QuiCQ 14/02/2025

From NPB with Love

"Love and markets share a truth: what’s truly valuable withstands the volatility of time."

— The QuiCQ

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

What’s not to like love? S&P 500 up 1% and less than 3 points from a new all-time closing high,

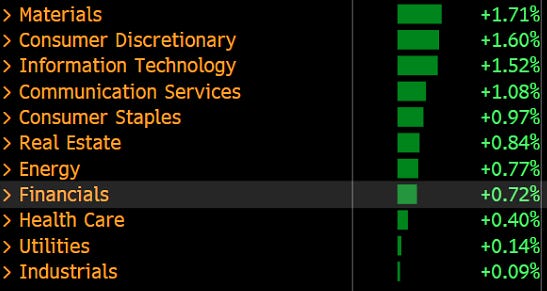

with 11 out of 11 sectors higher on the day,

And four stocks up for every stocks down, leaving us with this sea of green:

Additionaly, nearly 10% of stocks in the index hit a new 52-week high, versus only 2% a new low:

With all of the above, how can it then be that the bears amongst retail investors as measured weekly by the American Association of Individual Investors (AAII) has just hit its highest level in over a year? More on this in the Chart of the Day section …

Asian markets are mostly higher this morning too, notable exceptions Japan and India. On the latter, the BSE 500 is resuming its five month old downtrend by breaking a support zone and is heading towards our long-stated price target of 30k:

In the world of interest rates, we had a bit of a conundrum day yesterday, as bond yields FELL after the US PPI reading that was at least as hot as the previous’ day CPI number, especially ex-Food, ex-Energy:

Maybe the rally in bonds (sell-off in yields) tells us a lot about positioning and bombed out sentiment.

Similarly, the USD should have been strong, but it was not. Maybe there is still residual strength in non-dollar currencies on peace talk hopes, but whatever it is, the USD is having a not so good week (to the relief of many):

And finally, Gold is continuing its unabated march higher:

Have a great day and have an even greater Weekend!

André

As mentioned in ‘The Comment’ section above the AAII, which does a survey on the bullish- and bearishness of its members on a weekly basis, showed yesterday that the percentage of bears (47%) is at its highest in well over a year. This seems odd, given that index closed yesterday -0.06% off a new all-time high.

In the current bull run of the S&P (top clip), that started in autumn of 2022, a similar high reading has been seen three times before (bottom clip):

On each occasion (vertical lines) it was the beginning of a new leg higher.

Stay tuned …