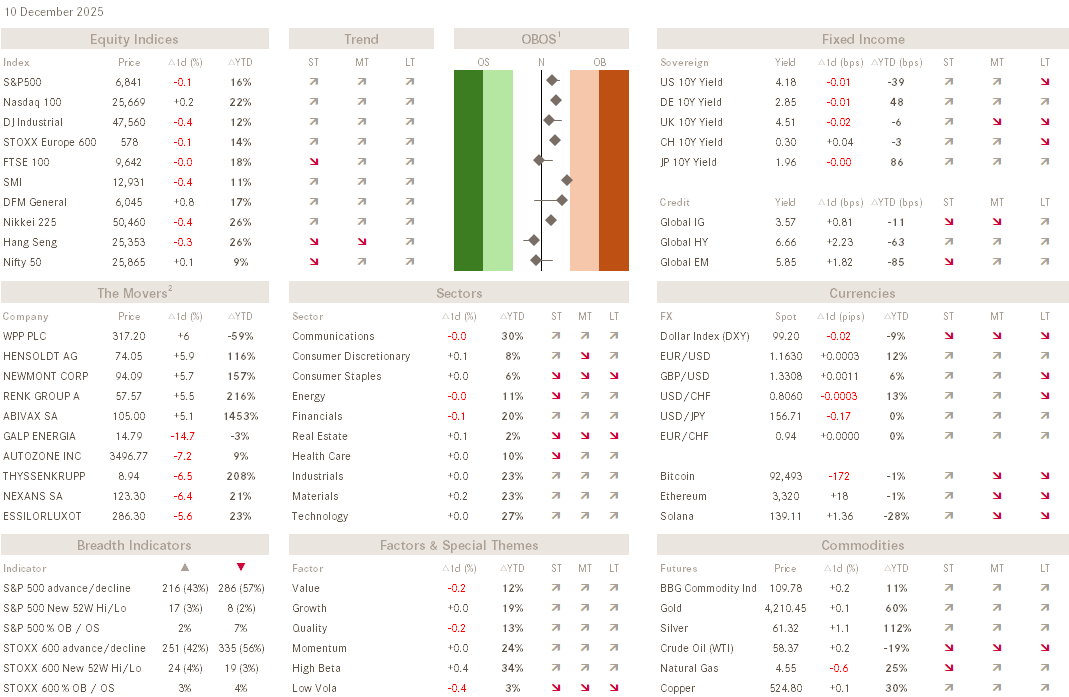

QuiCQ 10/12/2025

The Silver Surfer

“Too many people miss the silver lining because they’re expecting gold.”

— Maurice Setter

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Don’t tell me I did not ‘warn’ you:

The Quotedian (October 27th 2025) - A Silver Lining

And here we are now, right into that blow-off top:

And is this it now? Is Silver about to hit a brick wall? Perhaps.

But truly, nobody knows, but I encourage you to remember this chart of previous blow-off tops we have been using for a while now:

Plus, how many of your Uber-Driver and hairdressers are talking about Silver already? I rest my case.

