“Fantasy is silver and scarlet, indigo and azure, obsidian veined with gold and lapis lazuli. Reality is plywood and plastic, done up in mud brown and olive drab. Fantasy tastes of habaneros and honey, cinnamon and cloves, rare red meat and wines as sweet as summer. Reality is beans and tofu, and ashes at the end.”

— George R.R. Martin

Prefer to read today’s QuiCQ in PDF? Download here:

Nada. Nothing. Zip. Zero.

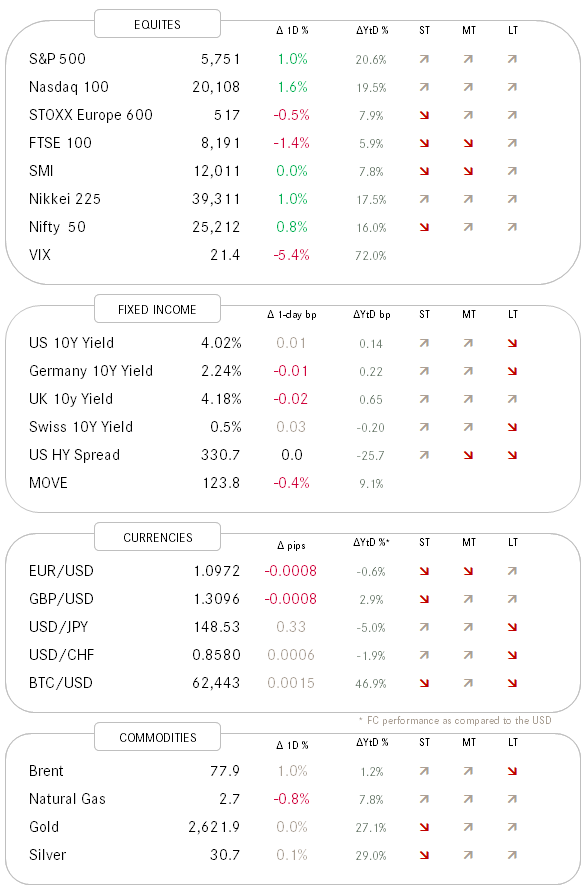

Good session for US equities yesterday, which rebounded enough to recover all of Monday’s losses, and in the case of the Nasdaq “and then some”. Nine out of the eleven economic sectors closes higher on the day, lead by technology stocks (+2.1%), with energy stocks being the laggard (-2.6%). The number of advancers outpaced the decliners by about two to one, whilst thirty stocks in the S&P 500 hit a new 52-week high, versus five a new 52-week low.

Thanks to the rally on Wall Street European stocks were able to regain some of their early session losses.

Asian markets are a bit all over the place. On one hand side Japanese stocks are up a solid percentage point, whilst Chinese stocks (CSI300) are down about 3%, but up nearly 6% from their intraday lows. All-in-all, my guess would be for a healthy start to our cash trading session here.

US 10-year yield continue to hover above 4%, only slightly off their intraday highs of 4.05% yesterday.

One big macro moving element is oil, which put in a nasty reversal in yesterday, plunging nearly five percent on the day (which would explain the weakness in energy stocks mentioned further up).

The US Dollar in the meantime has halted its ascend somewhat. Pause or reversal? Time will tell :-)

Nearly lastly, and FWIW, New Zealand’s central bank cuts its key policy rate by 50 basis points for a second time overnight.

And finally, we do not really cover corporate news items in this document, but the US DOJ’s mulling over a potential breaking up of Google over monopolization accusations is nearly a macro event …

Cryptocurrencies have found their deserved way into portfolios and asset allocation models of many investors and here at NPB we pride ourselves of having been one of the first in Switzerland to offer trading and storage.

But as in any asset class, excesses happen and rotten apples appear. In the digital currency space those are normally referred to as “sh.tcoins”. Within that realm it is undeniable that the name-giving to some of the coins has been of utmost entertainment value: Dogecoin (DOGE), Shiba Inu (SHIB), PooCoin (POOCOIN), SafeMoon (SAFEMOON) to name but a few (some others could only possibly be mentioned by scratching their names into public toilet doors…).

But I think I ran over the most hilarious one yesterday, the name of the token being:

HarryPotterObamaSonic10Inu(ERC-20)

Say what? HarryPotterObamaSonic10Inu(ERC-20). OMG! Funnily enough, HarryPotterObamaSonic10Inu(ERC-20) has the ticker of BITCOIN and actually has a really constructive chart:

Is HarryPotterObamaSonic10Inu(ERC-20) leading the way higher for other cryptos?

MicroStrategy (MSTR) which thanks to its crypto-heavy balance sheet has become a leveraged play on Bitcoin, would suggest that indeed cryptos may be in for another leg up: