QuiCQ 14/01/2025

We're back!

"Though absent long, these forms of beauty have not been to me as is a landscape to a blind man's eye."

— William Wordsworth

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Your favourite three-minute financial market read, The QuiCQ, is back.!! I had to delay the relaunch by a week as we were extremely tied up producing out 2025 Outlook which you can download from our web page by clicking on the logo below:

And now to our usual review of market happenings over the past few hours, tailored to my very own points of interest (i.e. non-exhaustive & fully biased).

First, if you have not yet done so, scroll back up and look at the trend arrows over the three time horizons for the different assets under observation. It shouldn’t, but a change of calendar year can do to markets!

Clearest trends standing out:

Asian equity down all three time frames

Bond yields up, up and away

Ditto for USD versus anything else

Most commodities also with up arrows over the short-, medium- and long-term

“If it looks like a duck, swims like a duck, and quacks like a duck, then it probably is a reflation/inflation trade.”

— The QuiCQ

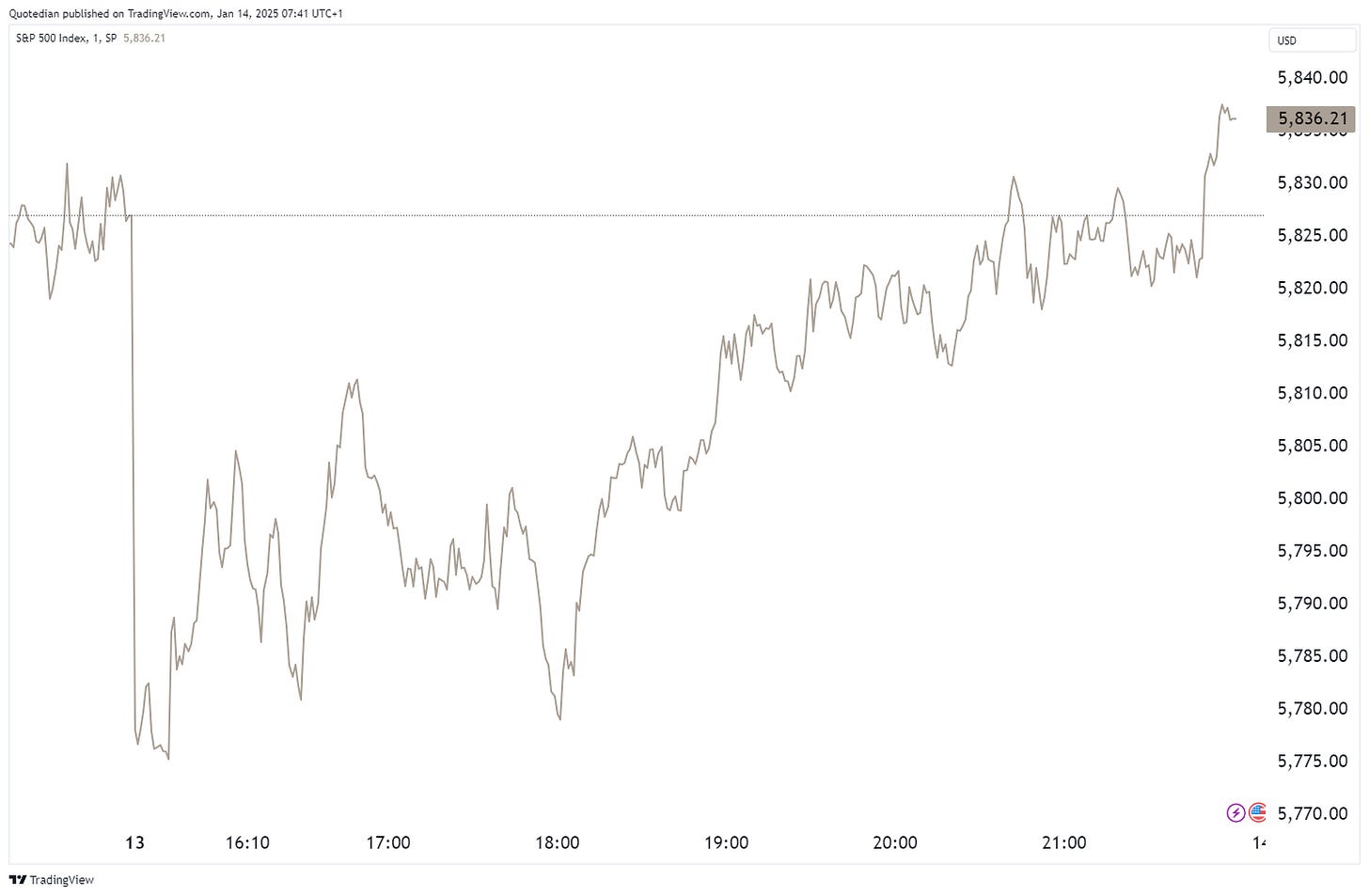

Onward to yesterday’s session, which started with an important sell-off on Wall Street. However, with the S&P 500 closing the post-election gap at the opening (see also chart section below) and shortly after European investors’ left for their “Feierabendbier”, stocks started to head higher, making the whole move look constructive:

Duration remained under pressure, with the US10-year yield touching the 4.80 level and the 30-year version of the same bond trading just below 5%, having briefly exceeded that level on Friday post the NFP number:

The number of market implied rate FOMC rate cuts through to the end of this year has now dropped to one and to two by the end of year 2026, leaving the assumed terminal rate at 3.90ish:

Similar to the recovery rally/reversal trade in equities, non-USD currencies also got a bit a breather over the past few hours, after the EUR/USD cross (1.0254 now) reached an intraday low of 1.0176 yesterday.

Today we’ll get PPI in the US, but macro- and micro-events will really pick up tomorrow Wednesday, with the consumer inflation number (CPI) due in the US and also in the US the largest banks (JPMorgan, Goldman Sachs, Citi) and money manager (BlackRock) kicking of earnings season.

Two charts to the price of one today…

First, as mentioned above, the S&P 500 quite precisely closed its post-election gap in yesterday’s session and the immediately turned higher:

So far, so good.

The timing here also fits well our second chart, which shows the Russell 2000 (small cap index). A turn higher of prices here would be very timely and make the chart look at August 2024 (black circle). If not, we are at the danger of looking like August 2023 (blue circle):

Stay tuned …