QuiCQ 09/04/2025

Houston, we have a problem ...

“Beam me up, Scotty”

— US Yields to US Treasury Secretary

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Yesterday was the last (tariff) offramp for the next 100 miles (10% in the S&P) - and it seems we (he) missed it …

As the US government did not step away from its tariff threats, these how now come into full ‘function’ nearly everywhere today.

And the market it is not liking it ..

Let’s start with the most worrying:

The US 10-year treasury yield briefly hit 4.50% during Asian trading hours - US Treasury Secretary Scott Bessent’s worst nightmare (see today’s Quote of the Day).

The next thing to worry about here:

The Japanese Yen and the Chinese Yuan are both substantially higher versus the US Dollar overnight (albeit reversing some of the gains in the past few minutes):

I would then go on to wonder, not suggest, just wonder whether any of these two Asian countries may be liquidating some of their Treasury bond holdings … not only possible, but maybe even probable.

The “good news” then would be that both countries have already substantially reduced their Treasury holdings over the past years, since the Russian experience basically, and jointly only (yes, tongue in cheek) have a bit less than USD2 Trillion to go:

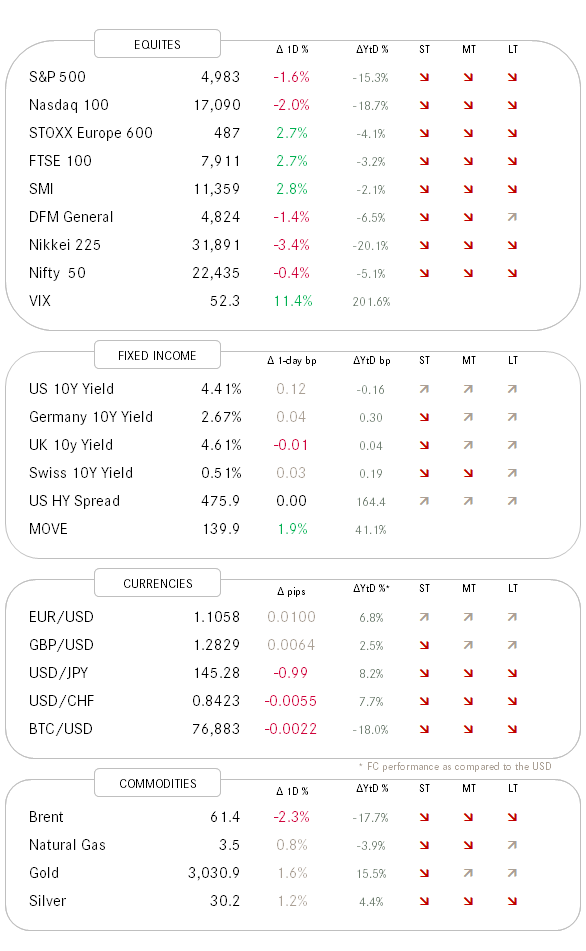

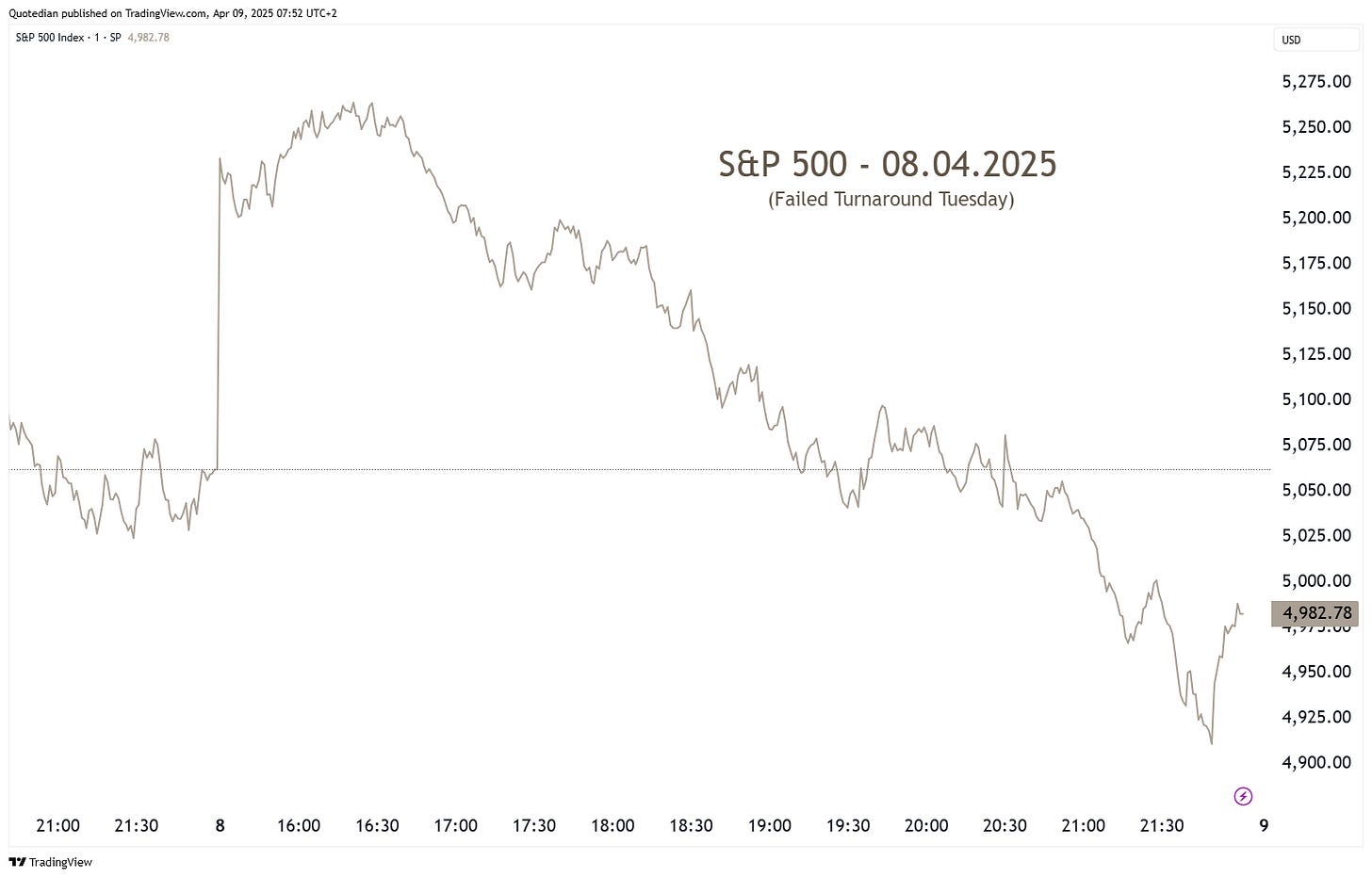

Equity markets, which especially in the US went through a kind of a failed ‘Turnaround Tuesday’ experience,

are prone to open weaker today too, given the current readings of futures market:

Let’s go back to bond markets for a moment, where credit spreads in the meantime are heading for the exit too:

Reaching a level of 600 to 700 over the coming weeks would not surprise me, given the current bleak outlook.

Expectations for a Fed rate cut are increasing at a …. well… uh… increasing pace, but I ask myself how much those would help under the current set-up:

For what its worth, this headline from earlier today:

I am a bit surprised not to see Gold higher (also in connection to the chart of the day at the bottom of today’s letter):

Still, the yellow metal is rebounding right on the lower edge of its uptrend channel.

Oil (WTI) is bracing for a full-blown recession:

Unfortunately I do not have much better news for you today, but in case cute cat videos cheer you up, click on the image below:

For everyone else: After Maniac Monday and Turnaround Tuesday, let’s brace for Wipeout Wednesday!

It’s definitely time to take out this Simpsons classic:

May the trend and the force and volatility be with you!

Yes, I kept the worst for last … here’s another worrisome Armageddon chart:

In short, the trust that investors put into US Treasuries (supposedly the risk-free asset) over bank debt over the next 30 years as its lowest in modern history …

In the best case, this hints to a highly dysfunctional market.