QuiCQ 07/11/2025

That was QuiCQ!

A slip of the foot you may soon recover, but a slip of the tongue you may never get over.

— Benjamin Franklin

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

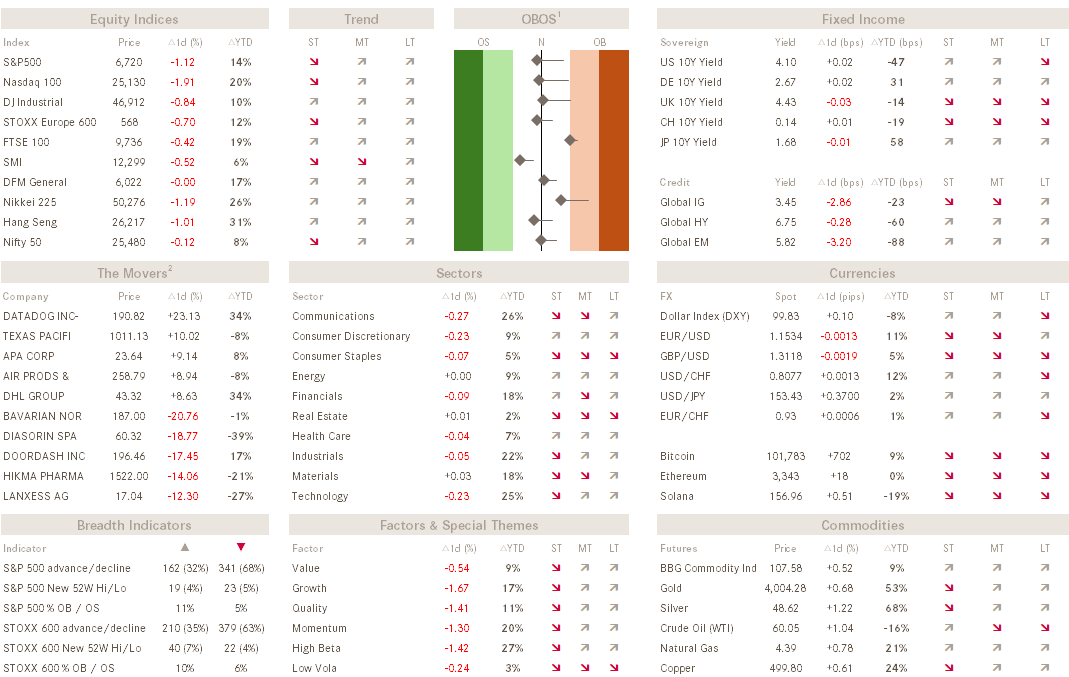

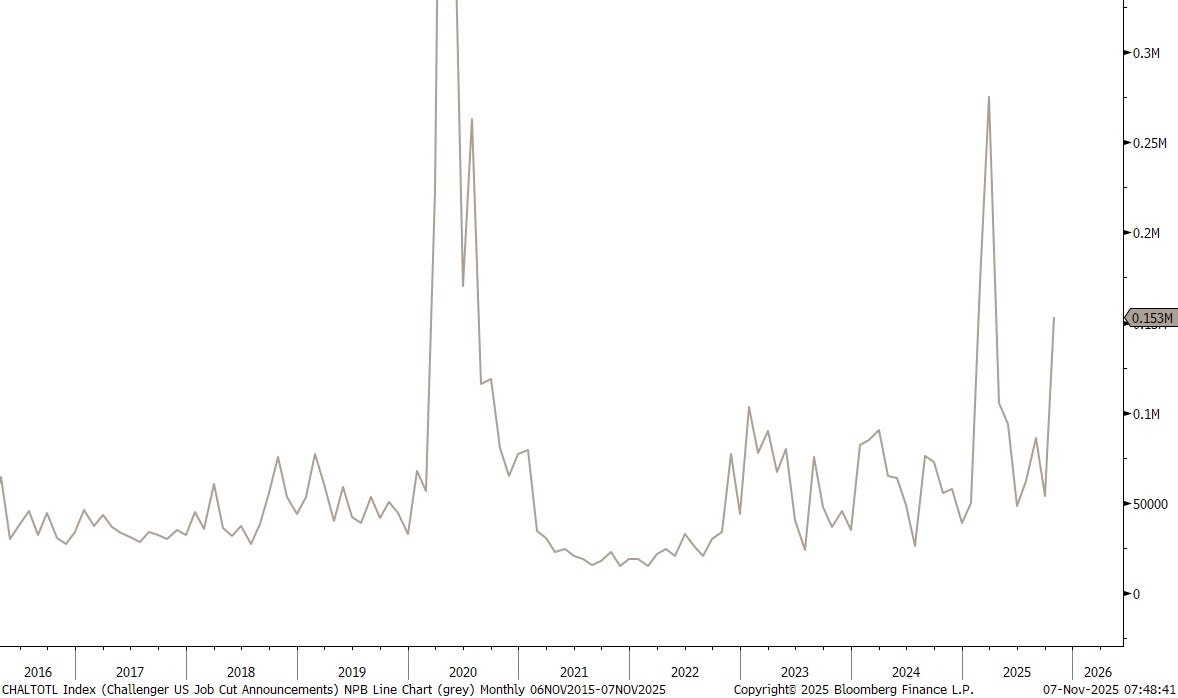

Markets tanked yesterday, apparently on the back of a weak employment report by one of the private employment companies (Challenger, Gray & Christmas), as we are still lacking the ‘official’ employment and NFP numbers usually published by the ‘temporarily’ (Editor’s note: 🤣🤣🤣) closed government.

