QuiCQ 06/12/2024

Samichlaus or Schmutzli?

“Have an opinion on what the market should do but don’t decide what the market will do.”

— Bernard Baruch

A quiet, consolidating session for stocks with all major US indices pulling a tad back on the day. We can probably put this down to ordinary, orderly and well-justified profit taking, not least as the AAII survey saw jump back up to nearly 50% bullish opinions from last weeks reading at 37%.

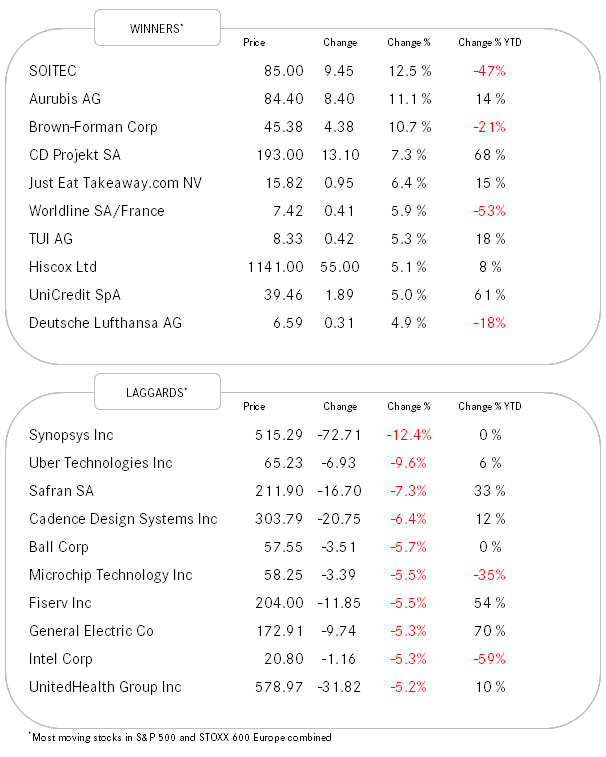

Roughly two thirds of the stocks in the S&P 500 printed red:

In Europe’s session, little impact was felt from the fact that France just witnessed the quickest government fall (i.e. PM ousted) in the 66-year history of the Fifth Republic. No wonder, as political upheaval has been around since the European elections in late spring and most seems to have been pre-empted already:

Time to start thinking about thinking to start catching that falling knife known as the CAC-40? Perhaps.

A similar buy the fact, sell the rumour has been witnessed on the OAT-Bund spread:

Little movement on other bond markets was to be observed.

If you were looking for massive price action, you had to turn to cryptos. The Bitcoin put in a famous “Darth Maul” candlestick formation:

Other than that, not a lot caught my attention.

So, here we are then, first Friday of the month, which of course means it is NFP Friday!

With only 12k new jobs announced in October, which was largely explained away by strikes and tornados, today’s number will be a watched closely if that October number was really only a glitch. Here are the stats for today:

Have a great weekend!