QuiCQ 09/07/2025

Semis lead ... copper?

“Time is the only currency you spend without knowing your balance. Use it wisely.”

- Gregory Bloomfield

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Yesterday, we got more Trump Tariff Tantrum (TTT) after Monday’s deadline extension and additional 25% tariffs on a dozen or more trading partners. Yesterday’s TTT included 50% and 200% tariffs on copper, respectively pharmaceuticals and a “no extension” warning on the August 1st deadline.

As so often, markets … couldn’t give a monkey’s.

Well, at least not equity or bond markets as a whole.

Copper did react with a 13% price jump:

As mentioned, equity markets reacted very little and generally enjoyed a very quiet day with a narrow trading range:

The number of stocks rising and falling was pretty much balanced as were sectors advancing and declining:

The performance of energy stocks stands out above. Here’s the SPDR Energy ETF (XLE):

A promising start or just another flash in the pan? Given that crude oil was only marginally higher yesterday, I find the move on the equity side quite encouraging.

On the rates side of matters, don’t look now, but Japanese bond yields are on the up again. Here’s the 30-year JGB yield:

Why should you care? After all you are not invested into Japanese Government bonds:

Albert Edwards of SocGen fame sums it up best:

“Global bond yield suppression has been a constantly favourable backdrop for equity investors since the 2008 Global Financial Crisis. Every attempt to withdraw support has led to the financial markets convulsing until policy makers are forced to U-turn. I have always exhorted clients to keep a close eye on Japan. Major financial events often happen first in Japan, for example the late-1990s tech bubble bursting first in Japan.”

Point in case I would you remind you of the 13% sell-off with (short-term) impact on all global equity markets in August of last year …

I hear a lot that the Dollar is oversold and will bounce… perhaps, but so far the bounce is pretty timid:

So, will markets continue to ignore the US administration seemingly erratic decision-making forever? Of course, not! When will start paying heed? Hard to tell, but likely not on the subject currently under scrutiny, but something completely new. In our Q3 outlook published yesterday, we quoted a former Citibank CEO saying:

“Capital will flow to countries where it is welcome and stay where it is well treated.”

If you’d like a copy of our Q3 outlook and/or the accompanying chart book, drop me a line:

Time's up, more tomorrow - May the trend be with you!

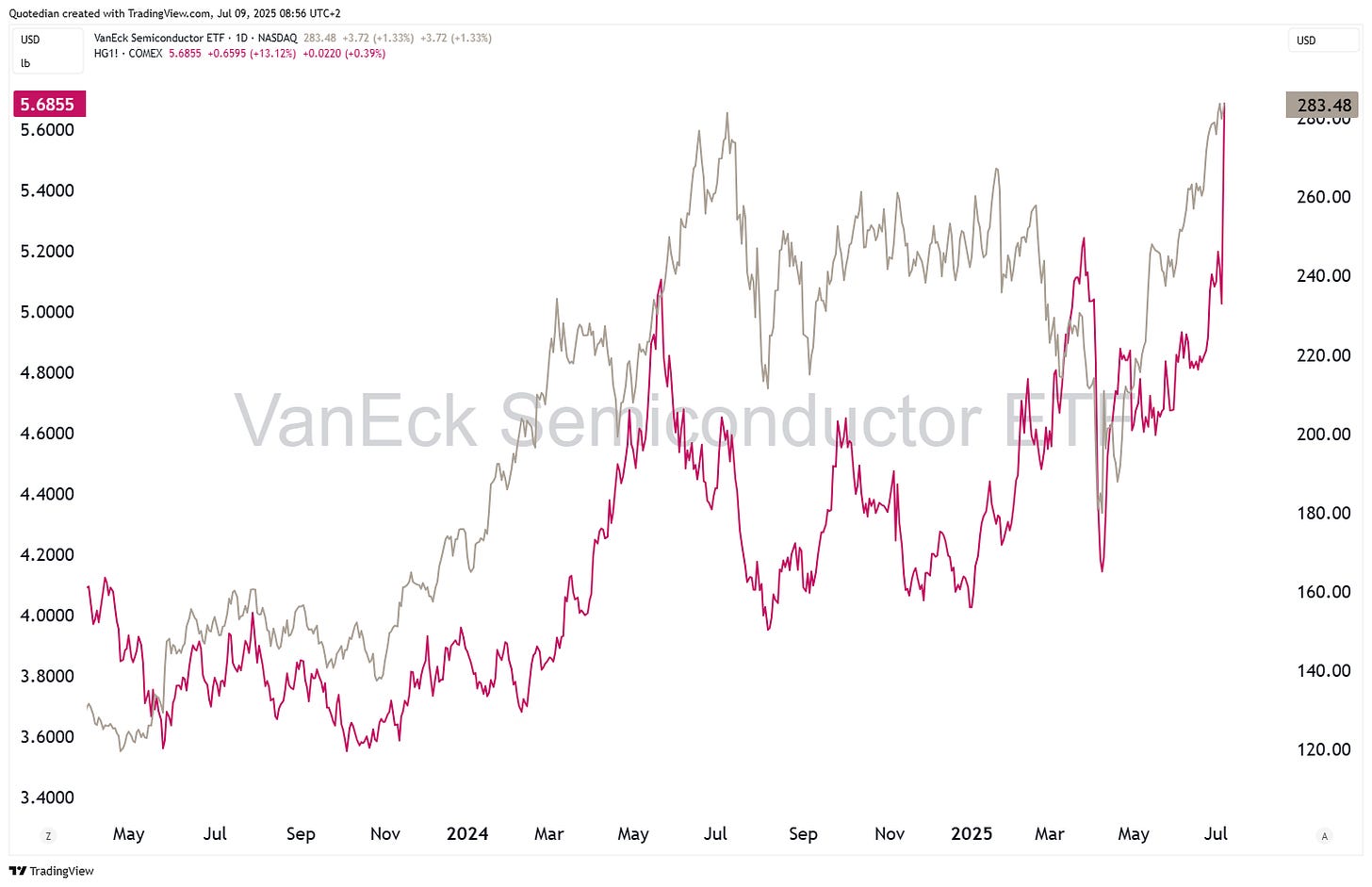

Are Semiconductor stocks (SMH, grey) a leading indicator for Copper prices (red):

Perhaps!