Perhaps.

Indeed did Challenger report an increase of nearly 180% in job cuts, though this is a a pretty volatile number anyway:

To me, this much rather starts smelling like profit taking on overly expensive stocks. With only 37 trading days left in a surprisingly good year for equity investors, some may be start getting itchy to lock in those gains. The danger lies in that this may become a self-feeding, quickly spiraling loop should everybody start to try and do the same.

Yesterday I wrote about the S&P possibly be on its way to ‘test’ the 50-day moving average. Well, with only 55 index points to go, we can already now say: “That was QuiCQ"!”

The only two sectors up yesterday in the S&P were Energy and Health Care. And as you can see in the bottom left part of our newly minted dashboard above, breadth was not terrible but also definitely not good at about two-to-three (winners/losers):

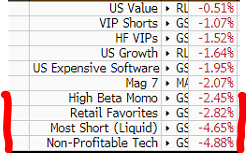

The following ‘special’ factors table then also reinforces our view that profit taking is happening in some of the wonkiest segments of the market:

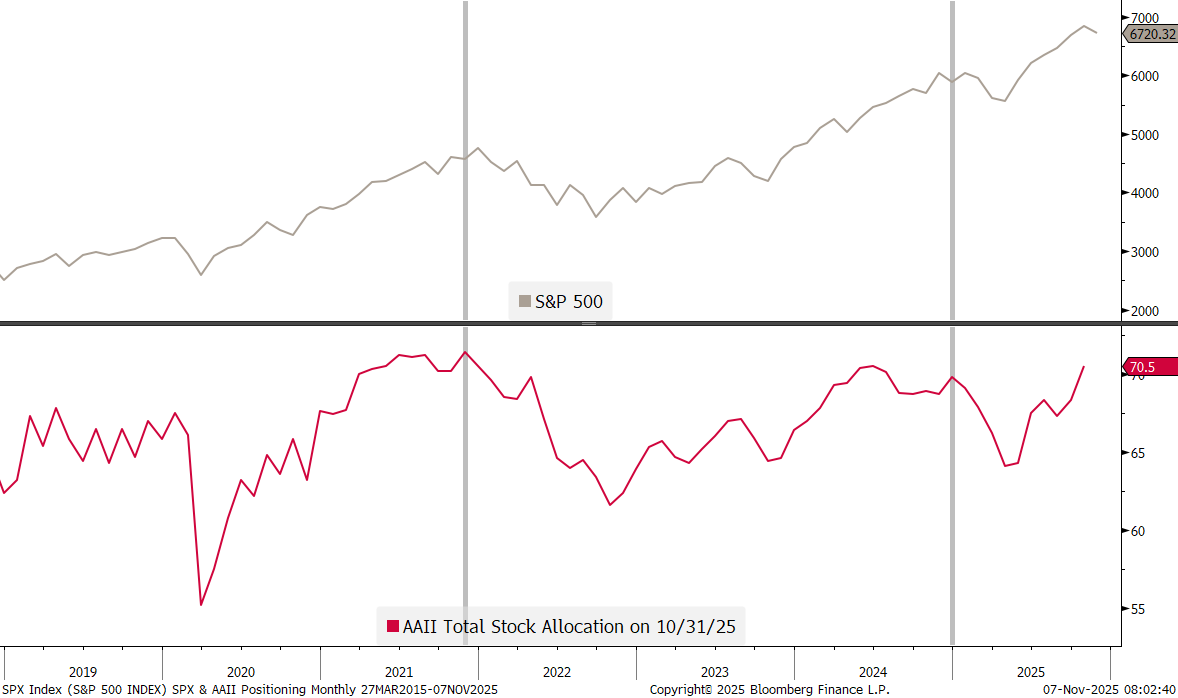

This, as the AAII reported one of the highest equity allocations in recent history by the associations members:

Bond yields (UST10y) reversed their previous day’s advances as investors fled from stocks into the ‘safety’ (Editor’s note again: 🤣🤣🤣) of government bonds:

The US Dollar has weakened over the past few hours, with the EUR/USD cross rebounding quite precisely where it had to:

Bitcoin investors must be biting their fingernails, as the 100k support line is being challenged:

But, all in all, I think the most important news item of the past 24 hours, was this one:

It gives me great comfort to continue to overweight the metals & mining segment.

