QuiCQ 09/05/2025

Papa Americano

"There's bullshitters and there's liars. The difference is the liar tries to hide his bullshit while the bullshitter lets you know he's lying."

— Matthew McConaughey

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

I suggest you click on the YouTube video below to accompany today’s short update:

Latest around second 19 (00:19) you should be able to connect today’s subtitle with the choice of the video and an event dated yesterday.

Onwards …

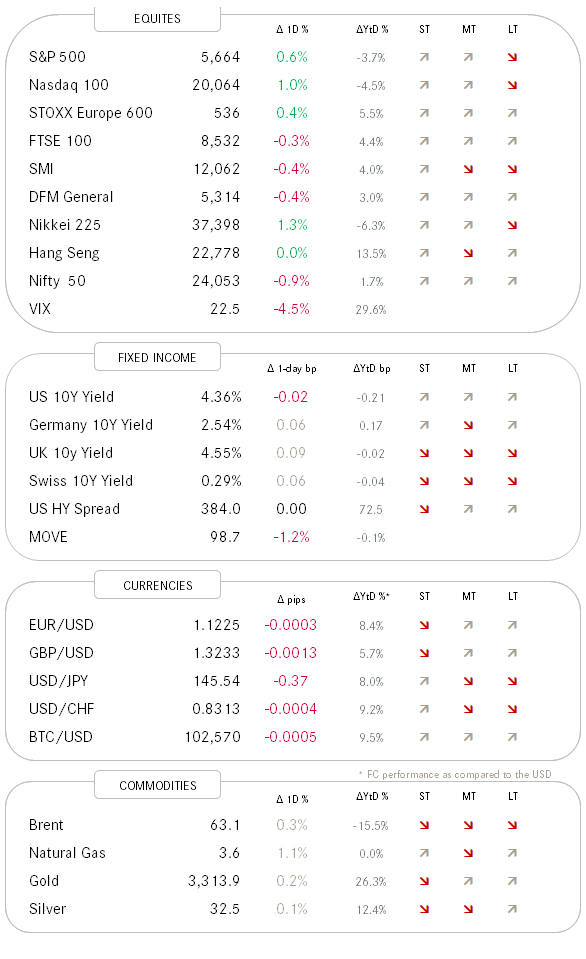

Strong session for equities yesterday around the globe, especially for the more high beta (read: speculative) segments:

An early rally brought the S&P 500 into the vecinity of its 200-day moving average,

but a late “sell-off”, probably profit-taking induced made the index close up 0.6% on the day ‘only’:

Still, the session left a very positive underlining tone, despite the late sell-off, as breadth of tilted in favour of advancing stocks by more than 2:1 and as much as the more speculative corners of the markets where amongst the strongest gainers (see above) the more defensive segments were being sold off:

Catalyst for all of the above was of course likely improving outlook regarding the tariff situation, with an agreement between the US and the UK reached and China and the US meeting in sunny Switzerland this weekend for such talks. By mid-summer, tariffs are probably boring the market to death and investors will be looking for something else to worry about.

In bond markets, duration was under pressure (read: yields higher) as recession worries decrease on the back of solid labour market readings (yesterday: initial jobless claims) and the Trump Tariff Tantrum unwind. Here’s the US 10-year Treasury yield chart:

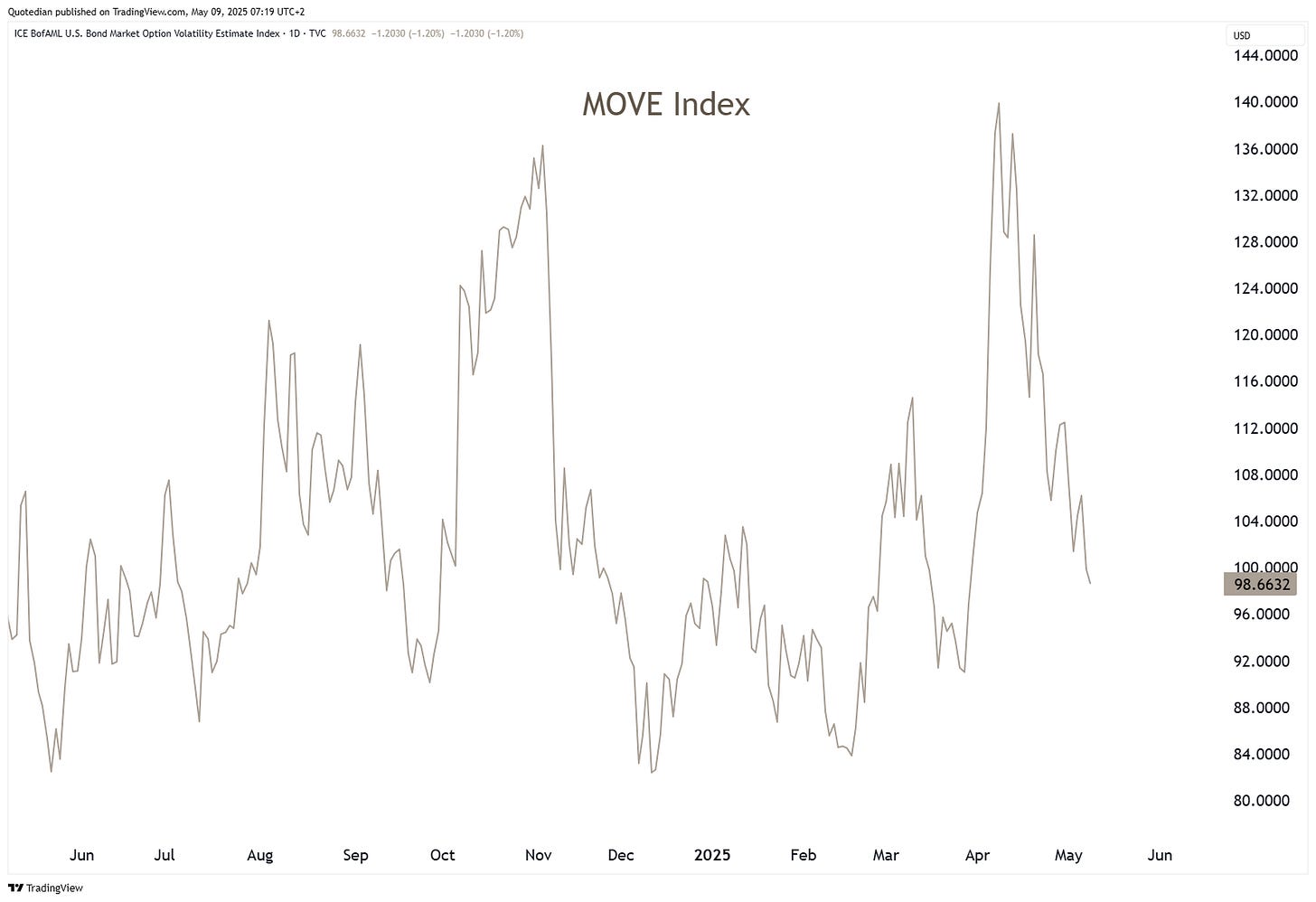

But more importantly probably, is the bond market getting more orderly again, best witnessed via the MOVE, the treasury bond market equivalent of the VIX:

In currency markets, the US Dollar has gained territory against all of its G-10 peers since the beginning of the week:

Bucking the trend is only Bitcoin (normally quoted in USD), which trades above 100k for the first time since February again:

But the ultimate “proof” of the tariff-trade narrative unwind yesterday was probably Gold, down nearly 4% from the intraday high yesterday to the lowest level in the wee hours of Asian trading this Friday:

Our call for a double-top yesterday seems to have been very timely!

Time’s up - have a great weekend and “May the trend be with you”!

One equity segment I did not mention above was small cap stocks. One of the best performing major indices in the US equity market yesterday was the Russell 2000, synonymous with small cap stocks:

Observing the ratio chart between the Russell 2000 (RTY) and the S&P 500 (SPX), we notice that a short-term downtrend line (black dashed has now clearly been broken:

This was helped by a positive divergence between momentum (MACD) and price - see black arrows. Should the ration be able to break above the medium-term downtrend channel (blue), then we finally could be in for a small cap relative outperformance.

I will try to keep you posted on such a breakout, hence, STAY TUNED!