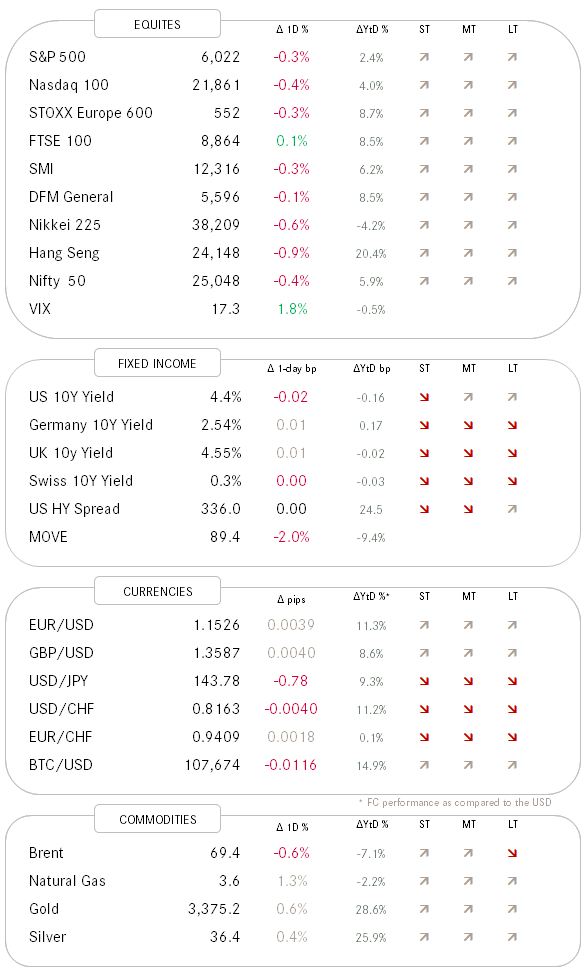

QuiCQ 12/06/2025

Surfin' USA

“I didn't think I was a genius. I thought I had talent. But I didn't think I was a genius.”

— Brian Wilson

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Yesterday seemed like another early summer lulls session, where a softer-than-expected (remember our whisper-number comment yesterday?) largely failed to lift the stock market meaningfully higher. However, it did have an impact on the bond market, with yields dropping about ten bp across the entire term structure. Here’s the intraday chart of 10-year version:

As the move took along the entire curve, no noticeable steepening or flattening was registered.

Back to the CPI number for a minute … whilst the reading was inline, respectively lower than expected, hinting to that the Trump Tariff Tantrum so far failed to exhibit inflationary pressures, it is widely expected that this will show up over the coming months. Also, here’s an interesting chart on the “Common Man Inflation” from Stratega Research Partners via John Authers at Bloomberg:

Quite contrary to the governments attempt to ‘hide’ inflation via Core and Supercore CPI numbers, the “Common Man CPI” focuses on prices that affect you and me everyday. The pace of increase has been faster than average hourly earnings, over the past years, which arguably was one of the reasons bringing down the Biden administration. It continues to outpace wages …

The following chart shows the CPI Diffusion index, i.e. how many items in the inflation basket are rising and how many are falling. At around 50%, as TS Lombard put it, not showing inflation, but also not disinflation:

In any case, yesterday’s CPI has sent the Fed on an early summer holiday, with the next cut expected earliest in September:

Little to observe from the equity session yesterday, other than that an early post-CPI rally on Wall Street fizzled out in the second half of the session and eventually took the S&P 500 (and others) into negative territory by market close. Hawkish trade talk comments by US President Trump then pushed futures prices further into the red before some stabilization in the grey hours of the European morning:

It was also these hawkish trade comments then, which sent the US Dollar noticeably lower again against the other G-10 currencies:

The EUR/USD for example is challenging the previous cycle high from three weeks ago again:

And Gold is pushing towards its all-time highs again of course too, given the weakness in the Greenback:

But the biggest mover in the macro-complex was oil, which saw its price per barrel over 4% on the back of increased sabre rattling between the US and Iran. Whilst the ‘black gold’ still trades below its 200-day moving average, it has pushed above previous support turned resistance again, improving the outlook substantially:

Another reason for the Fed not to cut …

Finally, RIP Brian Wilson, genius behind the Beach Boys. Time to reminisce:

Time's up, more tomorrow - May the trend be with you!

From the FT: “Gold has overtaken the euro as the world’s second most important reserve asset for central banks, driven by record purchases and soaring prices”