Here’s the chart of silver, hammering in a short-term bottom:

We were supposed to get US payrolls data, where the total was supposed to be seen at -23K. However, we will get Michigan consumer sentiment and inflation expectations. The New York Fed’s 1-year inflation expectations print is also out.

Fed’s Miran will also have a fireside chat at the University of Cambridge after the European market close. I would consider him a dangerous tongue.

Have a great weekend,

André

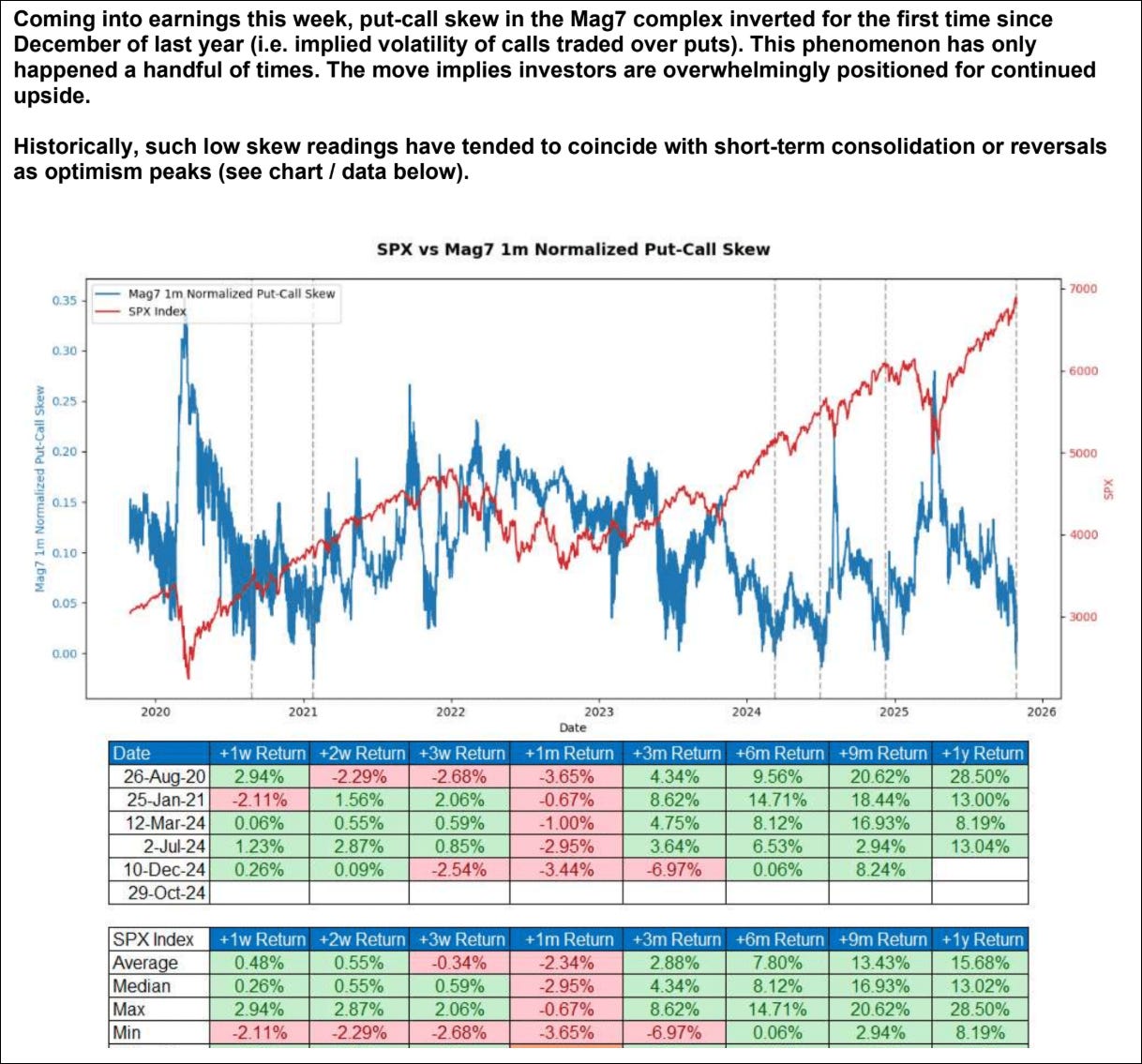

The following chart GS chart reached me via the always fantastic Kevin Muir at The Macro Tourist (click here).

All required comments with the box, which do not improve on our more sour outlook in the section above.

We also get a very late speech from the Fed’s Miran on stablecoins and monetary policy, which could be challenging for some given he understands them and most central bankers don’t: will we get a hint of how things will work shortly ahead under the GENIUS Act?

Curious to see how the year ends: a bout of profit-taking or a festive rally?