QuiCQ 12/11/2025

“Holding cash when markets are cheap is expensive, and holding cash when markets are expensive is cheap”

— Jim Leitner

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

US stocks bifurcated somewhat in yesterday’s session, with the Dow Jones Industrial index advancing more than one percent to close at a new all-time high,

whilst the tech-heavy Nasdaq 100 index retreated by three tenth of a percentage point, with semiconductor stocks (SOX -2.5%) being the largest drag on the index. Making the news where Nvidia and Softbank, where the latter announced it had sold their USD 6 billion stake in the former. Sounds like a lot of money? Less than 0.15% of NVDA’s market cap.

NVDA stocks ‘dropped’ about three percent on the day:

Whilst Softbank’s share dropped about by the same amount, though saw its stock down over 10% intraday:

The crazy thing? Softbank probably sold its stake to give more money to OpenAI which will then buy more chips from NVDA …

Maybe this cartoon then fits in well here:

The almighty S&P 500 got stuck somewhere in the middle, up 0.2% on the session. Here’s the daily chart, which looks still very constructive:

7,000 - here we come?

Breadth, as you can see in our new dashboard,

was strongly positively skewed, even more so for the STOXX 600 Europe index. Talking of which, quietly also reached a new ATH yesterday:

In other markets, UK Gilts saw a sharp drop (bond price rally),

as unemployment numbers (upper clip) surprised to the upside, and wage growth to the downside (lower clip),

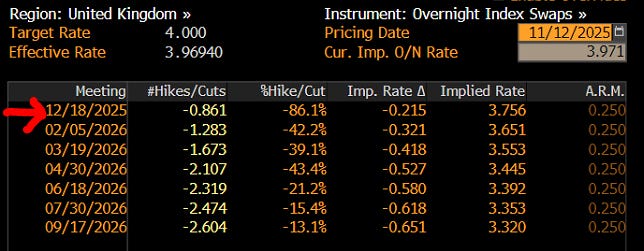

hinting to a weakening UK labour market, but also increasing odds of a December rate cut meaningfully:

Last but not least, I would like to turn your attention once more to the energy commodity complex, where crude oil prices saw a 1.5% jump higher yesterday (coinciding with the COP30 in Brazil?),

and Natural Gas has rallied more than 50% since mid-October:

That’s all for today - have a great day!

André

In my last comments above, I mentioned to move higher in oil and gas prices. Today’s chart of the day then notes that oil refining stocks, proxied via the VanEck Oil Refiner ETF (CRAK - bottom clip) have been breaking out to new all-time highs. Will it be enough to lift the integrated oil companies, proxied via the SPDR Energy Select ETF (XLE - top clip) out of their consolidation to new cycle highs?

I think yes, but, stay tuned …