QuiCQ 10/12/2024

Reversal

“The bear have all the arguments. The Bulls have all the money.

— The Editor of The QuiCQ

Tight schedule induced speed round …

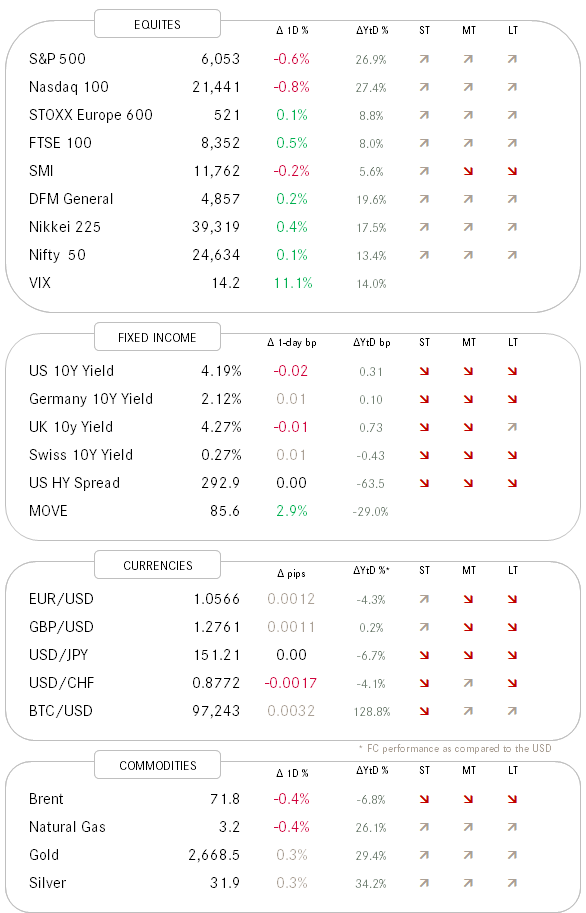

Equities —> If you've had a good year so far in the (US) stock market, chances are you had a pretty bad day in the market yesterday. On the surface, today's action wasn't awful. The S&P 500 was down 0.5% while the Russell 1,000 was down 0.7% and the Nasdaq gave back -0.8%. Not a tragedy.

However, under the hood we observed one of the largest reversal of fortunes in recent time. More on this in the COTD section below.

Rates —> Eventless session with small drift tendency higher. Clearly, the market is waiting for US CPI and PPI figures out tomorrow respectively Thursday.

FX —> The Japanese Yen weakened on some contradictory Fed speech. Gold a tad stronger on foreign central bank buying.

This morning —> Very decent +3% start to Chinese equity session upon further stimulus speech, that then faded away into a 0.7% advance only at the time of typing. However, green dominates this mornings’ Asian equity session. European equity futures point to a weaker start, US futures are flat.

What made yesterday’s session noteworthy was the near perfect performance distribution based on how stocks had performed so far this year heading into today. The fine people at Bespoke broke the Russell 1000 into decile performance buckets, with decile containing the best performing stocks YTD, decile 2 the next 100 best and so on until you get to decile 10 which contains the 10% bottom performers YTD.

The chart below shows then the performance of those buckets yesterday - quite the reversal and hence our opening phrase in the equity section.

Here’s some more … 26 stocks in the Russell 1000 were up YTD 100% or more through last Friday. This is how they performed yesterday: