QuiCQ 15/01/2026

Size Matters

“From a small seed a mighty trunk may grow.”

— Aeschylus

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Only a short note today, with some key observations, as we are still in recovery mode from writing our 2026 outlook published yesterday (click here) and especially from putting together that gargantuan, nearly 150-pages strong accompanying chart book.

Onwards…

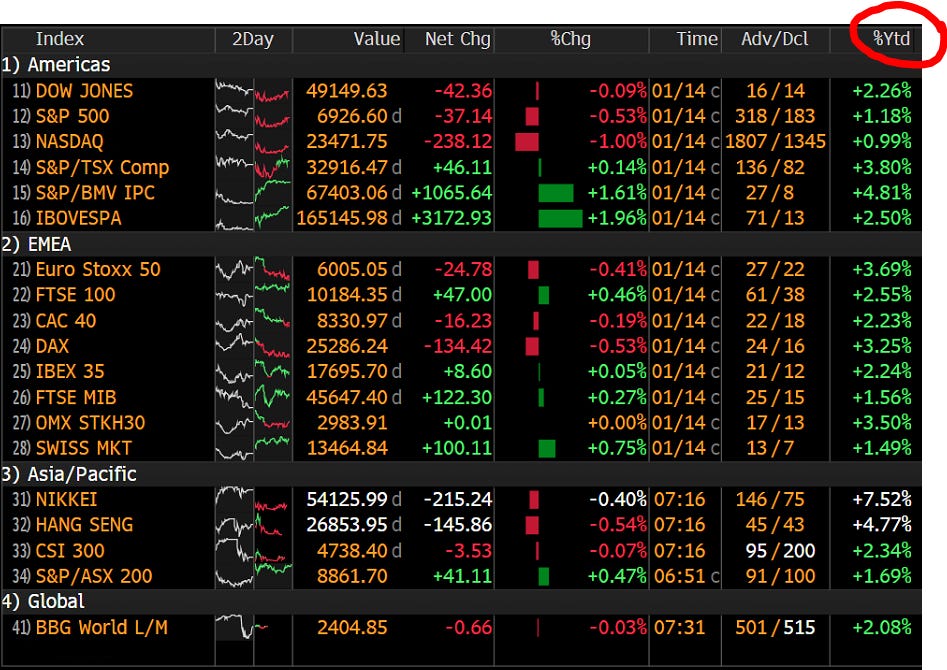

Equity markets had a strong, healthy start into 2026, with the famous Bloomberg WEI<GO> screen showing noting but green on a YTD-basis:

As much European, as US as some Asian indices have all made already several new all-time highs, which is clearly not a bearish sign. Nevertheless, we need to be on the outlook for early warning signs, such as a divergence between the consumer discretionary/staples ratio (lower clip) to the overall market (upper clip):

