QuiCQ 06/03/2025

All Eyes on the ECB

“Great changes are best understood not in the moment of eruption, but in the shifting of the ground that preceded them.”

— Unkown

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

In a mix over (no-) tariff hopes and good economic data, US markets finally also found a footing yesterday, and as the chart below shows:

All three major indices bounced of their 200-day MA (black line) and this will likely remain the focal point at least for market technicians over the coming days to weeks.

The gains on the day where not massive at between one and one and a half percent, but breadth was solid, as three times as many stocks closed higher on the day than lower (S&P).

Sector performance was also respectable, with nine of the eleven sectors printing green and the more defensive sectors towards the lower end of the performance table:

But the real star of the non-stop show that are financial markets are currently bond yields around the globe, for many different reasons. In many aspects, finally the dog is wagging the tail again, and not vice versa.

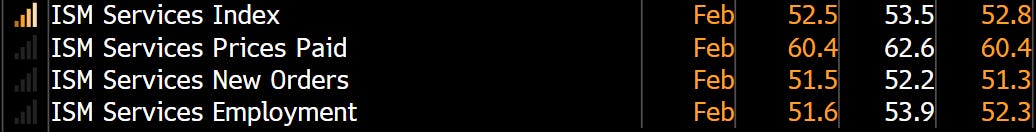

Starting with the US, after Monday’s horribly “stagflationary” ISM Manufacturing readings (lower activity, higher prices paid), the Service ISM expanded overall more than expected and also so in the subsegments of New Orders and Employment:

Yes, Prices Paid was higher too, but it could have been worse.

US 10-year Treasury yields started climbing immediately after the numbers release and are trading above 4.30% again:

German yields, as proxy to European rates, had their largest jump since the German reunification three and a half decades ago:

The German yield curve (10y-2y) is steepening like made:

All of this makes sense of course, as the planned lifting of the Schuldenbremse and subsequent spending plans could bring nearly unprecedented growth to the old continent. Of course, this is not through yet, as FDP and the Greens would have to agree to Gargamel’s Bundeskanzler-elect Merz’ plan.

In the context of this, today may be one of the most exciting ECB meetings of recent past. Will they cut as expected by Bloomberg’s surveyed economists,

and as implied by futures markets:

And finally, still moving around in the realm of interest rates, Japan’s 10-Year JGB yields just hit their highest level since 2009:

All this relative strength of non-US yields to US yields means we should see continued US Dollar weakness over the coming weeks to months, as we have seen over the past 24 hours:

Can’t remember the day exactly, but it was earlier this week that I mentioned the EUR/USD could move to 1.09 over the coming weeks:

This is once again prove that you can price targets and time frames, but never both together!

That’s all for today - have a great ECB day!

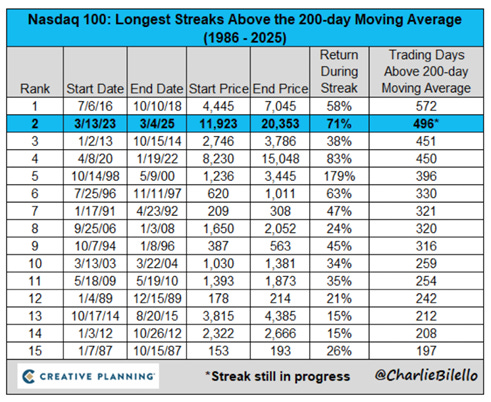

As we showed above, the Nasdaq 100 index has rebounded from its 200-day moving average, leaving the uptrend intact (for now):

The following table from the always fantastic Charlie Bilello, shows that the current streak of the index above its 200-day MA is the second largest over the past 40 years:

Will the streak continue to approach the longest or maybe even outdo it? Or are we about to witness the end of the streak?

Stay tuned …