QuiCQ 07/02/2025

NFP Friday

"The best way to appreciate your job is to imagine yourself without one."

— Oscar Wilde

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

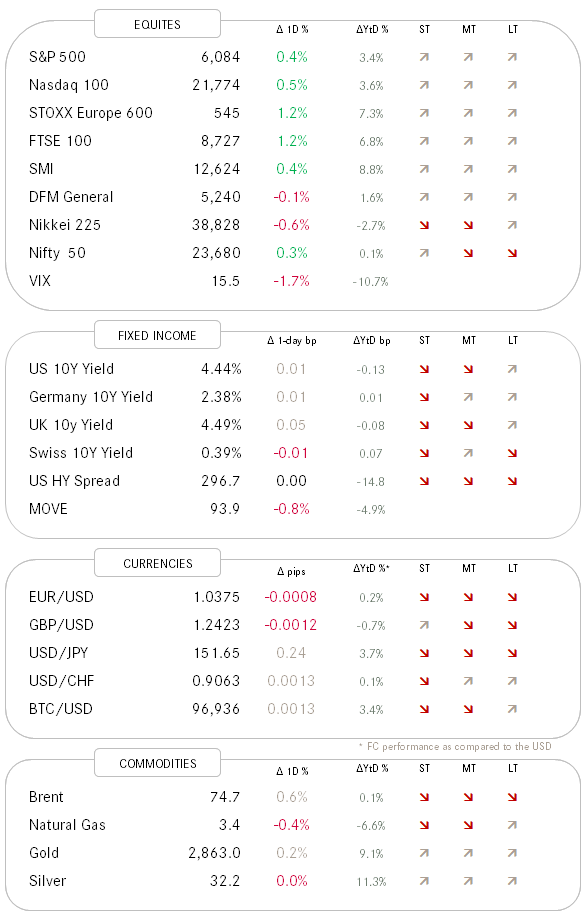

More or less a quiet session yesterday. with European stocks yet again outperforming their US counterparts. A more serious pattern is evolving here now, but we’ll have a closer look at the in next week’s Quotedian, which should be out Monday morning.

The S&P 500 (and Nasdaq) closed a touch higher on the day, though there was a quirky intraday move down and the up towards the end of the session:

The number of stocks up versus down on the day was balanced, though sector-wise the pendulum was leaning much more towards green:

One day does not make a trend, but watch that outperformance of consumer staples yesterday, which could be an early indication of a rotation towards more defensive.

Little to report from the interest rate side of the market, but there at least some action to be observed in FX market.

As mentioned in yesterday’s QuiCQ, the Bank of England did indeed cut their key policy rate by 25 basis points to 4.5%. What was not expected was the 7-2 MPC (Monetary Policy Committee) vote, with the two “dissidents” not calling for no rate cut, but rather for a jumbo 50 bp cut! This sent the GBP briefly into a tailspin before gradually recovering again. Here’s the intraday chart versus the EUR:

Another currency on the move is Japanese Yen, which we also have highlighted on several occasions. The currency of the land of the rising sun rose (pun intended?) another percentage point versus the greenback before falling back a bit in Friday’s early hours:

Today is the first Friday of the month, which of course means all focus on the US non-farm payroll number at 14:30 CET

Enjoy your Friday and enjoy your weekend!

André

As mentioned above, today is NFP number day! An earlier indicative reading this week by the ADP, showed a declining number of job openings, which may hint at a lower NFP number today.

Or not.

As the chart below shows, is the market, via the S&P 500 Human Resources and Employment Services Subindex (red) in stark disagreement with the ADP reading (grey). We are hearing increasingly anecdotal evidence of a weaker US jobs market, but for now, employment stocks disagree and in the past they have been the tail waging the dog.

Stay tuned …