QuiCQ 14/05/2025

Animal Spirits

“Even apart from the instability due to speculation, there is the instability due to the characteristic of human nature… a large part of our positive activities depend on spontaneous optimism rather than on a mathematical expectation.”

— john Maynard Keynes

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Who would have guessed? And especially who would have guessed so only a month ago? But indeed, did the S&P 500 at 5886.55 yesterday, leaving it in the green (+0.08) on a year-to-date basis… Amazing!

Does it feel right? No! Should we fight it?? NOOO!!!

It was not a massive rally yesterday, with market breadth actually pretty balanced between the number of stocks up and those down on the session. Yet it was enough to lift the “one benchmark to rule them all” into positive YTD-territory as mentioned at the outset.

There is still more than 4% to go for the S&P 500 to reach a new all-time high, but given that we have now left the 200-day moving average well behind, this seems more than doable:

Especially it seem possible as the Mag 7 have so far not really being pushing the rally, as they still have 12%-plus to go to a new ATH:

Reason for the markets’ bullishness yesterday? Other than animal spirits and FOMO? Well, let’s add a slightly, slightly softer inflation (CPI) reading to the buyers’ excuse list.

Some of the animal spirits in the market are visible in this small one-day returns table:

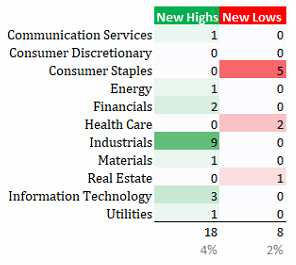

Below, in the chart of the day section, I show a particular breadth indicator, which is based on % of stocks hitting a new 20-day high, having been triggered. But it is also interesting to observe how many stocks are already hitting new 52-week highs versus those hitting now 52-week lows. On the S&P 500 for example?

But even more pronounced so in Europe (SXXP):

Several market strategist (GS, JPM, Yardeni, others) have been lowering their odds of recession since the beginning of the week. Is this pushing bond yields higher? Here’s the 10-year treasury yield chart:

The Dollar, initially a winner after Tariff pre-agreements over the weekend, has started to fall again:

Meanwhile, Gold continues to hold (just about) above key support:

Time's up, more tomorrow - May the trend be with you!

A few weeks ago we wrote about how the (US equity) market had triggered a Zweig Breadth Thrust buy signal (click here).

Now, the widely followed deGraaf Breadth Thrust also triggered. This indicator gives a buy signal, when over 50% (55% in the current case) of stocks in the S&P 500 trade at a 20-day high:

Historically, when the deGraaf Breadth Thrust fires, the S&P 500 is higher 6-months later by a median return of +8.5% with a 85% positivity ratio, and higher 12-months later by a median return of +16.1% with a 93% hit ratio: