QuiCQ 13/03/2025

What could possibly go wrong?

"Gold is the money of kings; silver is the money of gentlemen; barter is the money of peasants; but debt is the money of slaves."

— Norm Franz

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

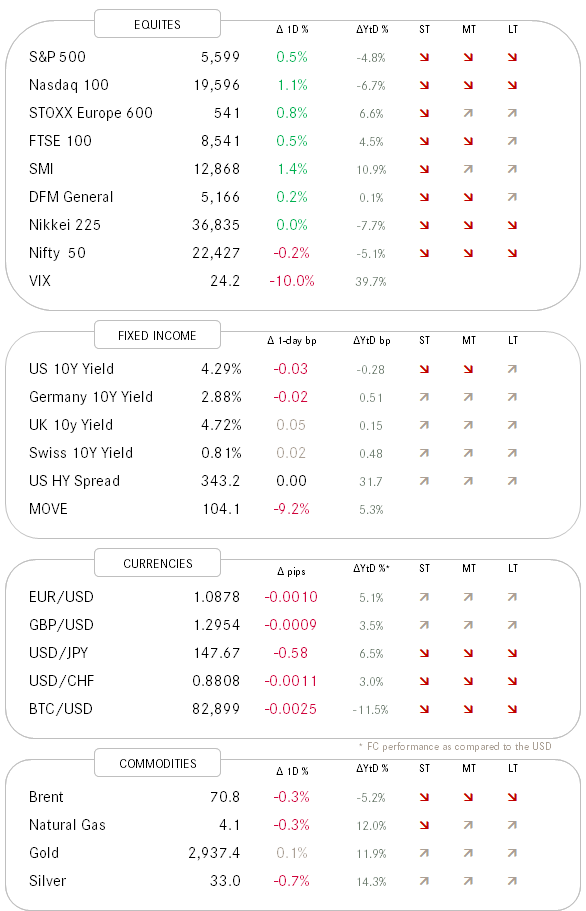

Stocks reversed some of their hefty losses of the previous few sessions, but really only very timidly so.

Despite six out of eleven sectors in the S&P 500 printing green, the advance-decline ration was still nearly 1-to-2 in favour of the losers and the table of new 52-week highs versus new 52-week lows further highlights the shallowness of the ‘bounce’:

The one index to rule them all hence, remains in a very precarious situation, now having closed for three consecutive days below the 200-day moving average:

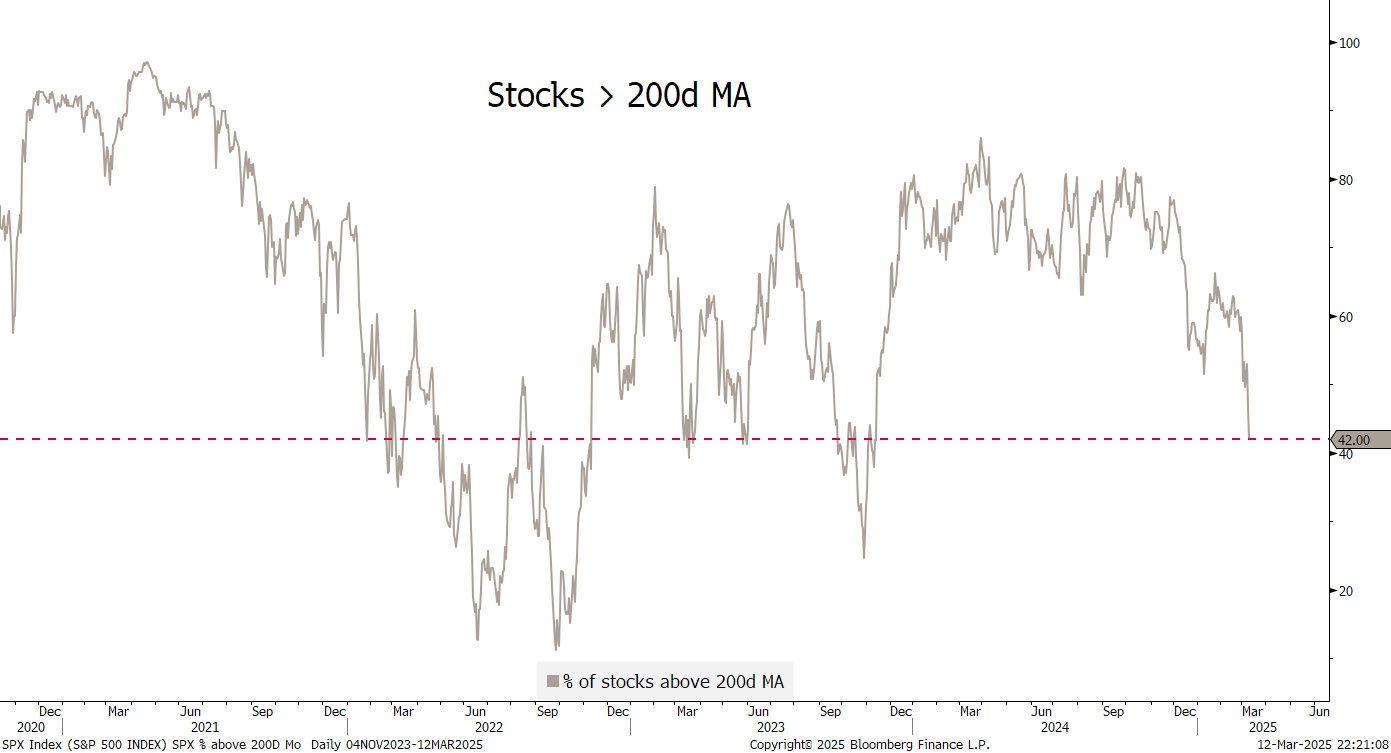

And the % of members of stocks in the index trading still above their 200-day moving average has now shrunk to 42%, the lowest reading since December 2023 and dangerously approaching the bear market territory of 2022:

On the interest rate side of things, US inflation (CPI) numbers came in slightly lower than expected:

As I have repeated ad nauseum, these number are lagged, inaccurate, manipulated and ergo unimportant. More or less markets gave them the unimportance they deserve this time around, as yields (the 10-year version below) quickly corrected and than as quickly corrected the correction:

Not only did US inflation surprise to the downside, but so did the same number (CPI) in India:

Remark: I love Indians and their sense of humour. Reporting inflation numbers to the second digit to the right😂😂😂

This deeper-than-expected decline in India's inflation in February - which brings it below the Reserve Bank's target of 4% - could allow the central bank to cut rates more aggressively to support growth. Whisper number has now gone from a 25bp to a 50bp cut on April 9th.

Little movement on the currency side, where the US Dollar has found an every so slightly reprieve from the slaughtering of the past few weeks. Here’s the Dollar Index (DXY):

Gold is approaching all-time highs again,

but especially Silver looks poised for a massive upside breakout:

Today, PPI and Initial Jobless Claims in the US should get most of attention on the economic agenda. And as the Eurozone has little economic data to show today, they have decided to send out a royal flush of ECB bankers: Rehn, Guindos, Vujcic, Makhlouf, Holzmann, Villeroy, and Nagel are all expected to have speeches on … well … something…

Time's up, more tomorrow - May the trend be with you!

As discussed above, the market is very shily trying to put in a bottom, but market internals remain weak so far.

In any case, the good news is, as already discussed in Monday’s Quotedian “Clear and Present Danger” (click here), that yesterday marked the seasonal low of the thirty past years:

What could possibly go wrong?