QuiCQ 10/09/2025

Parallel Universe

“I love you. I love you in every universe.”

— Doctor Strange in the Multiverse of Madness (2022)

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Universe One:

Israel carries out attack in Qatar targeting Hamas leaders

Poland shoots down Russian drones

The BLS (Bureau of Labour Statistics) reports 910,000 fewer people than thought were on payrolls over the past year

The current US administration tries with all its soul and heart to further undermine the Fed independence already in question

Trump tells EU to hit China and India with 100% tariffs to pressure Putin, basically painting the US/EU into a corner, because doing and not doing it will now have negative consequences

French President Macron appointed 39-year-old Defence Minister Lecornu as his latest prime minister, immediately drawing the wrath from all corners of the parliament

Gold (December 25 futures) hits a new all-tim high at 3,715

Universe Two:

Stocks go up

Hard to understand the ignore of the stock market to many things happening around the world, be it economic or geopolitical, but then again, this has been the Status Quo for a while now. I guess it’s just: “The trend is your friend, right until the end, at the bend …”. We are all just collectively hoping that we’ll fit through the exit door once the fire breaks out.

But anyway, in the meantime we are not complaining, our job is always easier when “things” go up. Hence, we welcome the S&P 500 closing at another all-time high (ATH) yesterday. Not an absolute new ATH (which was reached last Friday shortly after market opening at 6,532), but yes, a closing ATH:

Breadth was actually slightly negative, with losers outpacing winners at a ratio of 3:2, leaving us with following heat map for the S&P 500:

This early Wednesday mornings Asia stocks are flying higher across pretty much the whole continent:

And index futures point to a healthy +0.25%-0.50% higher start too here in Europe.

We already mentioned Gold futures contracts (DEC25) trading briefly above $3,700 over the past hours - our price target of $4,200 is approaching quickly. Here’s the Gold spot chart:

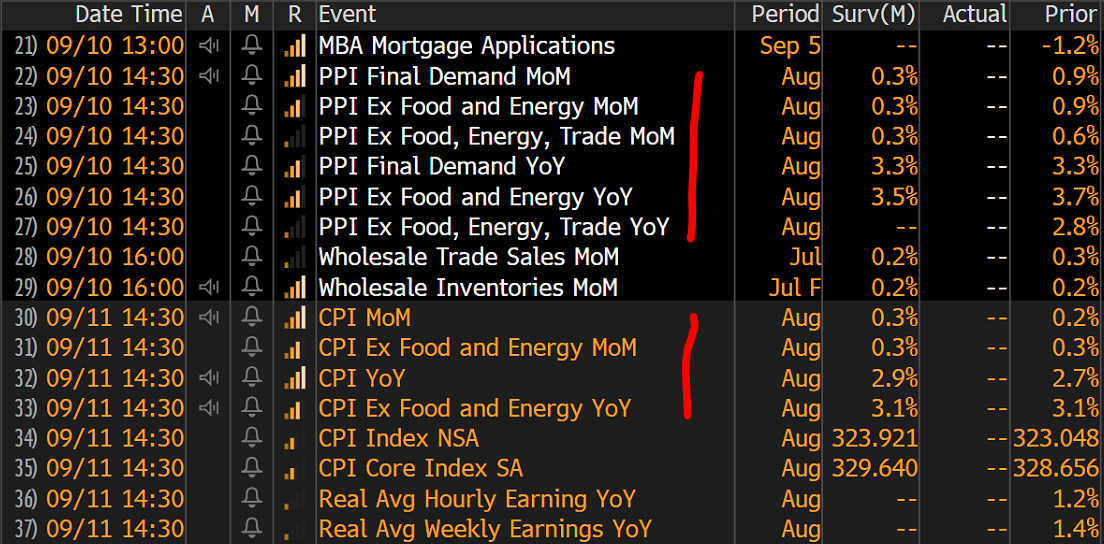

Bond and currency markets where relatively quiet yesterday, with both yields and the US Dollar recovering some of the previous’ days losses. However, the next 36 hours or so could turn out to be ‘livelier’ as the market awaits US PPI number later today and especially US CPI tomorrow:

As I have stated ‘ad nauseum’, neither should matter, especially not the super-lagging CPI number, but market participants still like to waist their time with these. Having said that, are we in for a nasty (upside) inflation surprise this month? Check out the chart-of-the-day for a possible answer …

André

We showed this chart already in Monday’s Quotedian (click here). It compares the US CPI (grey line - RHS) to the ISM Prices Paid report (red - LHS):

A correlation is undeniable, as is a certain lead to the (soft) ISM report. Those prices paid would suggest a pick up in CPI over the coming months. Let’s see tomorrow.

(Quick remark: the two series and printed on different axis. Hence, only direction matters, not the size of the move).

Stay tuned …