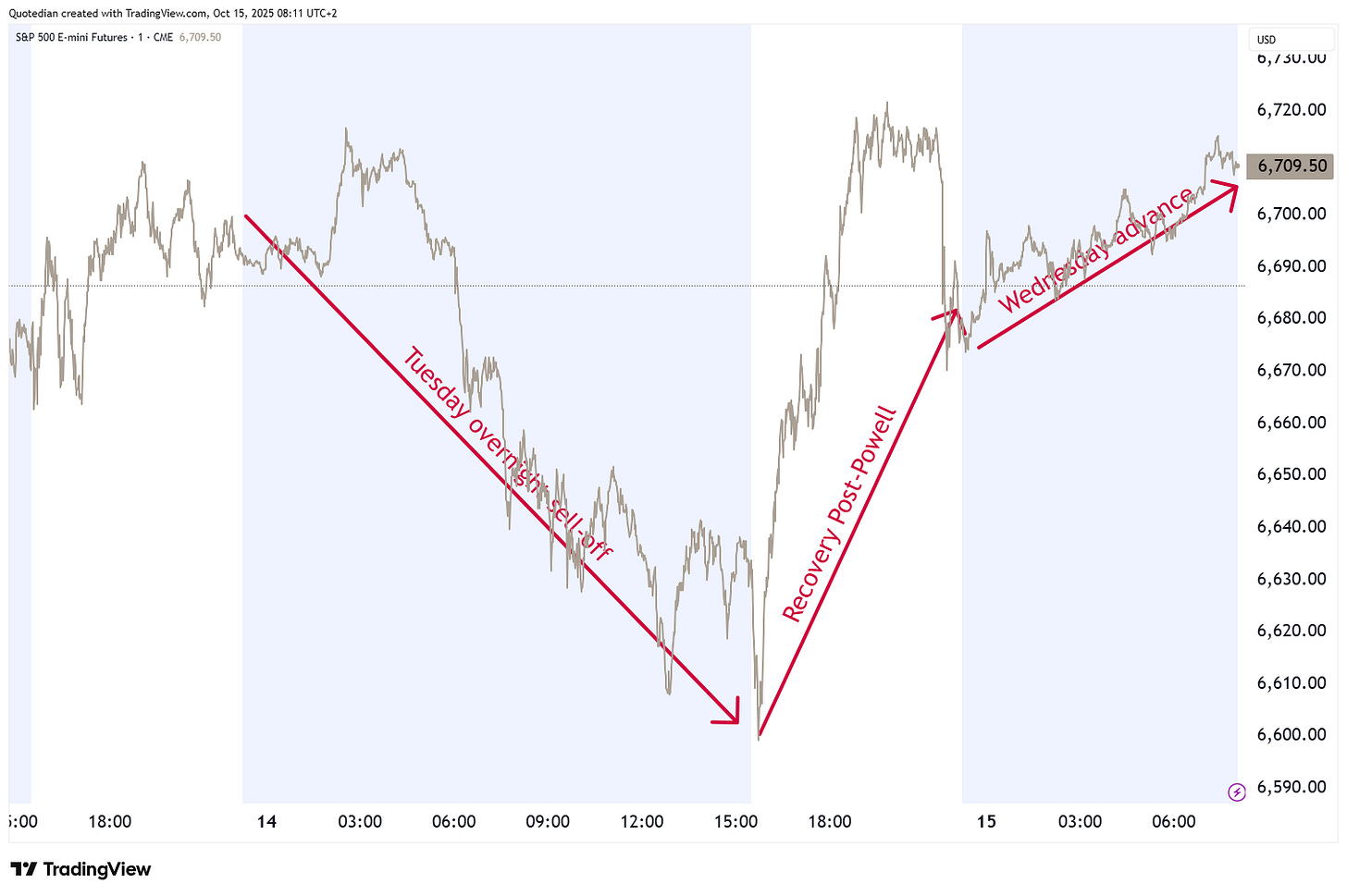

QuiCQ 15/10/2025

Going easy on the small

“The market can stay irrational longer than you can stay solvent”

