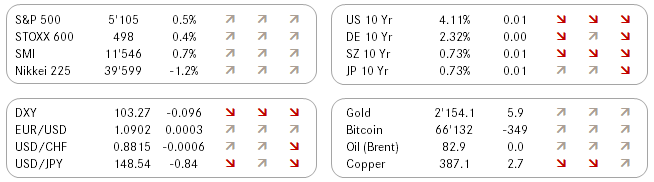

QuiCQ 07/03/2024

Canary?

"The dollar is our currency, but it's your problem."

-- John Connally

I started my career in 1988 as a currency trader on a prop desk of a (then) large American bank in Zurich. I gave up seven years later. Admittedly, currency markets have changed a lot between now and then, mostly courtesy central banks hefty interventions in the 90ies and a near witch-hunt for FX/macro investors.

Yet, will being a shadow of their former self, they can still serve as the proverbial canary in the coal mine, when it comes to larger impending macro- or geopolitical events. Two points in case:

1) The first graph shows the chart of the US Dollar versus the Japanese Yen. In Yen terms, the Japanese currency has appreciated over 1.5% over the past three days. A sizeable move for a G7 currency. This is on the back of expectations that the BoJ will finally abandon ZIRP this or next month, which in turn could have major implications on the Yen carry-trade. I wrote about it here.

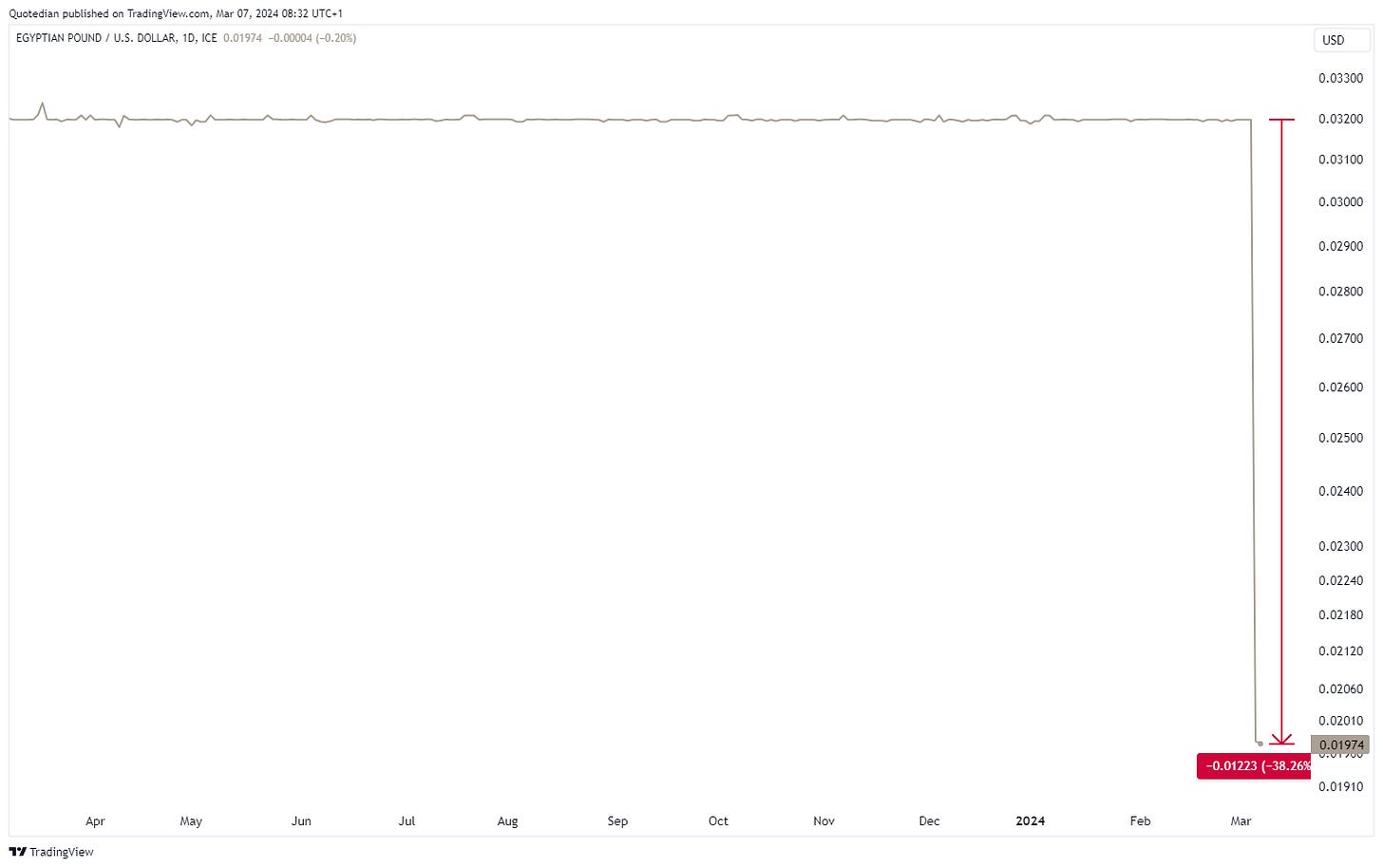

2) The second chart shows the devaluation of the Egyptian Pound announced by its government yesterday. Whilst the country was able to secure a $8 billion IMF loan the same day, pay attention to such events in large countries with a mostly young population.