QuiCQ 09/10/2025

Is Steel is the Real Deal?

“Man is free at the moment he wishes to be.”

— Voltaire

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Just a quick update today, as I am still in the quarterly Investment Committee week, which means two days of preparation (done), one day of ‘negoiating’ (done), and then two days of writing up. Very resource intensive and exhausting, but … also very rewarding!

So, off we go, with what of course is the best (human) headline over the past few hours:

The other ‘news’ is of course the forming of the “Everything Bubble”. Bubble in Gold, bubble in Stocks, bubble in Bitcoin … So, should we “Fade the Bubble” and hide in bonds and cash or “Learn to Stop Worrying and Love the Bubble?”. Our view to be revealed in next week’s Q4 outlook, but here’s a small hint: not the former.

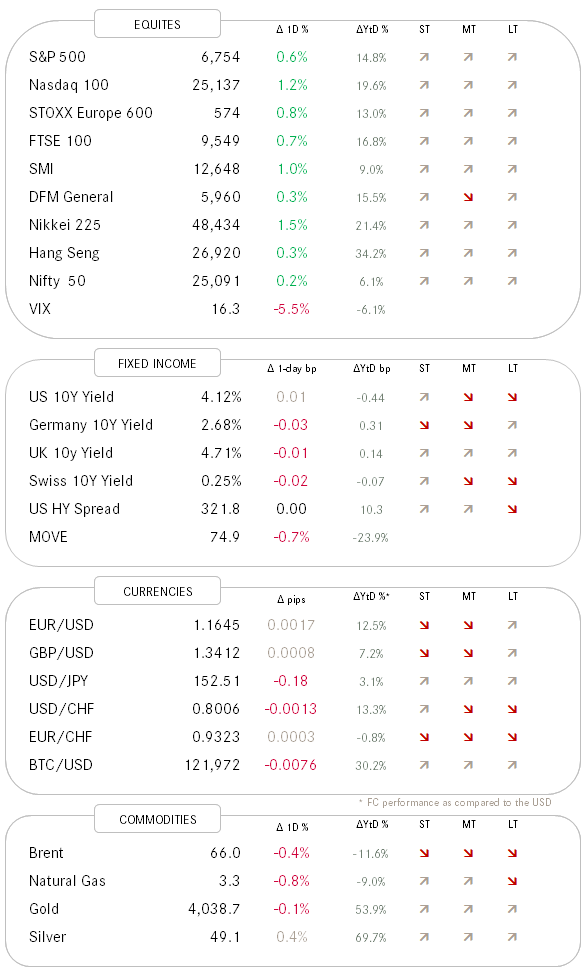

Anyway, stocks smashed higher yet again yesterday, lead by the Philadelphia Semiconductor (SOX) index (+3.4%), followed by the Nasdaq (+1.2), then the Russell 2000 small cap index (+1%) and finally the ‘tail’ made up by the mighty S&P 500 (+0.6%). All of them, with the small exception of the Russell 2000, made a new all-time high, which per se, is NOT bearish.

One of the market’s Achilles Tendons seem to be Financials right now, which again was one of the weaker sectors in yesterday’s otherwise everything rally:

I think to know a good reason for this relative weakness and have outlined in this week’s Quotedian dubbed “Pirate Credit” (click here).

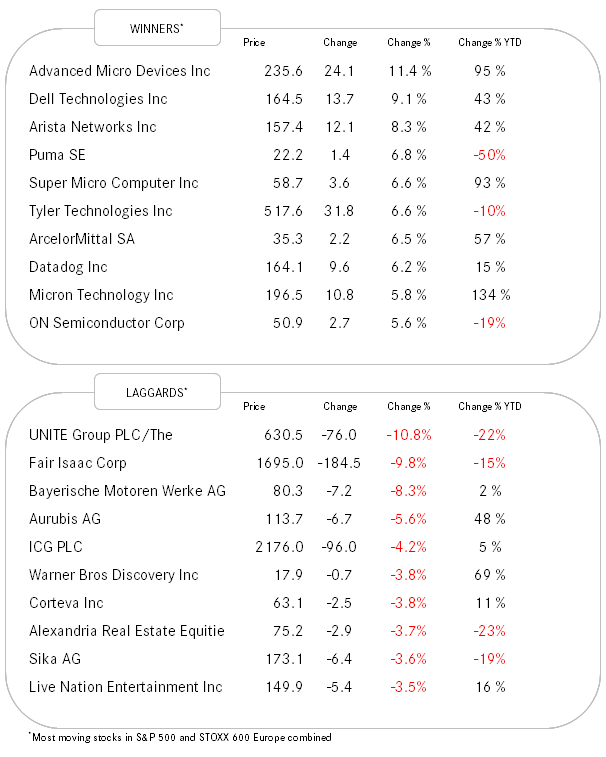

In currency markets, the US Dollar Index (DXY) has exceed a minor resistance level, which, coupled together with overly negative sentiment on the greenback, could give the current rally some more leg:

On the EUR/USD chart that translates to: if 1.1600 broken, then 1.1400 possible:

In cryptoland, Bitcoin made a new ATH on Monday, which would hint to the rally also continuing there. Solana and Ethereum may be the next two cryptocurrencies to achieve that feat:

But of course, ladies and gentlemen, we need to talk gold if we talk currencies/money … only six months and change after breaking through the $3,000 level, the shiny yellow metal broke above $4,000 yesterday:

Yes, looks a bit bubbelish, but the main risk continues to lay on the upside. BTFD.

Time's up, more tomorrow - May the trend be with you!

After our successfull release of “All That Shines is Gold”, followed by “Rocks over Stocks”, the next Blockbuster coming (hopefully) to a portfolio near you:

“Steel is the Real Deal”!

Taking the VanEck Steel ETF as a proxy for the steel sector, prices just moved above the December 2023 top (red dashed), marking its highest level in 15-years. Next stop: the 2010 highs (red dotted). After that: The sky is the limit.

Remember:

Thanks for everything you write André!

Talking about "pirate credit", if you think private credit is having some trouble, you can write about the current state of private equity (continuation funds, "democratisation of private equity", exits...) some day

The correlation between commodities and equities you highlight feels like a late-cycle signature that is strong but increasingly fragile.