QuiCQ 11/09/2024

Titbits

“Those are my principles, and if you don’t like them…well, I have others.”

— Groucho Marx

Prefer to read today’s QuiCQ in PDF? No prob, download it here, but don’t you dare complain about the formatting!

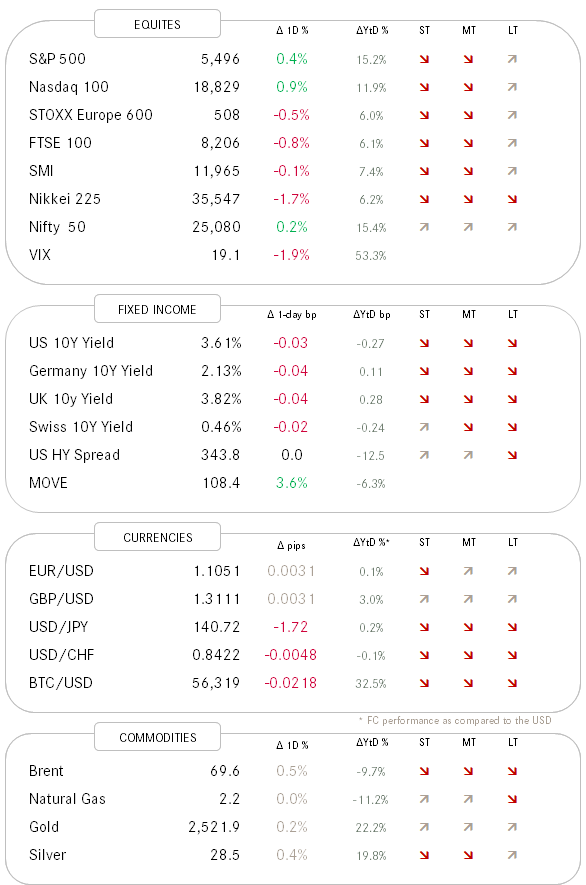

Yesterday’s session was not about the stock market, though it offered some interesting titbits too. Both the S&P 500 (+0.455) and the Nasdaq 100 (+0.90) closed higher, with the latter posting an impressive 1.4% rally shortly after the European market close. However, the Dow Jones Industrial index (aka Papa Dow) closed a quarter of a percentage point lower. How come? Well, the Dow is a price-weighted index, which means that stocks with a higher price get a higher ‘saying’. I know, I know, makes no sense at all, but hey, do not shoot the messenger … Anyhow, some of the higher priced stocks in the index are banking stocks such as JPMorgan (JPM) or Goldman Sachs (GS), which brings us back to that titbit of interest. Banking stocks should have done well yesterday, Fed's Michael Barr, the central bank official in charge of bank oversight, speaking in Washington D.C. said that the Fed and other financial regulators would amend their proposal for the upcoming Basel III regulatory framework, with the key update being paring back the increase in capital requirements for big banks, to 9% from an original plan for 19%. Unfortunately and nearly simultaneously, several large US banks, including fore-menionted JPM and GS amongst other, gave pretty cautious outlooks at Barclay’s Global Financial Services Conference in New York. Hence, most bank stocks fell on the day, offsetting the good news:

But, what really mattered yesterday, were (bond) yields and the oil price. The 10-year Treasury sliced itself through a key support and dropped as low as 3.61, where it still trades now give or take. The 2-year Treasury fell to 3.56%, which is its lowest level since September 2022.

Simultaneously, the price of crude oil (e.g. WTI) dropped by over four percent in yesterday’s session to a intraday low of $65.32.

We had an in-depth discussion regarding rates and their correlation to the oil price in Monday’s Quotedian “Seasonality Greetings”, and I kindly invite you to go and (re-)read it by clicking here.

In any case, both, yields and oil, are signalling an (overly?) negative economic outlook.

And finally, yes, not one word on the US presidential debate last night. I leave the screaming to others.

As long-term readers of The Quotedian and The QuiCQ may suspect by now, I have a tendency to err on the positive side of matters, especially if it is about investment risk-on matters.

However, it remains important to listen to possible disrupting facts (not opinions) to one’s view ;-)

In that context, the little statistic below caught my attention. It shows the yearly performance of the S&P 500 in years where utility stocks were the best performing sector as they are this year:

Hhhhhhmmmm. Interesting, but let’s brush it off with the small sample size argument!