“Government's view of the economy could be summed up in a few short phrases: If it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.”

— Ronald Reagan

Prefer to read today’s QuiCQ in PDF? Download here:

An overall quiet session yesterday, or should we rather call it a stealth session? After all: S&P 500 new ATH —> check. DJ Industrial new ATH —> check. NYSE Composite new ATH —> check. Nasdaq 100 closed July gap window —> check.

A lot of new ATHs there with fairly little noise about it.

Anyway, trading was calm, with stocks steadily drifting higher, the advance-decline ratio being 3:1 and only one sector (utilities) out of eleven ended lower on the day.

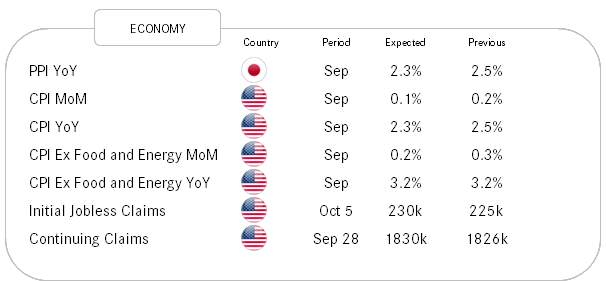

Bond markets traded lower, as yields on the Tens for example moved higher to 4.07% on the back of hawkish Fed talk (Logan) and ahead of today’s CPI. As mentioned a million times, this manipulated, heavily backward looking three-letter nearly swearword shouldn’t matter - but apparently it does.

The US Dollar unsurprisingly continued to move higher too on a increasingly hawkish sounding Fed, whilst Gold is trading just a tad above USD2,600 pressurized by a stronger greenback and some geopolitical tension relief.

Oil’s price volatility is probably a bit less about the Middle East right now, but more on the Chinese stimulus, as the market is trying to figure out how large its long-term impact is going to be.

Speaking of China, Asian markets are resoundingly positive this morning, lead by Chinese complex, with Hong Kong stocks up nearly up 4%, closely followed by China mainland equities.

US inflation numbers (CPI) are due today, however, there is another item on the economic agenda, which I did not shown in the table in the Agenda section. And that is France’s budget proposal. With the OAT-Bund spread (see below) already at its highest since the European Sovereign Debt crisis in 2011/2012, investors are seemingly already sitting on needles. Let’s watch this close for either relief or another Truss-moment.