QuiCQ 12/03/2025

All over the place

"Successful investing is about managing risk, not avoiding it."

— Benjamin Graham

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Speed note today …

Shortly after the European cash trading close, the S&P 500 entered correction territory, defined as a top to bottom drop of 10% or more, for about half an hour yesterday, before turning around:

The intraday charts of the S&P 500 reveals that the index was all over the place yesterday, as it tried to form a bottom, but got hit around from Trump Tweet to Tweet Tantrum to Tantrum:

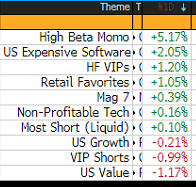

Looking under the hood, we see signs of another ugly session. All eleven sectors were down on the day (nowhere to hide) and losers outpaced advancers by a ratio of 3-to-1.

Mind you, some speculative corners of the market saw a rebound, though I am not sure I would evaluate that as a positive development:

On the fixed income side, duration came under pressure, as the bond yields rose on both side of the Atlantic. The US 10-year treasury advanced a not meaningless seven basis points on the day, but was still dwarfed by a stellar 10 bps rise in German Bund yields, which put that measure at 2.93%. Massive:

Little or no respite for the Dollar either, which continue to move from low to low, leaving little chance to sell on a rebound. Here’s the Dollar Index,

and here the more common view at the EUR/USD rate:

Time's up, more tomorrow - May the trend be with you!

As the world order of the past decades seems to be being toppled over in recent past, with a new accelerating pace since the inauguration of the new US administration, we need to ask ourselves if we still should hold was has worked in the past, or, if we just start focusing on what has not worked, and taking profit on what has.

Point-in-case, value stocks: