QuiCQ 06/11/2025

Road Trip

Nothing behind me, everything ahead of me, as is ever so on the road

— Jack Kerouac “On the Road”

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Apologies for the QuiCQ-radio silence this week, even though we did release a great Quotedian titled “Stocktoberfest” (click here), but as I am on small business trip it has been difficult to find the time to write.

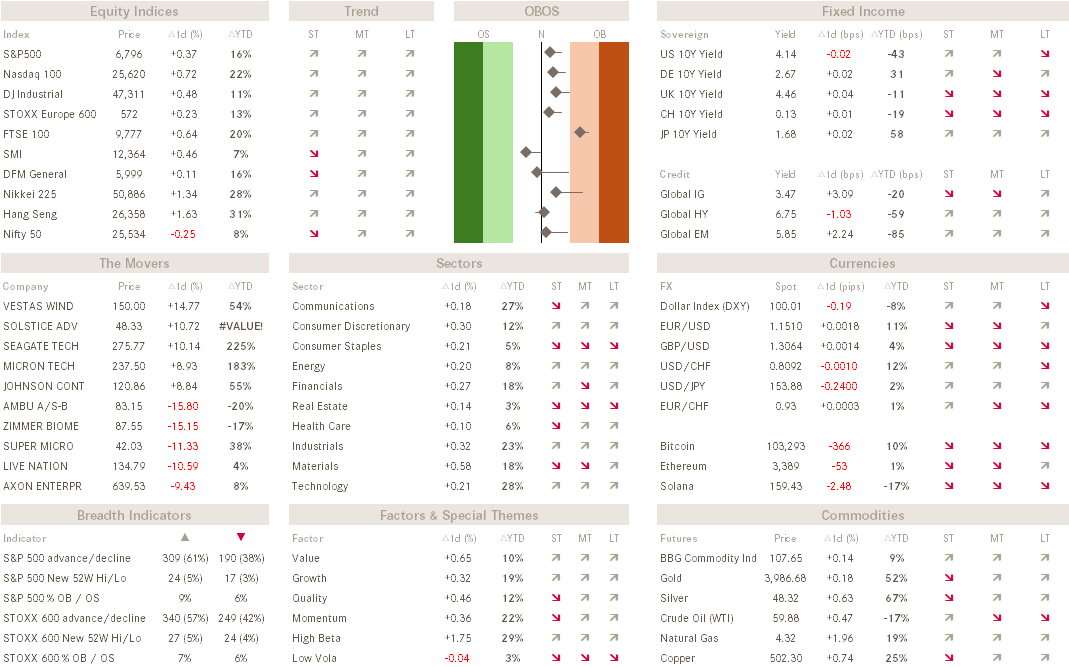

Today will also be a very short note, with the main purpose to introduce to you the new dashboard (see below)we are intending to use from now going onwards and it would be great to get your initial feedback.

A few things regarding the dashboard:

It is designed for more professional market participants, which you are

It is still missing a legend, which will follow (email me for immediate questions or clarifications needed)

Apart from the overall feedback, let me know what works better for you-´: the PDF or the inset picture

With all this in mind, here a very quick QuiCQ…

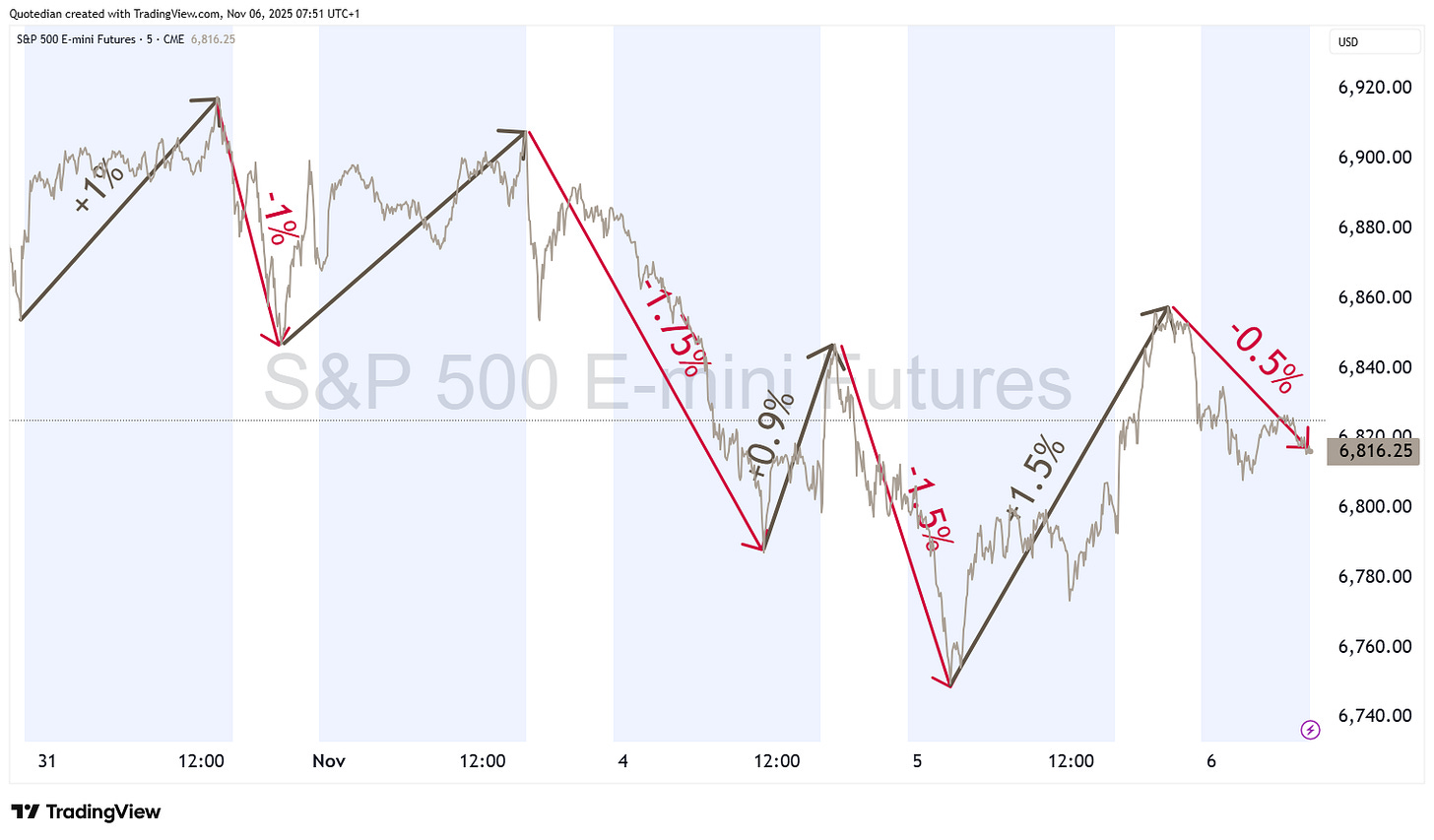

Equity bulls have been in slapping-mode this week:

This is what the slapping looks like on a tick-chart (S&P mini-Futures):

This is what the daily chart looks like on the S&P 500:

Here it seems that the “correction” may not quite yet be over and a pull-back to the 50-day moving could be possible.

However, the correction should be short-lived, as long as the mode remains risk-on, as measured by the high-beta to low-vola ratio (see below) continuing to move within its uptrend channel (red):

But maybe even more importantly to watch are bond yields, where the US 10-year Treasury yield shot higher yesterday:

That move came on the back of the US Supreme Court meeting to consider whether Trump’s tariffs are unconstitutional. The judges asked Trump’s lawyer questions that suggested they are leaning toward ruling against Trump’s tariffs. This sent bond yields higher since the Treasury would no longer collect those customs duties and would have to refund what was already collected. Watch this one closely.

And the other risk-on/risk-off measure to watch (for a possible switch to risk-off) is the divergence between the stock market (grey) and Bitcoin (red), the latter being a potential canary in the coal mine due to its liquidity function:

Elsewhere, gold is trying to bottom already again:

Ok, I warned you it will be QuiCQ and time has come to hit the send button as I have to head of in the first meeting of the day.

Leave me your feedback regarding the new dashboard if you care to, but in any case, make sure to hit that ‘Like’ button.

Regards from lovely Davos,

André