes.