QuiCQ 06/09/2024

UN-ENJOYMENT DAY

“Economic events rarely unfold in the way stock-market people forecast them.”

— Benjamin Graham

Prefer to read today’s QuiCQ in PDF? No prob, download it here, but don’t you dare complain about the formatting!

Finally it is UN-ENJOYMENT DAY! Indeed, market participants seem to have pushed themselves into an eerily sour mood as the week progressed where today’s crescendo in the form of the US non-farm payroll (NFP) number may have difficulty to live up to the negativeness of the whisper number …

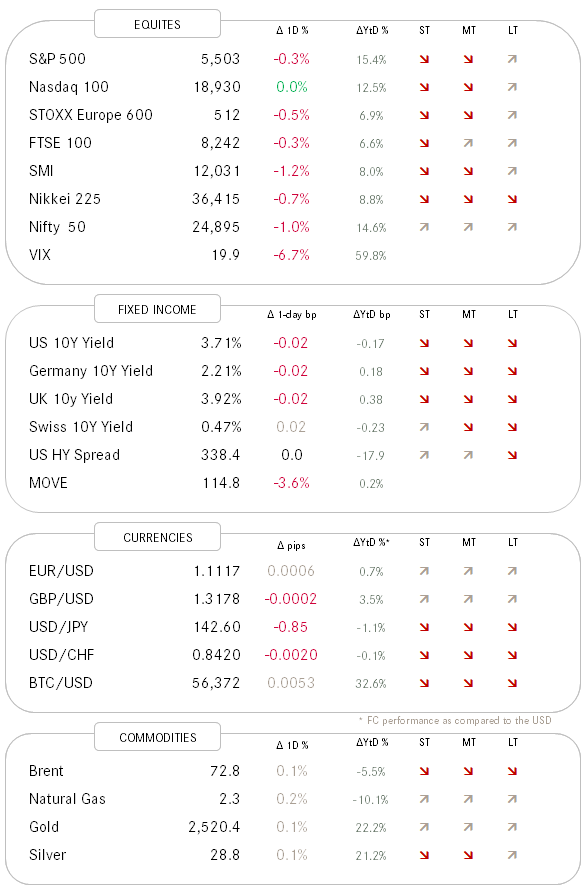

Anyhow, in yesterday’s session stocks closed down for a third consecutive day and albeit indices such as the S&P 500 were only marginally (-0.3%) lower, the weakness was broader than the previous day. Only two out of eleven sectors closed in the green and the up/down ratio of stocks was 1:3.

One observation to be made is that on a list of global stocks (SPGLOB), the new 52-week lows side is dominated by Energy stocks. This leads us to glance at the oil price, which we find trading below USD 70 (WTI) suddenly, closing in on the lows of December 2023:

It seems then that recessionary fears are winning the overhand over geopolitical fears.

This is confirmed by the US 10-year Treasury yield, which now trades at 3.71%, its lowest since July of last year.

And finally, the US Dollar once again is showing signs of weakness, with the Dollar Index (DXY) threateningly close to key support levels.

Have a great weekend and make sure to check in on The Quotedian on Monday.

The stock market chart (below the S&P 500 to represent them all) is starting to look dangerously heavy. The double-top (arcs) looks omnious, especially in combination with the negative divergence seen on the momentum indicator (RSI - bottom clip). Plus, we also know that the all important Nasdaq 100 (not shown) never made back up to the previous July high.

One last quiver for the bulls is that the S&P just needs to close the gap created on August 15th at 5,455. That could create a pivot point, but we are walking on increasingly thinner ice here …