QuiCQ 11/12/2025

CTRL + Print

“A great civilization is not conquered from without until it has destroyed itself from within”

— Ariel Durant

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

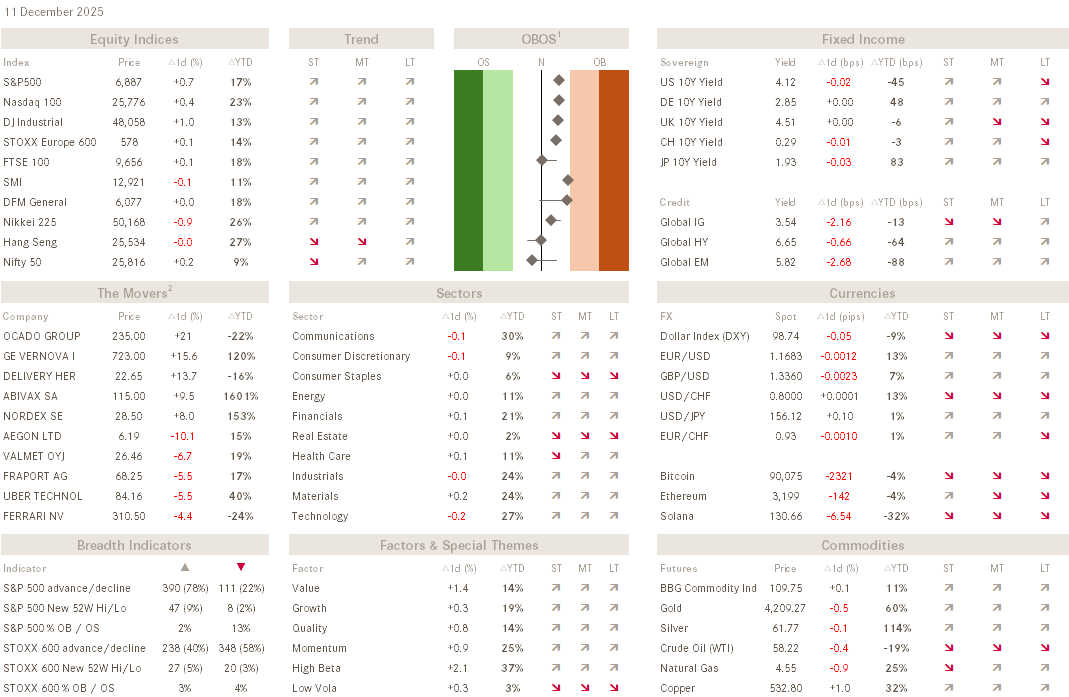

Finally we got that FOMC December out of the way, which delivered what was expected by market participants, a 25 basis points cut from 3.75-4.00% to 3.50-3.75%.

The meeting was a very special one for several reasons:

There where three dissidents: two advocating for now cut and one (guess who) voting for a 50 basis point cut

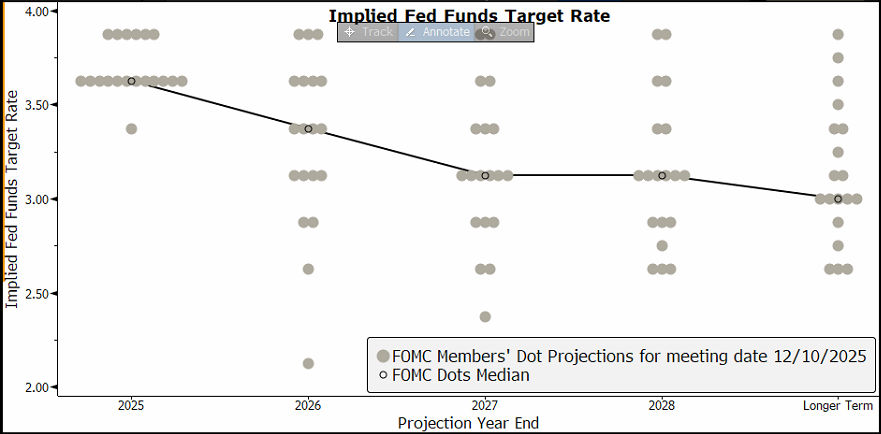

It as one of those where the always super-exiting (yawn) Dot Plot was updated:

The FOMC made a rate cut decision without actually having a lot of data to rely on (remember record-long government shut-down)

QE (Quantitative Easing) has been reinstalled

I will elaborate on these last two points closer in the next Quotedian, due Monday 15th December, but on point 4. one fellow newsletter writer put it eloquently in his missive last evening:

Whether we want to call them “Reserve Management Purchases” or use the adult, non-fiction name, quantitative easing, doesn’t change the outcome. Liquidity is being conjured out of thin air again, just as the most indebted federal government in U.S. history needs someone to quietly buy its bills for it.

Hence, starting next month, the Fed will be starting buying USD40 billion again. Check out our chart of the day at the end of this tome for a comment on that.

Hence, post-FOMC, the market reaction was what was to be expected from a market where the central bank just hit that CTRL+Print button combination again:

Stocks rallied, with many US indices either making new all-time highs or missing new ATH by only a few basis points. Point-in-case (pun intended), the S&P 500:

However, the joy for bulls for short-lived (for now), as post-market close Oracle disappointed with their earnings and outlook, seeing the share price falling 12% in after-hours trading, pulling index futures (S&P 500 mini) alongside lower:

Bond yields dropped (for now), especially at the short-end (2Y):

Gold and silver rallied, here’s the latter:

And finally, the USD started debasing softening again. Here’s the US Dollar index (DXY):

The SNB

We’ll leave at this for today - have a great day!

André

Call it what you want, “Reserve Management Purchases” or whatever, the Fed just announced the re-launch of QE yesterday.

This at a time, where the Fed’s balance sheet is still larger than it was post the COVID-crisis, and after a few years of QT (Quantitative Tightening):

This will dictate the path of asset prices over the years to come and the content of our publications (Quotedian, CIO Outlook) for the next few months.

Stay tuned …