QuiCQ 11/09/2025

Doom Sells

“The only thing we have to fear is fear itself.”

— Franklin D. Roosevelt

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

As geopolitical news darkens (Kirk’s assassination, France burning, Poland closest to war since WWII, Nepal Finance Minister attacked, etc, etc, etc.) stocks continue to tug along, with the S&P 500 reaching a new ATH yesterday,

mainly thanks to a gap higher at the opening, with the rally then fading away until the last half an hour of trading:

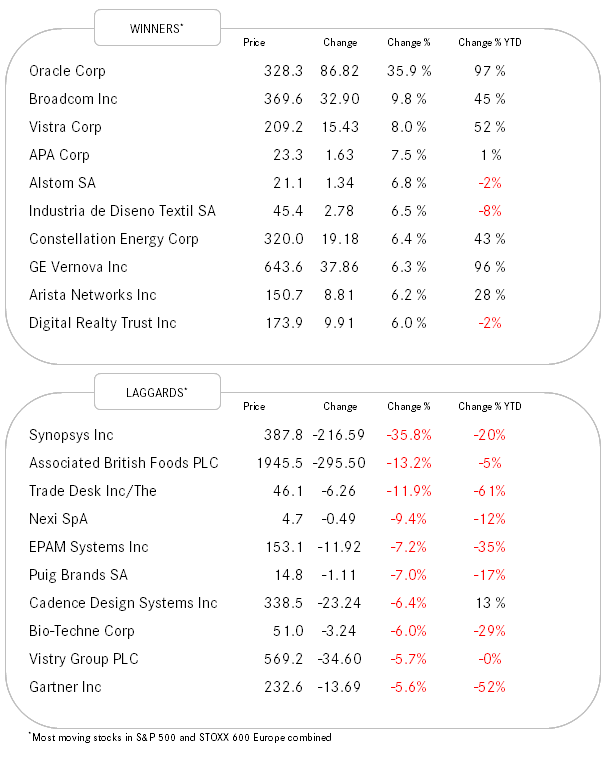

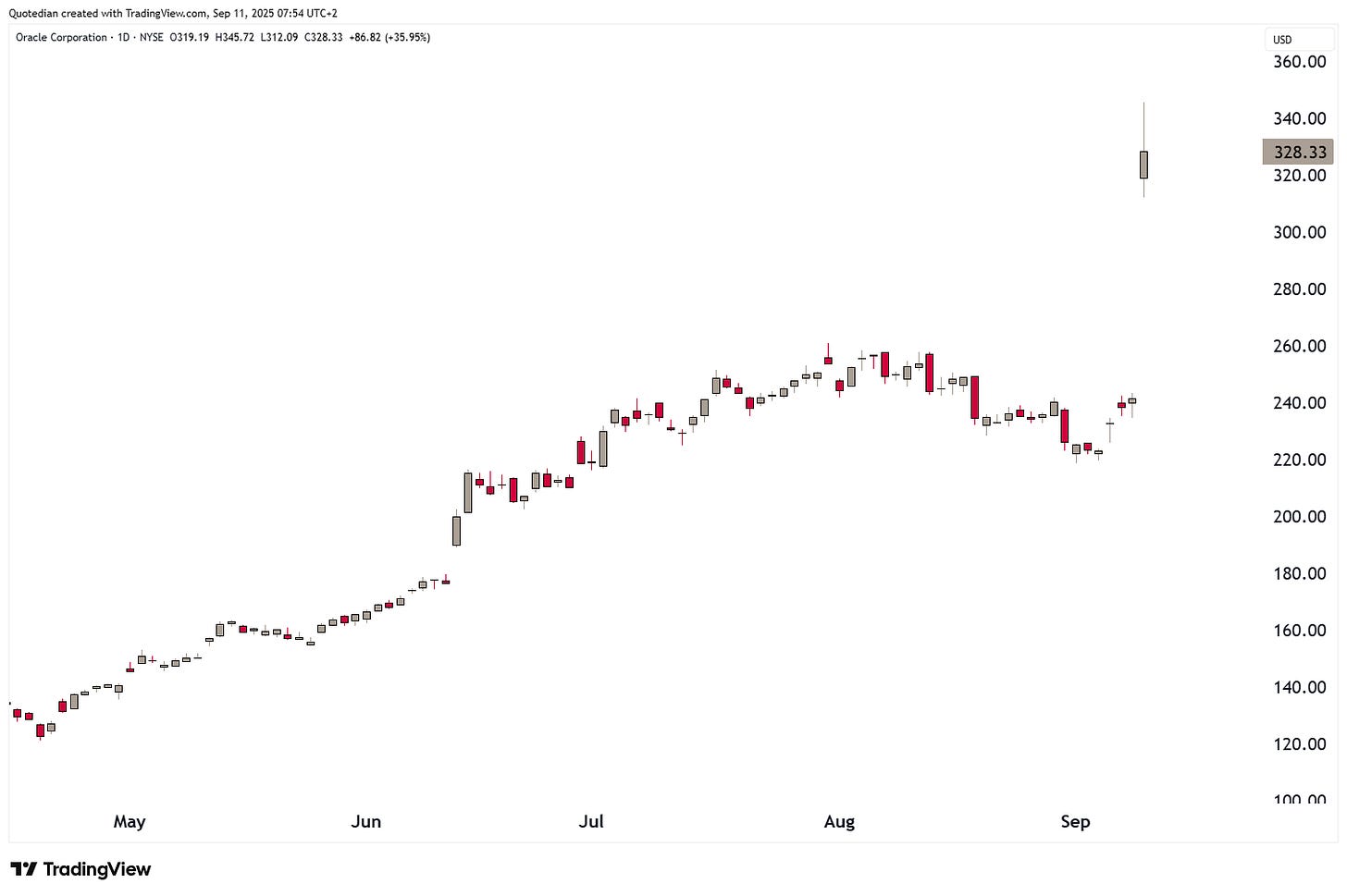

I don’t have the data on how many of the 19 index points the S&P 500 was up yesterday, Oracle with its stellar 36% one-day rise was responsible for,

but given that three stocks fell in the index for every stocks up, it must have been quite a few.

In that context it is interesting to observe that the S&P 500 (grey) has had three consecutive up sessions this week, whilst the S&P 500 equal-weight (red) version faced three consecutive down days, creating one of the largest gaps between the two so far this year:

In other asset classes, of note is the numbness of the oil price on any geopolitical news. (e.g., Russian drones in Polish airspace, Israel attacking targets in Doha, others). Here’s the chart for Brent:

Whilst the oil price did increase slightly, here is the excited reaction on the CBOE Oil Volatility index:

The Day Ahead

Later today, ECB rate decision with no change expected:

And then, all eyes on the US CPI out at 14.30 CET:

Here’s the range for the monthly estimate:

Have a great day!

André

(Un)fortunately, there’s always a bull market somewhere. And one that may have just gotten started, despite some very decent gains already, could be that of European defence. Latest since yesterday’s Russian drone intrusion into Polish airspace should even the sleepiest bench-sitter in Brussels have woken up to the new reality.

No one likes it, but one way to ‘play’ the European Defense renaissance is the ETF “Wisdomtree European Defense ETF” (EUDF/WDEF):

It was only launched back in March of this year, but the current price break out would suggest a price target between EUR39 and EUR41.

Stay tuned …