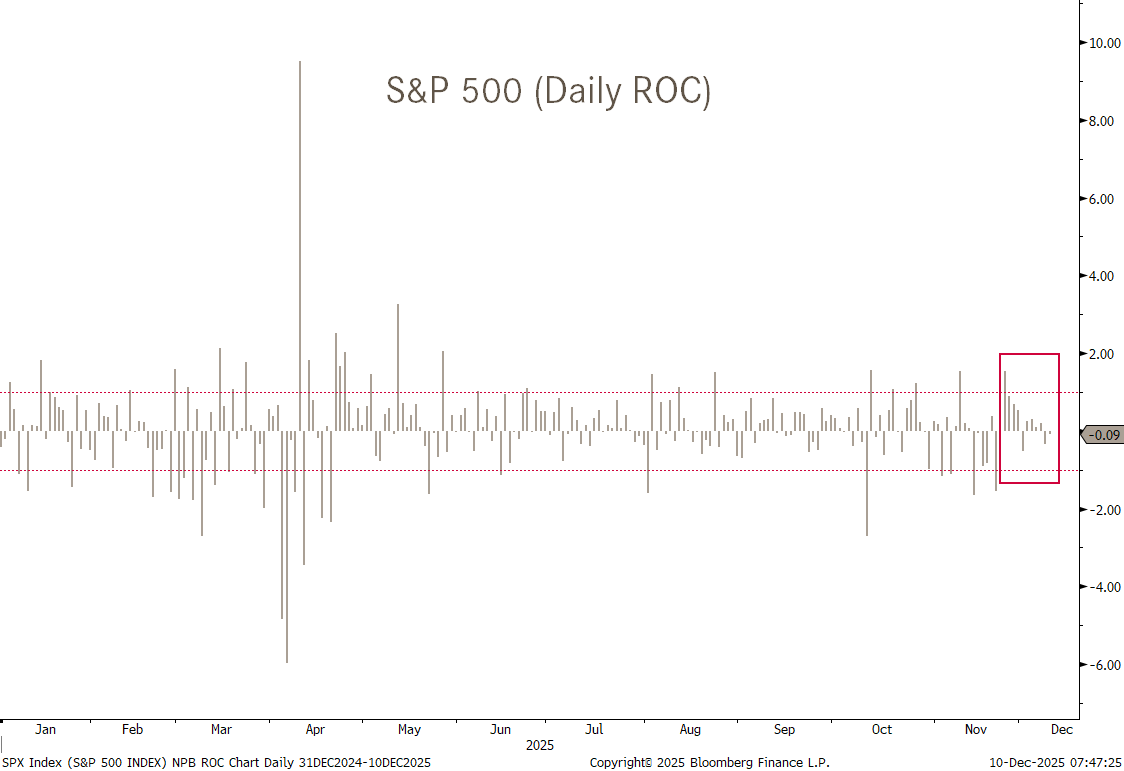

In stock markets, it has been “Waiting for Godot FOMC”, with no move in excess of one percent since November 25th (~12 sessions), coupled with an ever diminishing return range:

Some pockets, such as Transportation stocks and Small caps, have been stronger, but we wrote about this in this week’s Quotedian titled “Let’s Get Physical”, which you can checkout by clicking here.

US (and European) yields have been pushing higher recently, especially at the long-end of the curve. The 10-year US Treasury yield just completed an inverted shoulder-head-shoulder pattern, with a price yield target counting to just below 4.40%:

Is US growth maybe much stronger than expected and the Fed is about to committ a phenomenal policy error (and then a few more next year if Trump gets his way)?

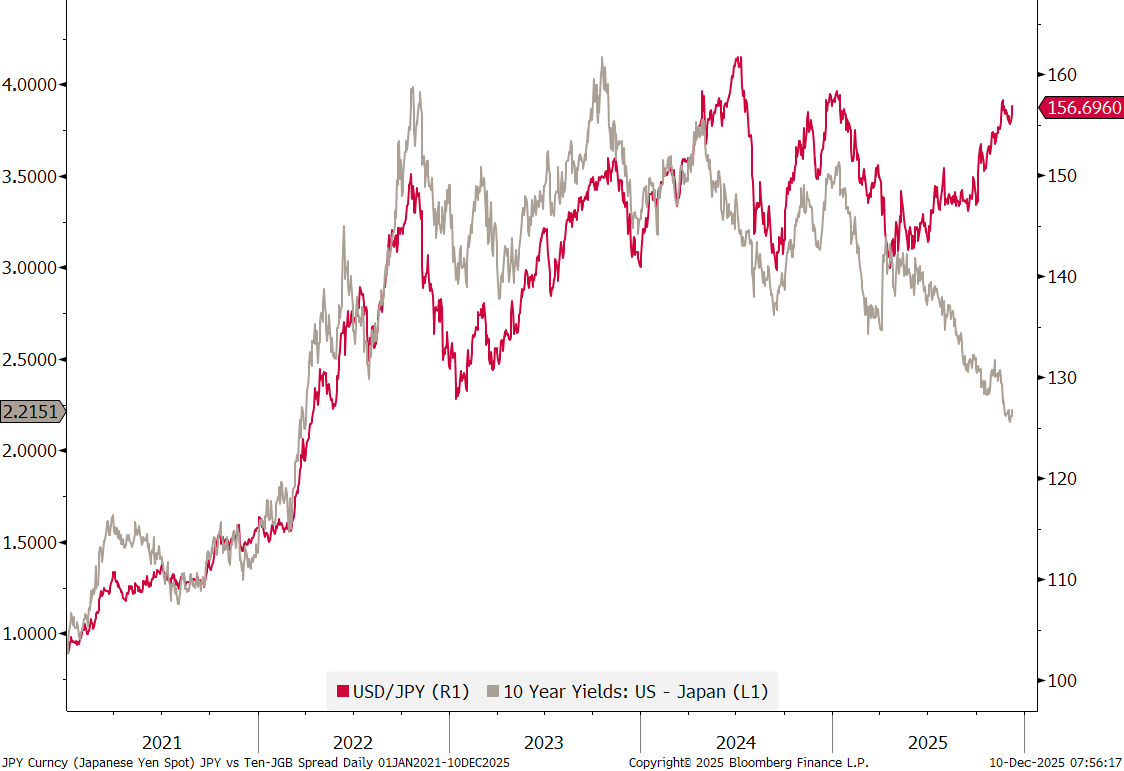

Further supporting such an outcome is our chart-of-the-day below:

The interest rate differential between US 10-year Treasury yields and 10-year JGBs (Japanese Government Bonds), the grey line below, has been shrinking substantially this year, as US yields range traded whilst JGB yields exploded higher. This should be beneficial for the Japanese Yen as compared to the US Dollar, but for some reason the USD/JPY cross (red line) is not buying it:

Stay tuned, I would suggest.