QuiCQ 12/09/2024

My Precious

“Smeagol Shows Them Secret Ways That Nobody Else Could Find, and They Say Sneak!”

— Golum

Prefer to read today’s QuiCQ in PDF? No prob, download it here, but don’t you dare complain about the formatting!

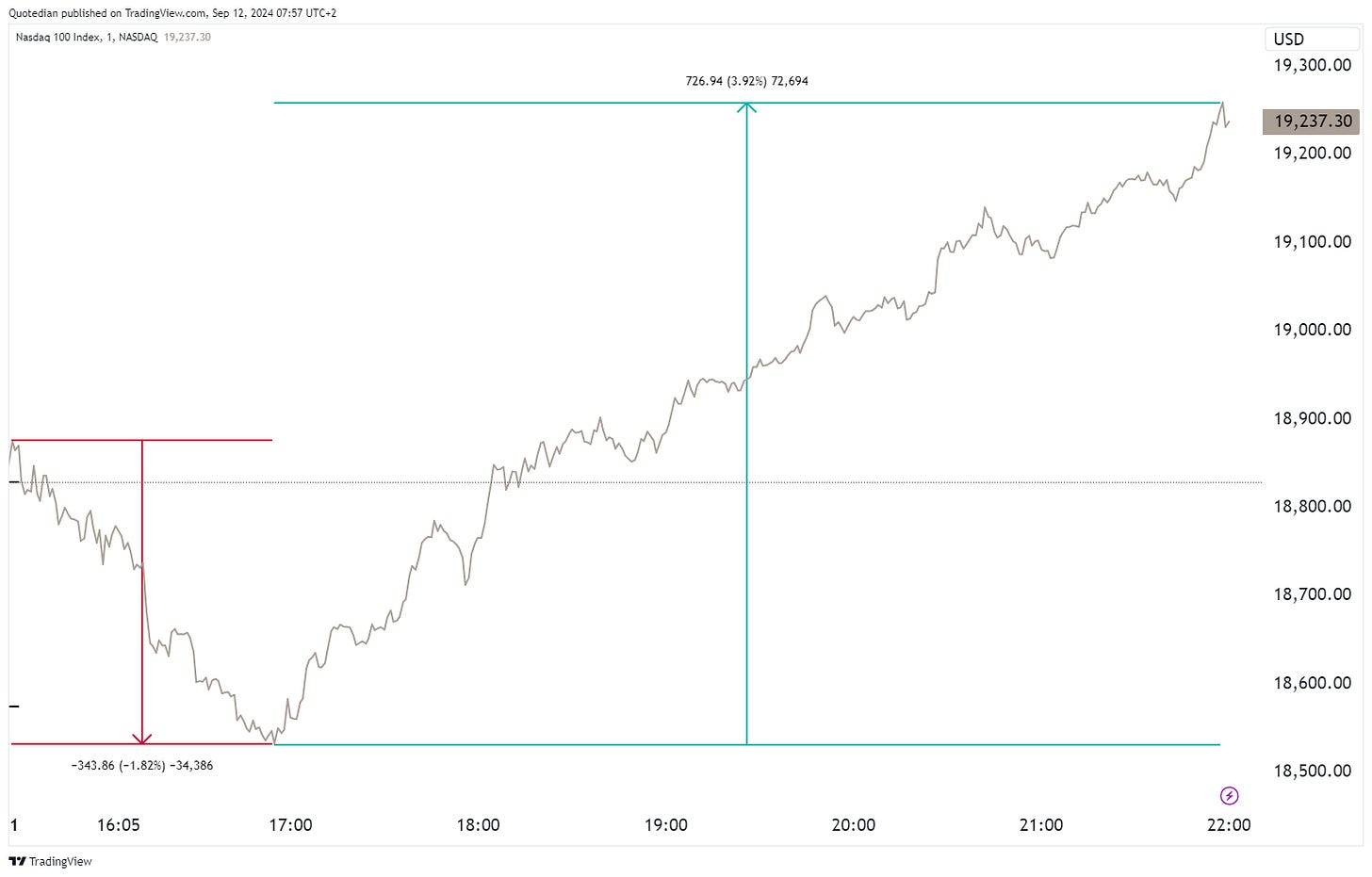

Landmark session yesterday, including the intraday-version of “The mother of all bear traps”. After a brief glitch higher in the very first minutes after the (Wall Street) opening bell, stocks quickly started selling off, sending the Nasdaq nearly 2% lower within the hour. That was the spoof. Then, for no apparent reason, the dip buyers come in and started slowly but steadily bidding, finally pushing up the NDX 4% from its intraday low:

Painful for the bears, which very likely on the S&P 500 already started pre-empting the break of the key support made up by last Friday’s lows (dotted line) and the 100-day moving average (black line):

But the ensuing rally not only put in a substantial higher high, but also had the index close above its 50-day moving average (blue line). Complete win for the bulls, were it not for relative benign breadth figures. Six out of eleven sectors were up and the advance/decline ratio was only about one-to-one.

Nevertheless, the pain trade seems clearly to be to the upside.

CPI numbers were a tiny tad above expectations, which was probably enough to end the Fed cut debate of 25 bp or 50 bp in favour of the smaller cut. Let’s see today’s PPI for the final verdict. Bond yields largely ignored all the fuss on the equity side and after a small rise from 3.62ish to 3.65ish, the rested there for … well, until now.

ECB is expected to cut 25 bp today at European lunch time.

Palladium may be offering an interesting catch-up play with other precious metals, especially Gold. Palladium as been in a bear market for well over two years now, retreating by over 60% since its all-time high in 2022.

Now, for a first time in two years, the price of palladium has exceeded its 200-day moving average, which may trigger other investors to have a closer look again. All of this is happening after a succesfull test of the pivot-point at $875.

A precious opportunity?