QuiCQ 15/01/2025

Odd Odds

“Middle age is when your broad mind and narrow waist begin to change places".”

— E. Joseph Cossman

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

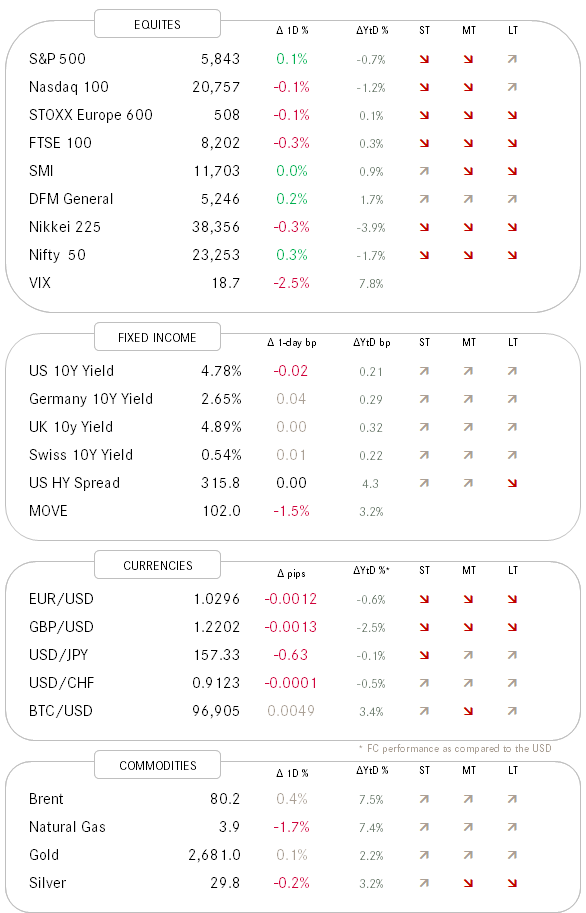

A very volatile equity session ended … well … very unvolatile, with the major indices either closing up or down a notch (1 notch is officially about 0.1%).

Here’s what that intraday volatility looked like on the S&P:

Though throwing a glance under the hood, we note that advancers on the day beat the decliners with a ratio of larger than 3:1.

As a matter of fact, and definitely an encouraging sign for the equity bulls, the S&P 500 equal-weight index has been outperforming the cap-weight version for quite a few sessions now and recently at an increasing pace:

Most of the volatility swings is probably attributable to the current dominance of rates (bond yields) over equities. Whilst swings on the 10-year US Treasury yield for example yesterday were less pronounced, market participants are still looking with eager (and fear) for the next move the bond vigilantes.

A lower PPI number reported yesterday gave a (short-lived) moment of relief, however, a continued positive outlook reading from the NFIB Small Business Optimism survey, coupled with the Treasury reporting that the federal budget deficit totalled a record $711 billion in the October-December period, up 39% from $510 billion in the same period a year ago, put upside pressure on yields again.

Side remark regarding NFIB Small Business Optimism: For obvious reasons this is a heavily Republican dominated survey crowed, hence the pick-up in optimism since Trump’s win should be of little surprise:

The US Dollar gave back some gains for a first time in what seems a long time, ex the British Pound which continues under siege:

Most eyes are on the CPI number today, though if it is not “shocking” one or the other way, I would expect markets to remain choppy with little net progress at least until next Monday’s inauguration day.

Big US banks (see table above) are kicking of Q4 earnings season today.

Believe it or not, whilst Fed Fund futures still imply one FOMC rate cut (25bp) for this year, option-adjusted odds for a rate hike this year have risen to 35%!!

As you can read in GS title to the chart, they think the odds are too high. Perhaps, but it is very illustrative of the change in tone that has taken place in only a few weeks.