QuiCQ 13/02/2025

Star Gazing

“The only function of economic forecasting is to make astrology look respectable.”

— John Kenneth Galbraith

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

In yesterday’s QuiCQ, I wrote and showed the following:

Here are the estimates of 61 ““““Qualified Economists””””:

If you paid attention, you may have wondered why I put the expression ‘Qualified Economists’ into quadruple air quotes (inverted commas).

Well, here’s exactly why:

Not one … keiner … nobody … nadie got the actually number right.

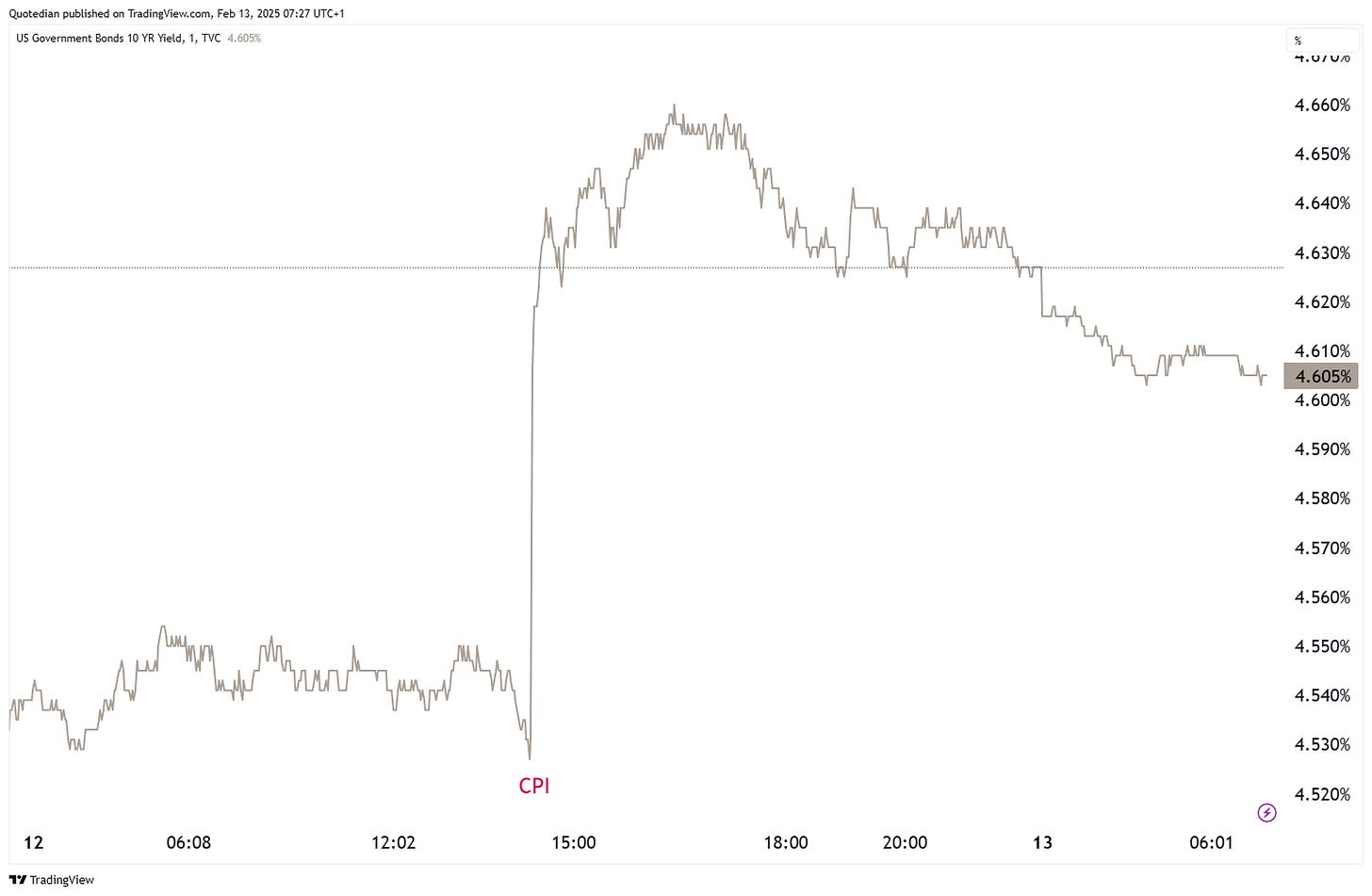

Anyway, in their defense, market were caught slightly by surprise too, as seen in the intraday move higher of the US 10-year treasury yield:

This of course reinforces Fed Chair Powell’s message the previous day, that there is no rush for further cuts. Accordingly, expectations for rate cuts derived via futures markets slumped further yesterday.

Equity markets were also mildly surprised by the strong reading. Yet, after an initial slump, stock investors remembered their eternal optimism and probably thought to themselves that either higher inflation is a sign of strong growth, or, in the worst case, equities are a good inflation protection, and went on to happily buy ever after:

It is of course true that noise of the Whitehouse over peace talks with Russia and Ukraine (note: I wrote with, not between …) may be talking place, may also have been an additional supporting factor.