— John Maynard Keynes

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

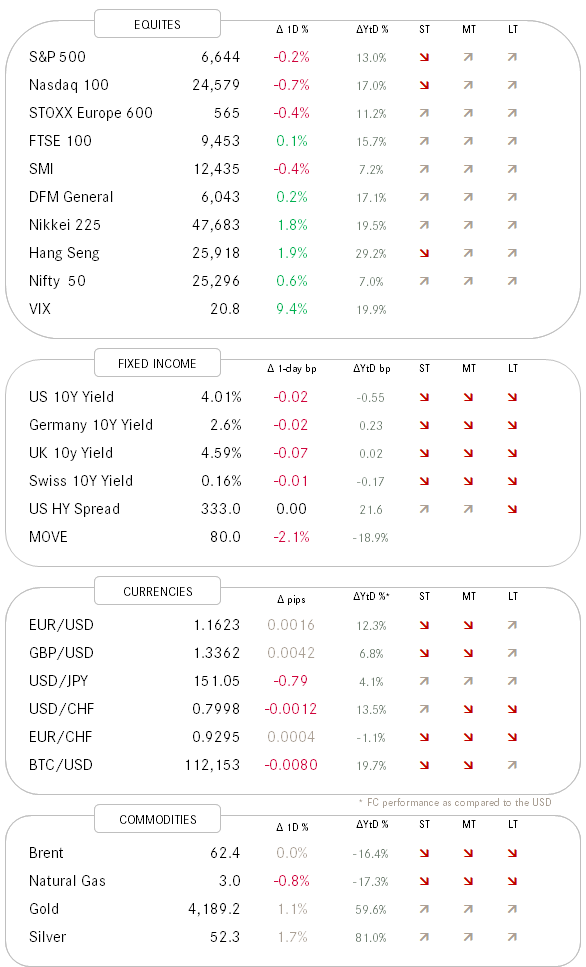

The market moving “news” of the past few hours was definitely comments by Fed Boss Powell, where he insinuated that the FOMC would be ready to lower interest rates again, even in the absence of reliable economic data (yes, an oxymoron anyway), given the current government shutdown.

But maybe the most noteworthy commentary from Jay Powell’s speech in front of the NABE was on the Fed balance sheet where its Treasury holdings have been shrinking by just $5b per month while its holdings of MBS have been reduced by $35b. There he said that the Fed may end the balance-sheet runoff over the coming months. Translation: QT is ending.

Markets reacted as they should, i.e. according to the playbook:

The S&P 500 recovered nearly all of its not unimportant overnight (futures trading losses) by the close of market and since then has gained more again in futures trading:

As we are talking about lower interest rates, the more interest rate sensitive ‘segment’ such as small cap stocks gained most, post-Powell. Here’s the Russell 2000, closing at a new ATH:

Here’s an interesting chart, showing the Russell 2000 (IWM - small cap) breaking its relative downtrend to the Russell 1000 (IWB - large cap):

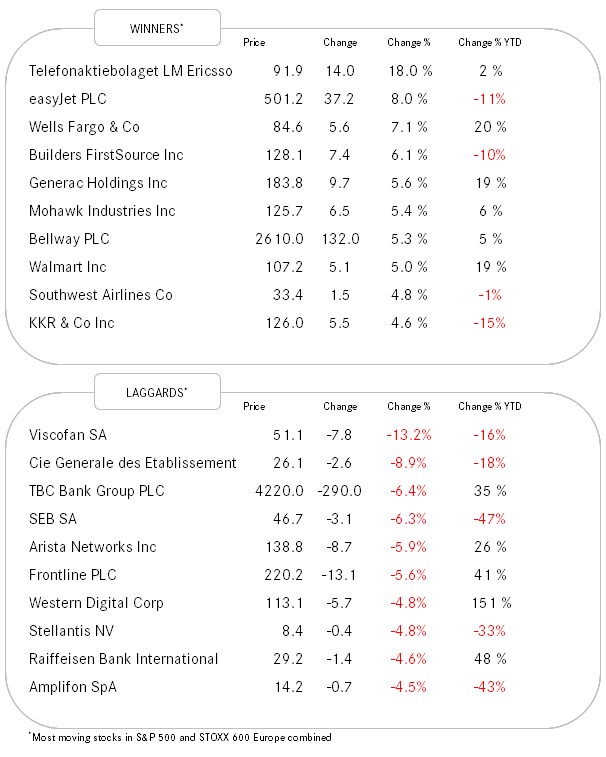

Another segment that ‘profited’ well from the prospect of lower rates were homebuilders (XBH), which turned higher on what seems to be an important pivot point this year:

Big banks (JPM, GS, C, WFC) kicked off earnings season yesterday, with all of them reporting more than decent results and the stand-out being Wells Fargo, which saw its share jump by more than seven percent:

In the whole OpenAI, Oracle, AMD, Nvidia saga I would have a close eye on ARM Holdings over the coming days:

Bond yields also reacted to the Powell comments as they should, by going softer. Here’s the 10-year US Treasury yield:

If this morning’s break is confirmed, target is below 3.80%. This means that the long-duration iShares 20+ Year Treasury Bond ETF is now trading at its highest since April this year:

