QuiCQ 10/05/2024

And the winner is ...

Prefer to read today’s QuiCQ in PDF format? No prob, download it here!

"If the world were perfect, it wouldn’t be."

-- Yogi Berra

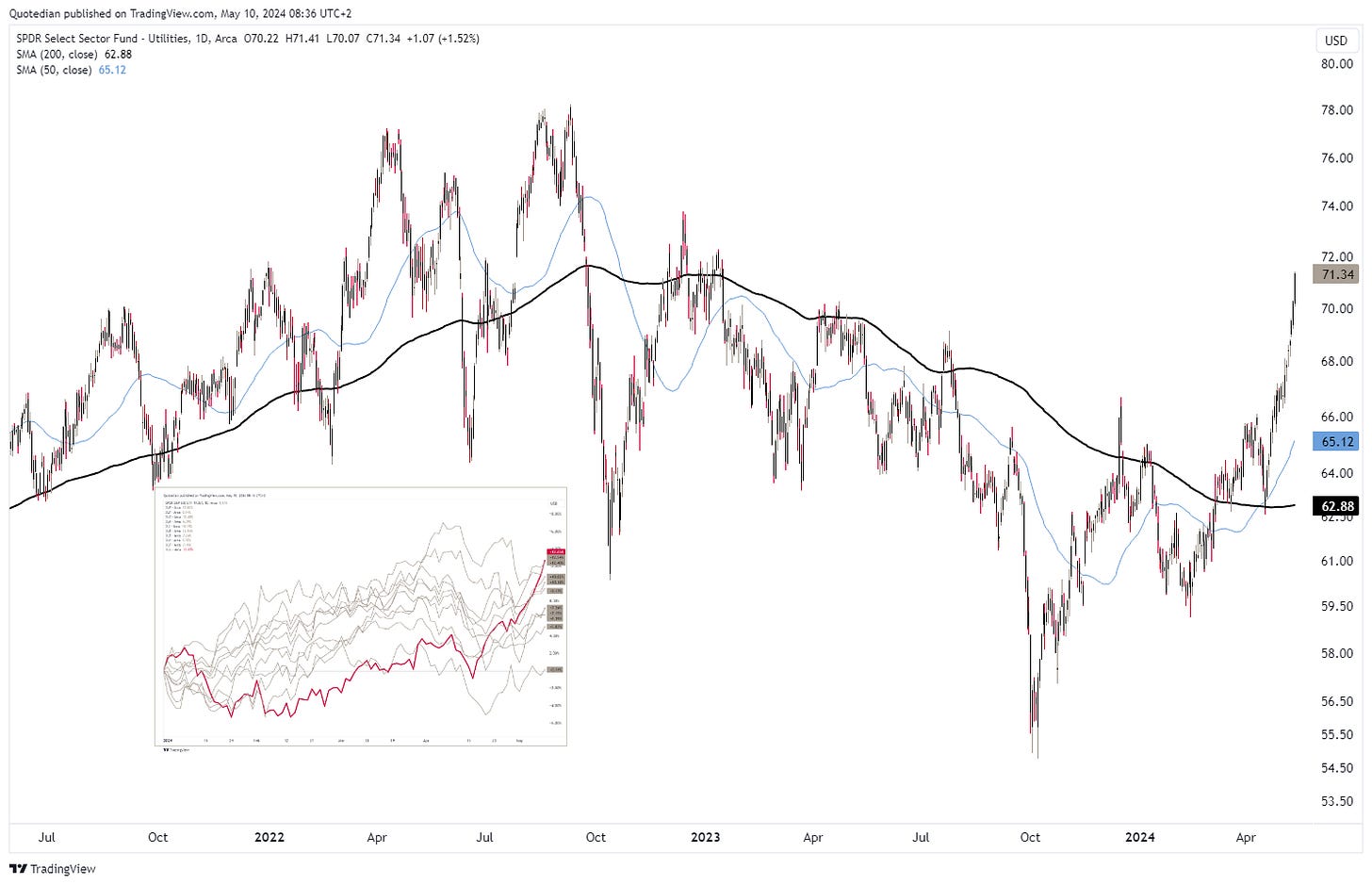

Aaaaand, the best performing sector year-to-date in the S&P 500 is … drumroll … Utilities (see inset graph below)! Big, fat, boring Utilities! And that despite that utility stocks are considered bond proxies, and bond performance (govies) is down year-to-date.

The graph below shows the SPDR Select Sector Utilities ETF (XLU). I mentioned a few times in this space (www.quicq.ch) and in the Quotedian (www.thequotedian.com) that one of the ways to play the energy-intense boom may be utility stocks. As the market seems to warm up to that trade, the short-term seems somewhat overbought, but there should be more upside over the coming months to years.