The S&P 500 was down only a quarter of percentage point by session-end. Market internals show a bit a bleaker picture though, with only two sectors (consumer staples and communications) printing a small green. Which mean nine sectors traded lower on the day, lead by energy stocks, which yes, probably had to do with a silver lining on peace talks. Stocks falling outnumbered those rising by a factor of two, leaving us with the following heat map:

Turning to currency markets, we know that the market got surprised by a higher US inflation reading, which led to higher US bond yields, which led to higher interest rate differentials, which then must lead to a higher Dollar. Right?

Wrong!

It seems that peace talk possibilities are overweighing interest rate differentials in a first assessment. This can of course make perfectly sense for European currencies. Now, for others …

This morning, Asian stocks are trading nearly across the board higher, led, once again, by the Hang seng Index. European equity futures hint to a one-percent plus start to cash trading in an hours time.

But…

Just before we cut off for today, here’s a reminder to the gentlemen on this list:

Tomorrow is Valentine’s Day!

De nada. And yes, you owe me 😉

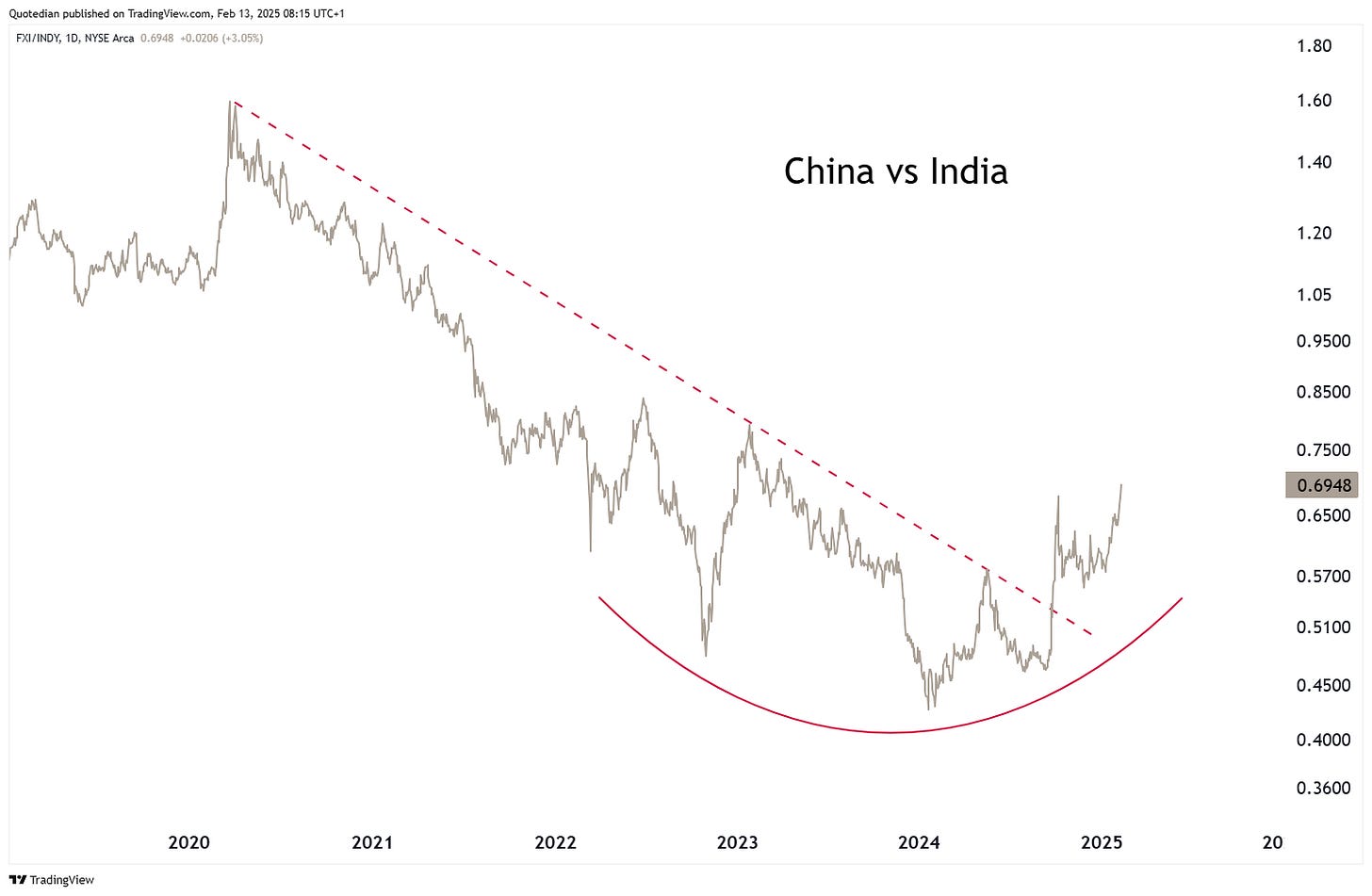

No stone throwing at a heretic like me, but what if the trade of the year is long China (FXI), short India (INDY):