QuiCQ 11/12/2024

So you're telling me there is a chance?

“We are masters of unsaid words but slaves of those we let slip out.”

— Winston Churchill

Just for the fun of it, and completely BETA, I offer you today’s QuiCQ also in Video format:

Now stop laughing your head off and leave some feedback, good or bad in the comments section:

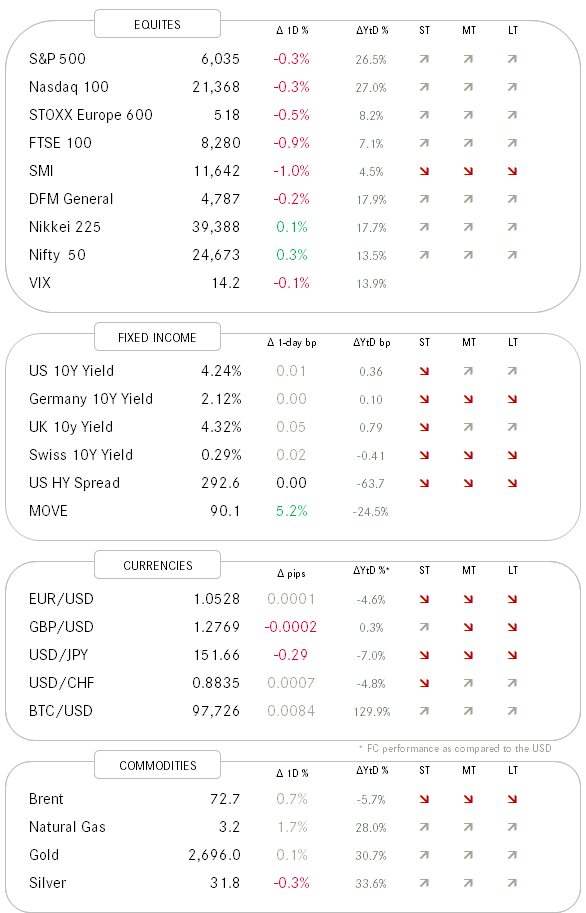

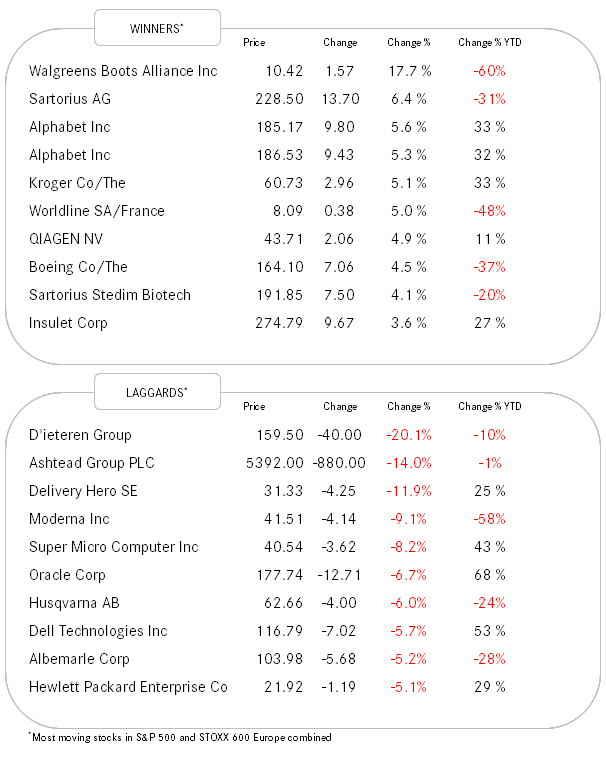

Stocks printed red for a second consecutive day yesterday, albeit it felt like a rather orderly, mostly eventless session. Mind you, the S&P 500’s -0.30% drawdown on the day could have looked worse without Google’s 5.5% quantum leap (what a pun, eh?) higher:

Only three out of the eleven sectors were able to keep their head over water, with the biggest losers being real estate and tech stocks.

The charts of the S&P 500 ‘normal’

and the S&P 500 ‘equal-weight’

look quite different, but both are simply witnessing consolidations within their uptrends.

Of course, is a big part of yesterday’s “dullness” attributable to today’s release of the US inflation numbers (CPI), from which investors hope to get an indication on next week’s FOMC decision.

Talking rates, US yields are pushing higher again, maybe in expectation of a higher CPI reading today, maybe because the bond vigilantes consider another rate cut unnecessary or maybe both:

On cue with rising rates did the US Dollar strengthen again too, pushing towards the lower end of the consolidation triangle we had observed in Monday’s Quotedian (click here):

Oddly enough, or not, is the price of Gold, which is often measured in USD, also pushing higher at the same time that the greenback found its bid again:

Trees do not grow into the sky, and this is also true for the species know as “Chips”. Semiconductor stocks are down 17% since their top back in July and in relative terms to the S&P 500 have been forming a shoulder-head-shoulder pattern as seen here:

In case the neckline (red) breaks, their could be 25% more relative downside to the broader market. But, always remember, there is nothing as bullish as a failed bearish pattern.

That’s all for today - have a great day!