QuiCQ 13/06/2025

Friday 13th

“Superstition is the religion of feeble minds.”

— Edmund Burke

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

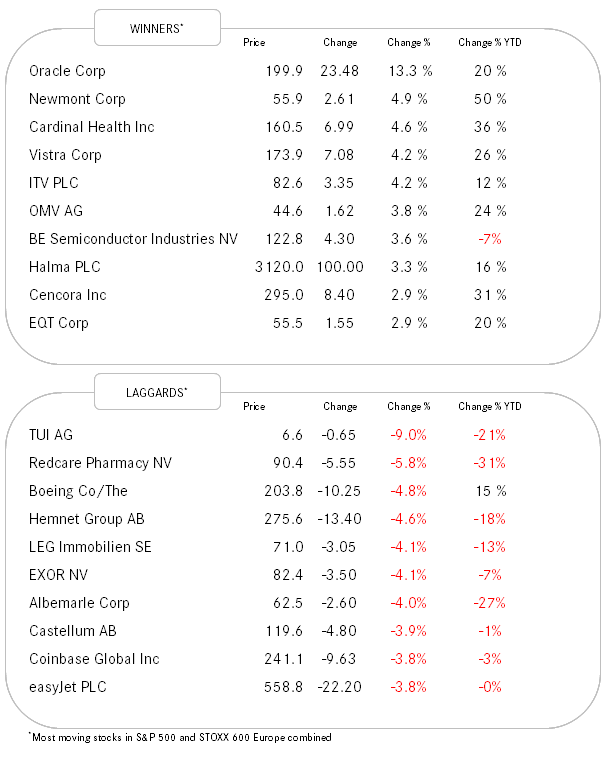

Neglectable today.

Just as markets were dozing off and global investors began reaching for their flip-flops and beach towels — spending more time pondering long-drink recipes than Bloomberg terminal codes — everyone was rattled awake “thanks” to an Israeli attack on Iran overnight.

While these attacks are not entirely a surprise — after all, the U.S. had been pulling staff out of Iran over recent weeks — the choice of timing hints at the Israeli military leadership’s distinct lack of superstition.

As always, the point of the QuiCQ is not to judge the pros, cons, or even the factual accuracy of military action. We remain extremely politically agnostic. Instead, we’ll take a quick glance at the immediate market impact following the strikes.

SPOILER ALERT: As we go through our more or less usual order of asset class observations, I can already spoil the beans on the fact that markts are reacting in classical risk-off manner: stocks down, treasury bonds up, dollar up, gold up.

Equity futures are sharply lower at time of writing. Using the most-traded S&P 500 mini futures, we can serve the sharp decline post the military intervention:

Asian markets, which are open for trade of course, are lower across the board

but most are a tad off their session lows, even after the news broke a few moments ago that Iran had retaliated, launching over 100 drone attacks in the past few hours.

European index futures suggest that our cash markets will open about 1.5% to 2% lower in an hours time.

Is this the end to the post-Liberation Day market rally? Perhaps, but probably not. This geopolitical hiccups, as brutal as it may sound, are usually pretty short-lived in terms of market reactions. Of course, the potential for a prolonged fighting between Israel and Iran are elevated. For now, let’s watch key support levels on the charts, with the first one for the S&P 500 being at its 200-day moving average:

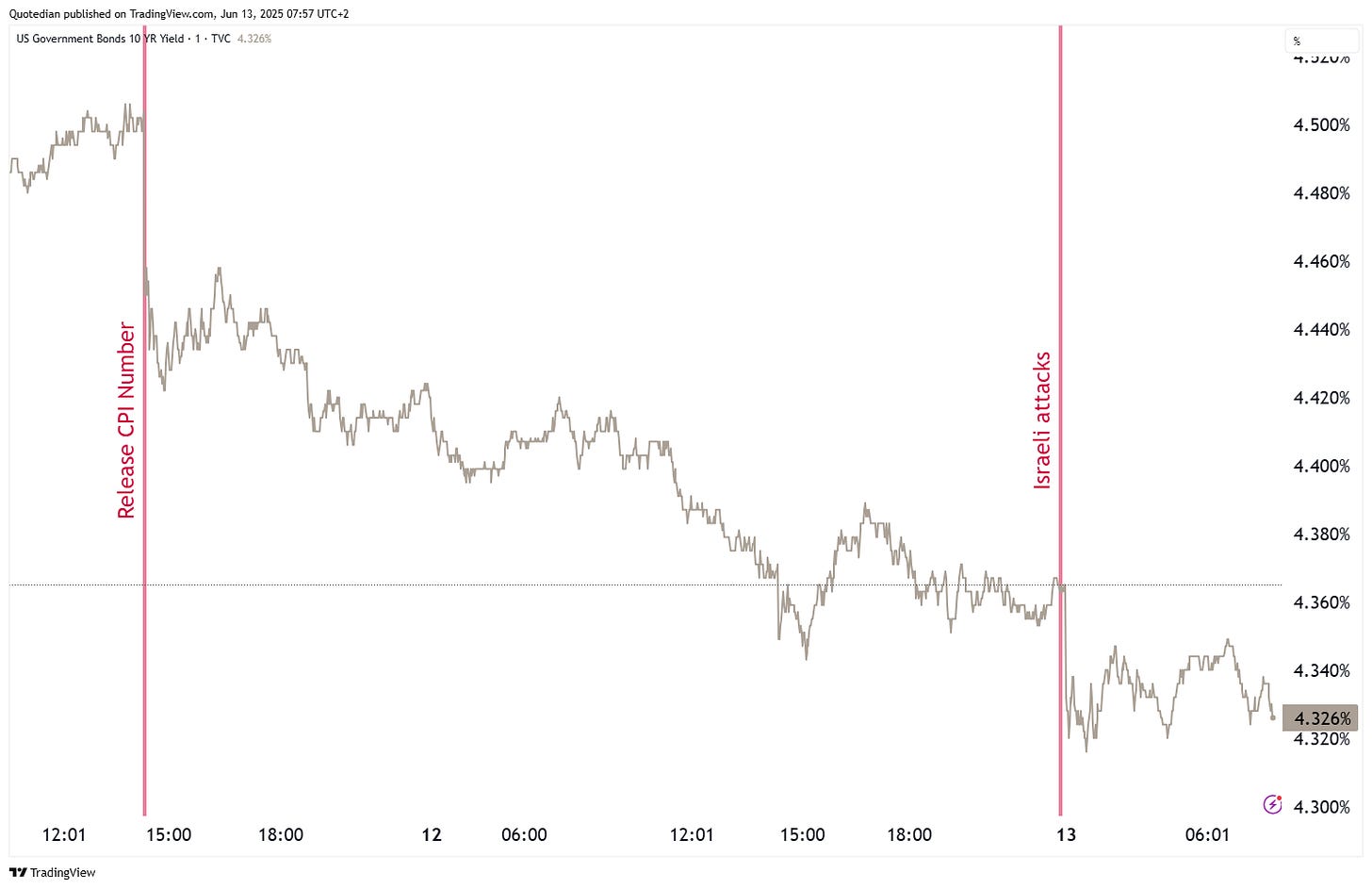

Treasury bonds are rallying under their function as safe-haven investment, with the US 10-year treasury yield dropping five basis points to 4.32ish. Though all truth being told, the pressure on yields (lift of prices) had been ongoing already since Wednesday’s release of the CPI number:

Other bond markets are seeing similar reactions to a similar extent:

The US Dollar is also up sharply in a classic risk-off reaction, except versus the CHF and the JPY, which are even more risk-”offier”:

However, this Dollar strength follows a break of key resistance yesterday, which now turned into a key support:

Gold trades higher too and is pushing hard into the upper end of is ascending wedge:

A break out to the upside would set a price target of $4,500 … (I just let that sink in).

And finally, the other big mover is surprise, surprise, crude oil! Though up ‘only’ five percent now, it was up more than double that in an initial reaction:

Enough for today and this week. See you back next Tuesday or for those smart investors amongst you who also read The Quotedian, see you Monday!

Bon week-end!

We already discussed in previous QuiCQs how Silver (red) had been playing catch-up with Gold (grey):

Now Platinum (dark grey) has joined the party too, and on a 1-year basis has actually raced ahead of silver already:

And, my-oh-my, on year-to-date basis, XPT has actually become the leader of the pack!