QuiCQ 12/09/2025

Up up and away

“If you can’t beat them, join them”

— American Proverb

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

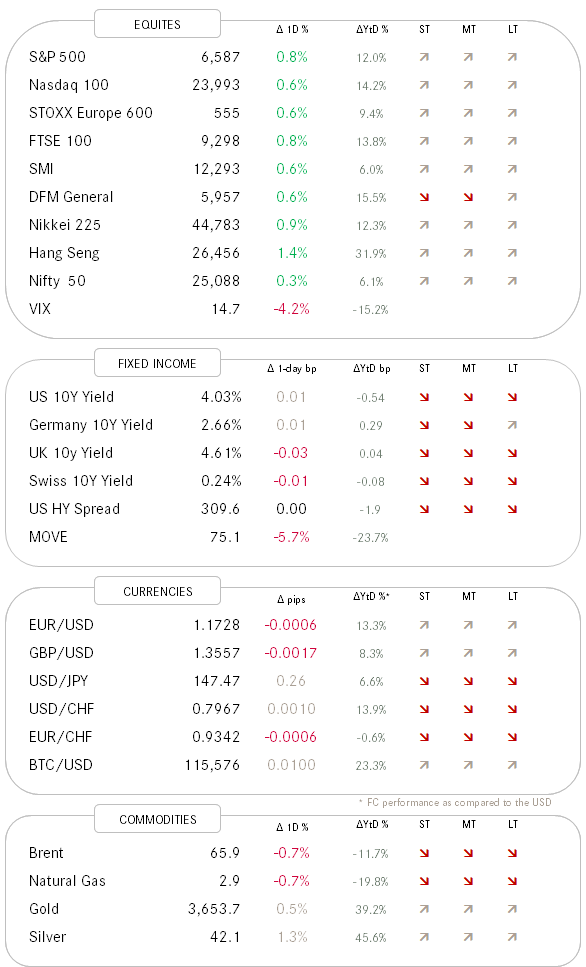

Yesterday, the other 493 stocks in the S&P most have collectively thought: “Oh, bugger” and under the leitmotif of today’s Quote-Of-The-Day (QOTD) threw in their collective towel of uptrend resistance. Finally, after three consecutive sessions where the S&P 500 was up, but the equal-weight version down, the latter provided a 1.5% rally reaching a new all-time high,

with 436 of its components higher on the day:

The rally was mainly fueled on the CPI readings, which showed yet another increase in inflation, but inline with expectations, i.e. a nasty upside surprise was avoided, paving the way for a Fed rate cut next week further.

Hence, if the rally was winged by the hopes of easier monetary policy, we should have seen a rally in small caps too, right?

Only a bit more than one percentage point to go to a new all-time high for small cap stocks (Russell 2000)!!

Already at a new all-time high were Semiconductor stocks, as measured by the Philadelphia Semiconductor index (SOX):

Pretty neat picture for any technical analyst this one - a break to a new cycle high in June of this year, followed by three/four months of consolidation between cycle high (dotted line - support) and all-time high (dashed line - resistance), followed by a break to new ATH. Beauty!

Over here in Europe, the ECB left their key policy rates unchanged as expected. Whilst ECB President Christina Lagarde did not confirm that the easing cycle is over, she did give a pretty rosy economic outlook for the Eurozone, citing amongst other:

Real incomes will continue to increase with inflation under control

Savings will likely decline, helping consumption

Military and infrastructure investment will materialize

There is still some money left to be dispensed from the EU recovery fund

Stocks applauded, though as usual a bit less vehement than their US cousins, and this year’s poster-child of the European stock market landscape, Spain’s IBEX, is on the verge of reaching yet another new ATH:

France remains a concern of course, though 10-year yields as canary in the coal mine have been coming down this week:

Staying on rates for a moment, the US 10-year yield briefly dropped below 4% (3.996% …..) after the CPI number, before ‘recovering’ above that 4-handle again, but there is little doubt that yields are on their way to test the 3.90% support (dotted line):

Little to report from the currency complex, other than maybe that Bitcoin & Co seemed to have started a new upleg. Especially Solana has been ripping higher over the past few sessions:

Next objective: $260, which is the all-time (closing) high (dashed line).

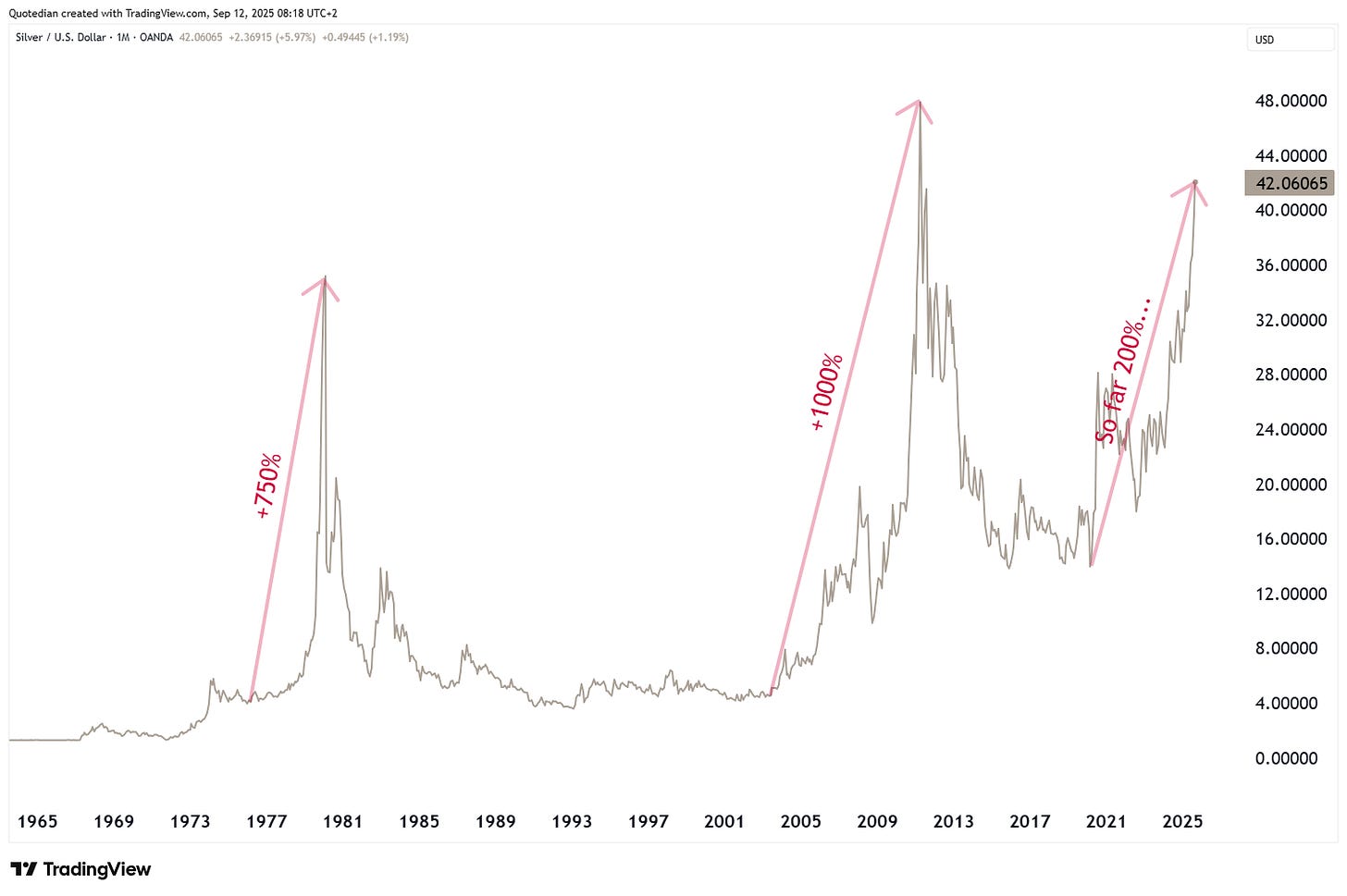

Finally, in commodities, Gold temporarily paused its rally, but Silver is moving relentlessly higher,

increasing looking like becoming one of the blow-off tops:

That’s (nearly) all for this week - make sure to check out the COTD below.

And make even “surer” to enjoy your weekend!

André

Gold is on a tear, we all know that. It has been so for a while. And it turns out that ‘for a while’ translates to 54-years, namely since the Nixon Shock when amongst other drastic economic measures the Gold standard was abolished in the US. Since then, Gold is up over 8,000%.

That’s one perspective, which some (most?) of us already know about.

The other perspective is that the US Dollar is down 99%(!) since the Nixon Shock. Here’s the chart of USD/XAU for the incredulous amongst you:

Sometimes It always pays off to turn things on their head to get fresh perspectives!

Stay tuned …

That's what I tried to convey, yes, Mr Dutchman. Was that message not clear? Apologies if not!

Please share newsletter with Tanguy as well Tanguy.Besrest@augemus.lu