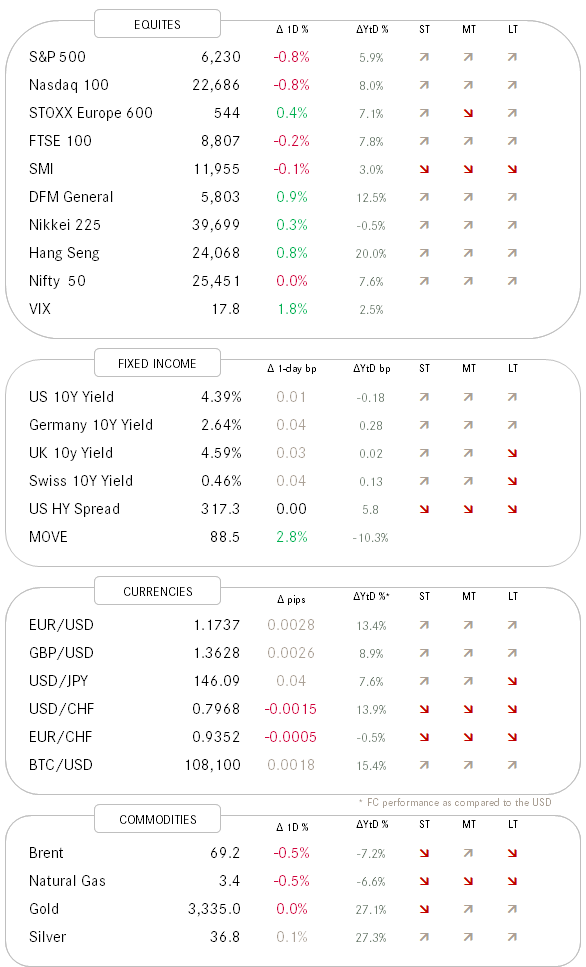

QuiCQ 08/07/2025

You've got mail!

“Always write angry letters to your enemies. Never mail them.”

— James Fallows

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Yesterday’s session stood in the sign of Trump’s Tariff Tantrum - once again… Sending out more than a dozen letters threatening some major trade partners as Japan and South Korea with imposing 25% levies and simultaneously pushing out D-Day (or should I type T-Day) from today to the 1st of August, got markets deeply confused. And what does a market do that just had one of its steepest rallies and then is confused? Yes, profit taking of course. Here’s the intraday chart on the S&P 500 mini-futures:

Stocks fell about one percent before recovering into the session end and then gained some more during after hours trading as confidence returned (shaded area).

The truth is, it has been kind of another TACO move, underlying Trump’s gentle nature (eheem), always looking for a peaceful outcome (in the end).

Despite the small, late recovery for US stocks shown above, internals on Monday were decisively negative, with over 80% of the constituents in the S&P 500 trading lower in the session:

Only two sectors, utilities and consumer staples, both very defensive, were able to eke out small gains.

Asian markets this early Tuesday are pretty upbeat, interpreting the delay to August 1st and an even possible delay beyond as a “get out of jail, free” card.

Bond yields have been on the up since the OBBBA was signed off last week, which is probably the right reaction given that the budget deficit will only increase under this one big beautiful bill act:

The Dollar is continuing to find a bottom and yesterday’s tariff noise helped the greenback a little bit:

As we outline in our NPB Q3 outlook, due to be published later this morning, the USD is oversold and should see a counter trend rally. However, the modus operandi is “sell the rally” and not “buy the dip”.

Gold continues in its consolidation triangle:

Time's up, more tomorrow - May the trend be with you!

The market rally in the S&P 500 has been impressive since the April bottom, hence luring all investors back into being overweight equities, right? Wrong!

As the chart below from the fine folks at Deutsche Bank shows, is equity positioning just about approaching a neutral level:

Stay tuned (and long?).