QuiCQ 08/05/2025

Wait and (FOM)C

"We will continue to monitor all developments very closely and carefully. We will act in a firm and timely manner."

— Jean-Claude Trichet

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Jerome Powell is increasingly reminds me of good old Jean-Claude Trichet during his years at the ECB … do nothing, but monitor to decide to do nothing.

Admittedly, the current Fed Chair is up to a more daunting task than any central bank chief in a long time, given the structural, tectonic shifts going on under the geopolitical surface. Plus, add-in the unpredictability of his very own government (in order not to personalize it) …

Onwards …

Investors had been swinging from FOMC meeting to FOMC meeting, observing every decision, scrutinizing every presser for the past few years, and now … it has become kind of a sideshow!

And this is not due to lack of statement - after all the Fed yesterday said "the risks of higher unemployment and higher inflation have risen” since it last met, kind of admitting to risks of stagflation rising. But the market didn’t really care, as everybody is focused on where tariffs will be after July 8th, when the current ‘pause’ is set to expire.

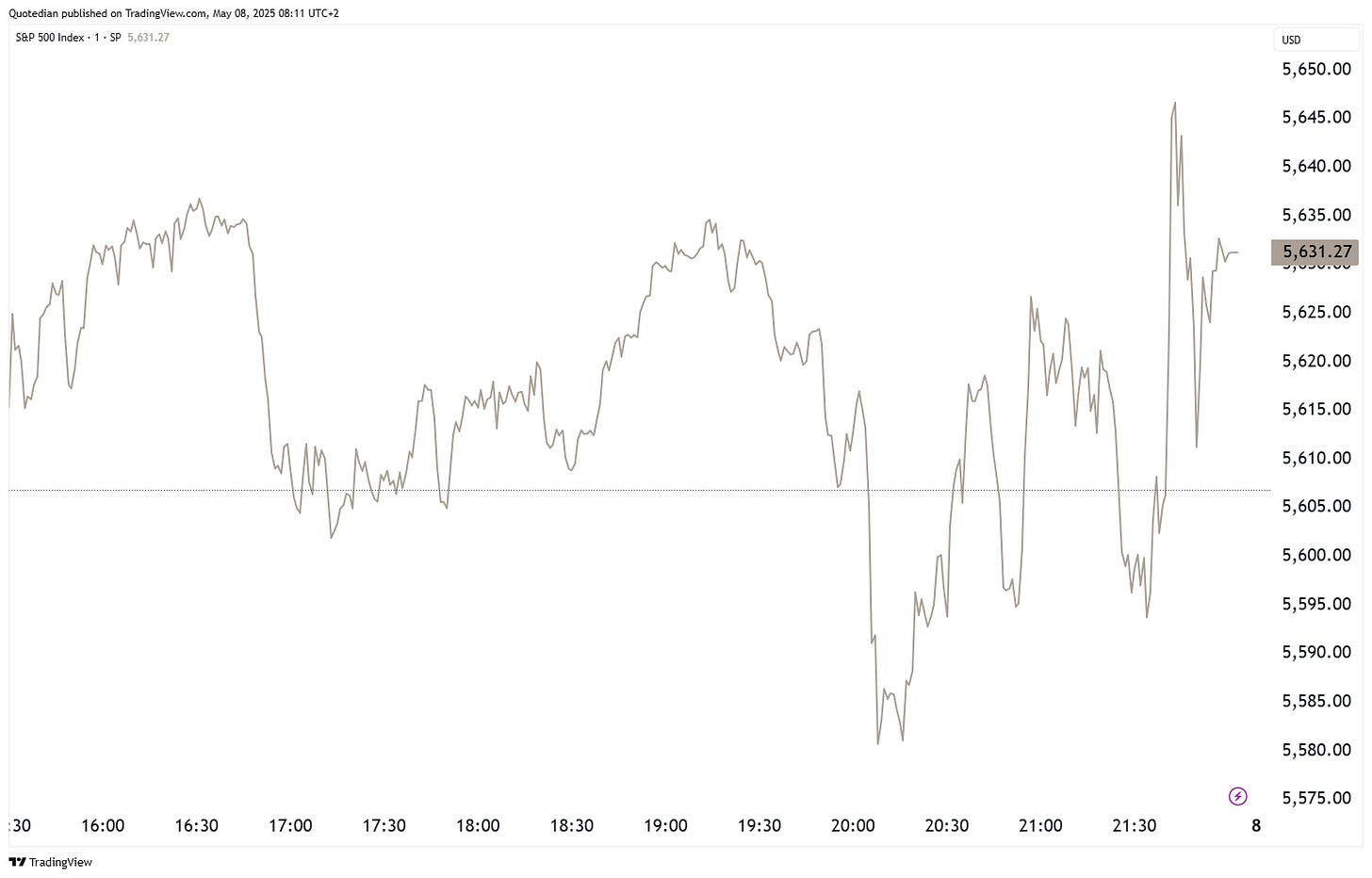

The S&P 500 closed up just shy of half a percentage point in a “much ado about nothing” session:

As a matter of fact, the market cared much more about this headline, than the FOMC statement:

This was enough to push the Philadelphia Semiconductor Index (SOX) up nearly two percent (with follow-through after-hours), keeping the short-term uptrend on the daily chart alive:

No wonder then, that the tech sector was up there with the top performers in yesterday’s S&P 500 session:

The big drop in Communication Services was courtesy of Alphabet (Google), which saw its share plunge 7%, as an Apple (!) executive testified at an antitrust trial in Washington that Google search volume was losing traffic to AI alternatives such as ChatGPT or Perplexity.

Back to the FOMC, where the bond market (US 10-year yield below) could not have been bothered less about the non-decision and/or the stagflation risk statement:

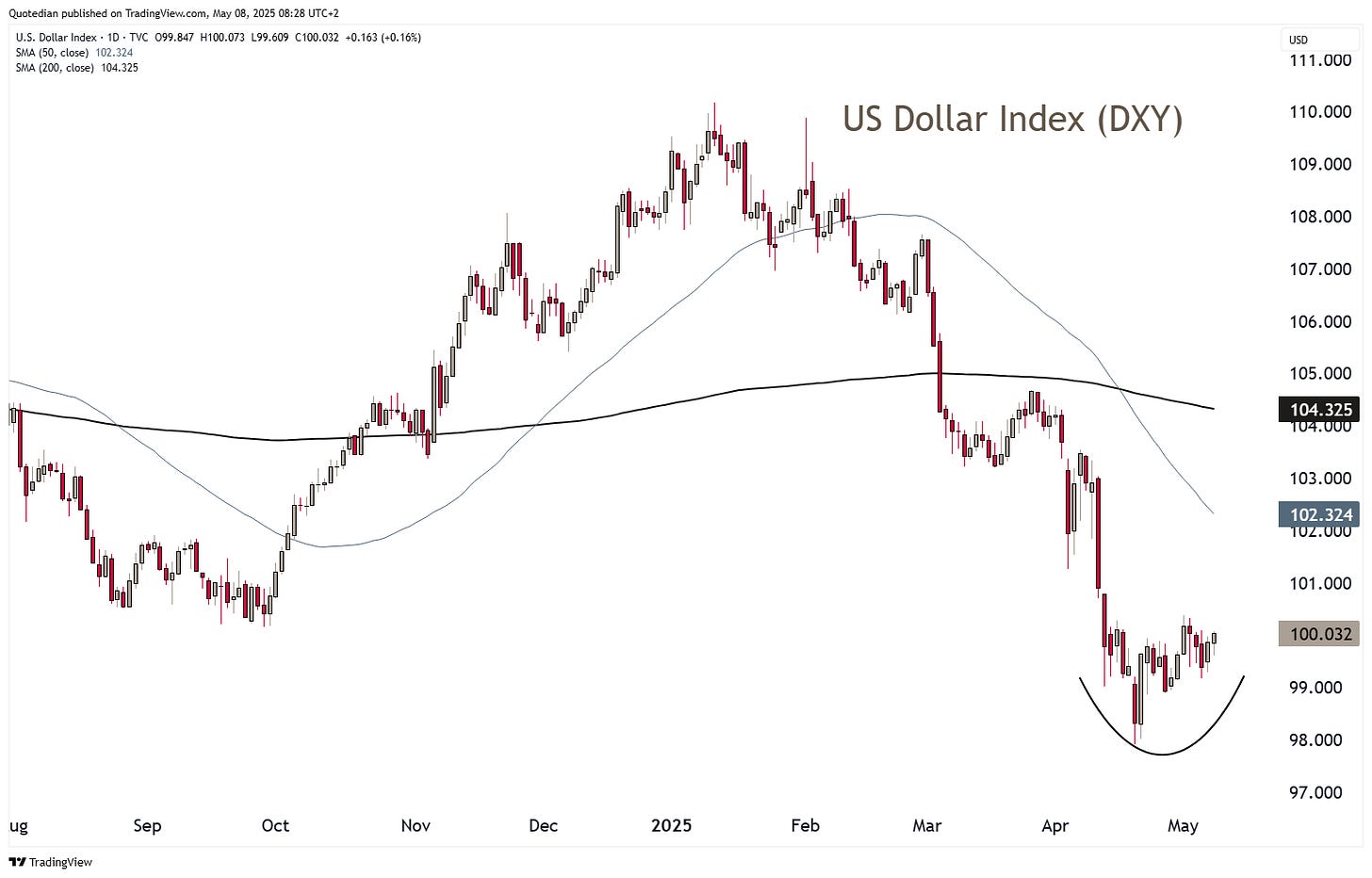

The US Dollar, which so far had been lagging the recovery rally post-liberation day sell-off seen in equities, managed to move above the 100 level in the Dixy (DXY):

On the EUR/USD cross this means that if the currency pair falls below 1.1260, we could see some further price downside (USD upside):

Gold, usually measure in US Dollars, is hence also a tad lower this morning, after having had an all-time closing high only two days ago:

With kind of a double top in place, our view for the next leg is for lower, rather than higher.

Does this previous statement bite itself with the fact that Bitcoin is breaking out to its highest level since February, at just shy of 100k?

No, not really, correlation (R2) between gold and bitcoin is 0.007, i.e. non-existential:

Time's up, more tomorrow - May the trend be with you!