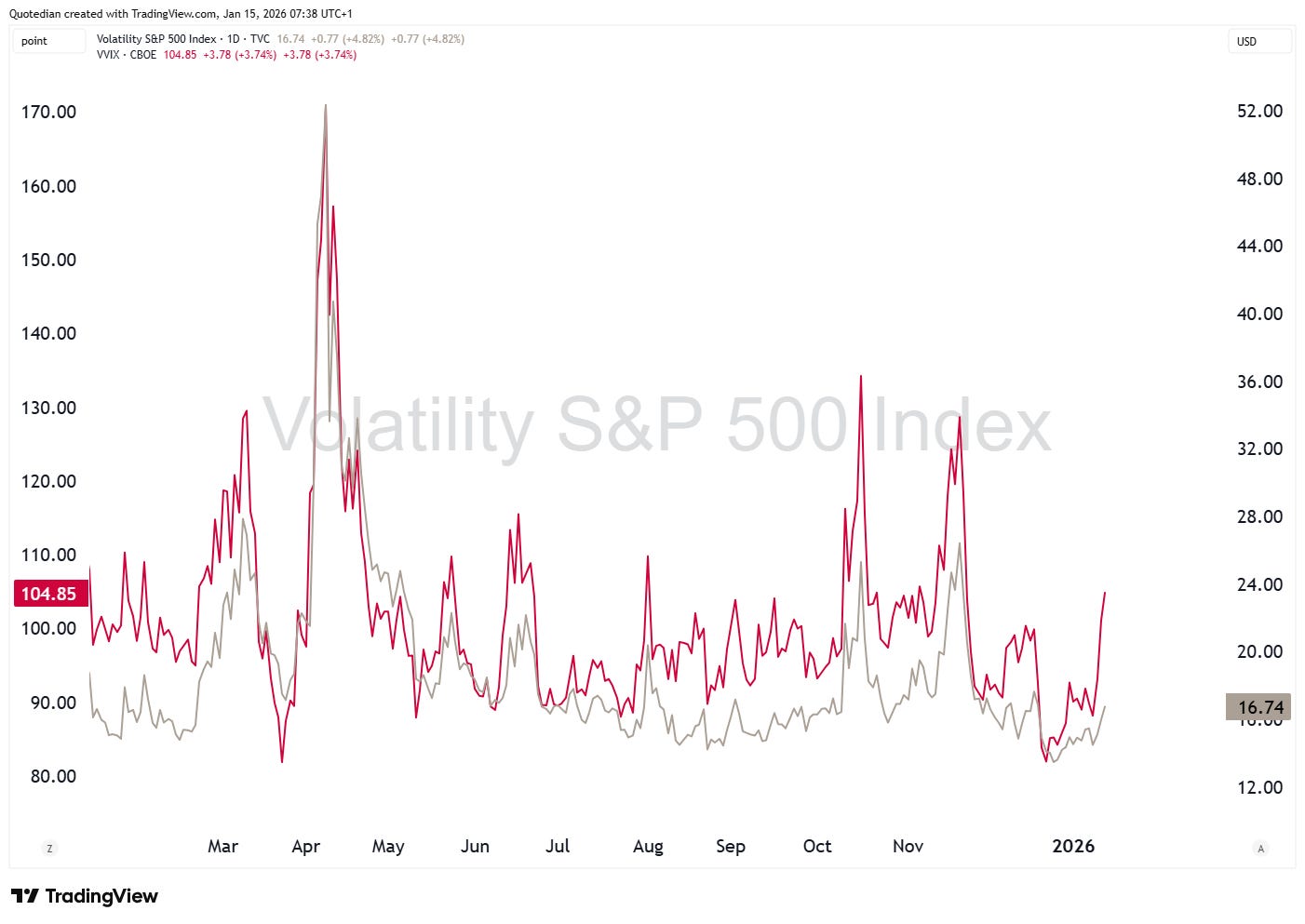

Another warning sign, at least for a short-term setback, is the rise in vol-of-vol (VVIX), not yet followed by simple volatility (VIX):

The Nikkei has a minor correction this morning after an extremely strong start into the year on the back of expectations that Prime Minister Takaichi is about to call a snap election in early February to bolster her notable popularity three months after her appointment:

Notin’ much happening in bonds and FX, so we’ll cover those in Sunday’s Quotedian, but definitely worthwhile talking commodities for a moment.

Silver is down 6% this early Thursday, but six percent down after hit an all-time high at $93.51(!!) yesterday:

And even now already, as you can see from the long-shadow on the last candle, is th eprice already recovering again.

Gold has had the same swing movements, but with substantially less volatily. Looking at the Gold chart, the immediate path seems clear (higher):

Last but not least, crude oil had its first down session following five consecutive closes higher, after US involvement in Iran got a tad less imminent:

I would not underestimate the possibility of more upside, not necessarily only given an explosive geopolitical environment, but also extreme positioning (short) and sentiments (negative) towards the black gold.

As I said, a short, small note only today, but as the COTD below shows, size does not necessarily matter.

André

Could it really be true? Is this the good one?

The relative ratio graph of the Russell small cap index to the Nasdaq 100 index, proxied via the ETFs IWM and QQQ (see below) has crossed at the same time to important downwards slanting trendlines AND the 200-day moving average:

Is this the start of something big in small (caps)?