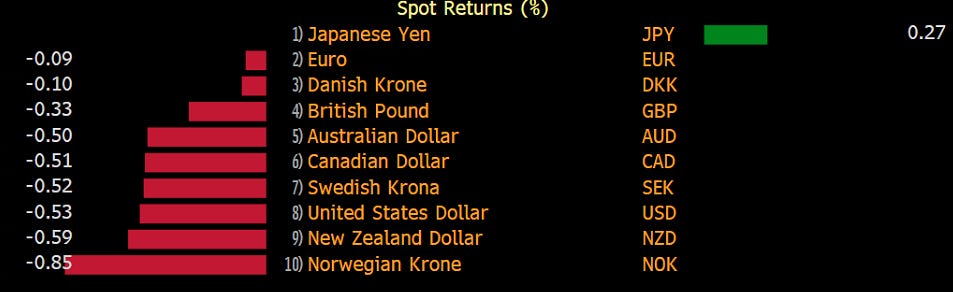

Finally, the US Dollar also reacted by the playbook, and softened against all other G10 currencies bar one (JPY) over the past hours:

But probably most weakness in the Greenback was once again seen versus Gold:

Running out of time, but keep this headline in mind as Argentina will hold a general election in less than 10 days time (24th October):

Time's up, more tomorrow - May the trend be with you!

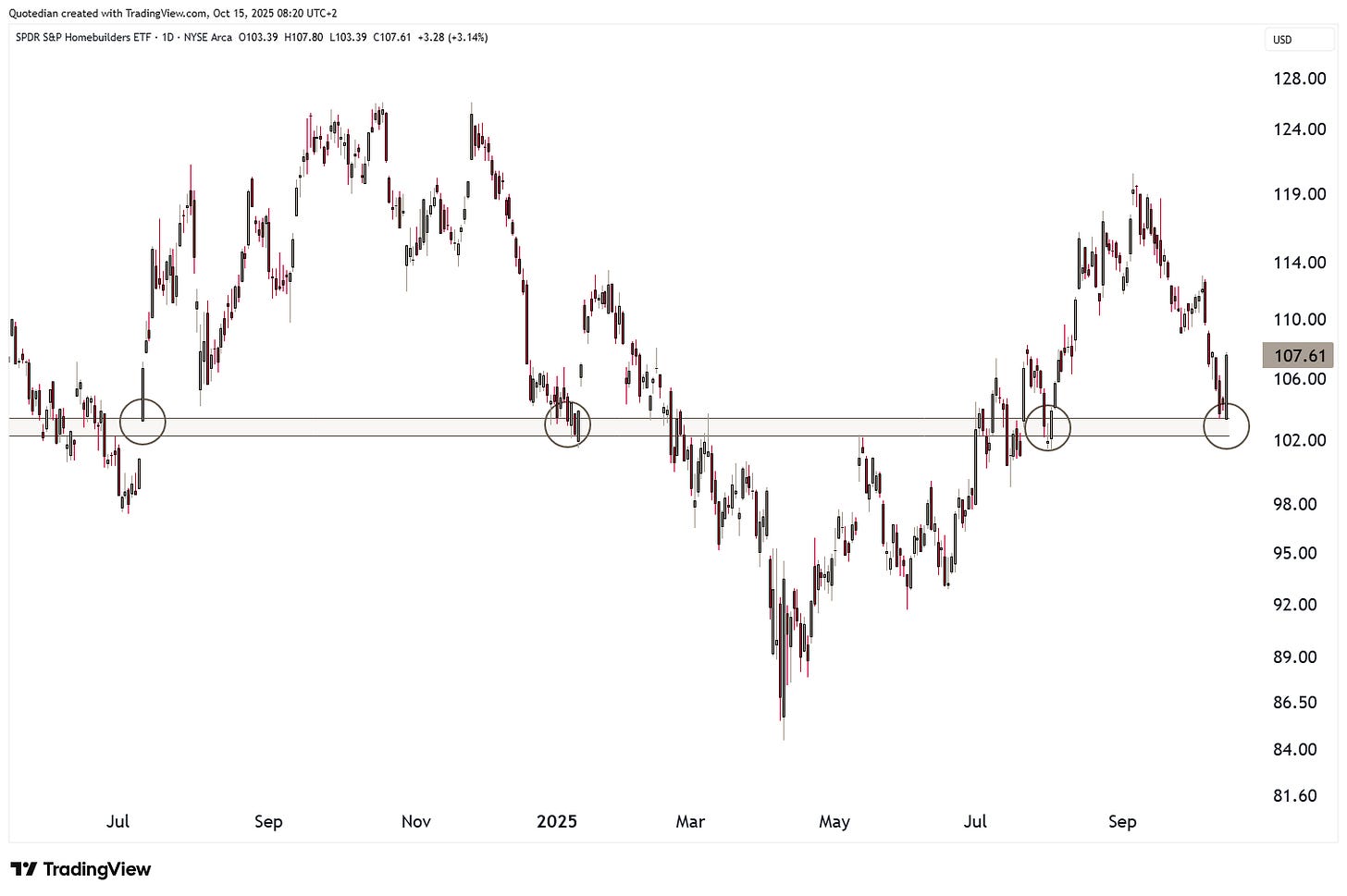

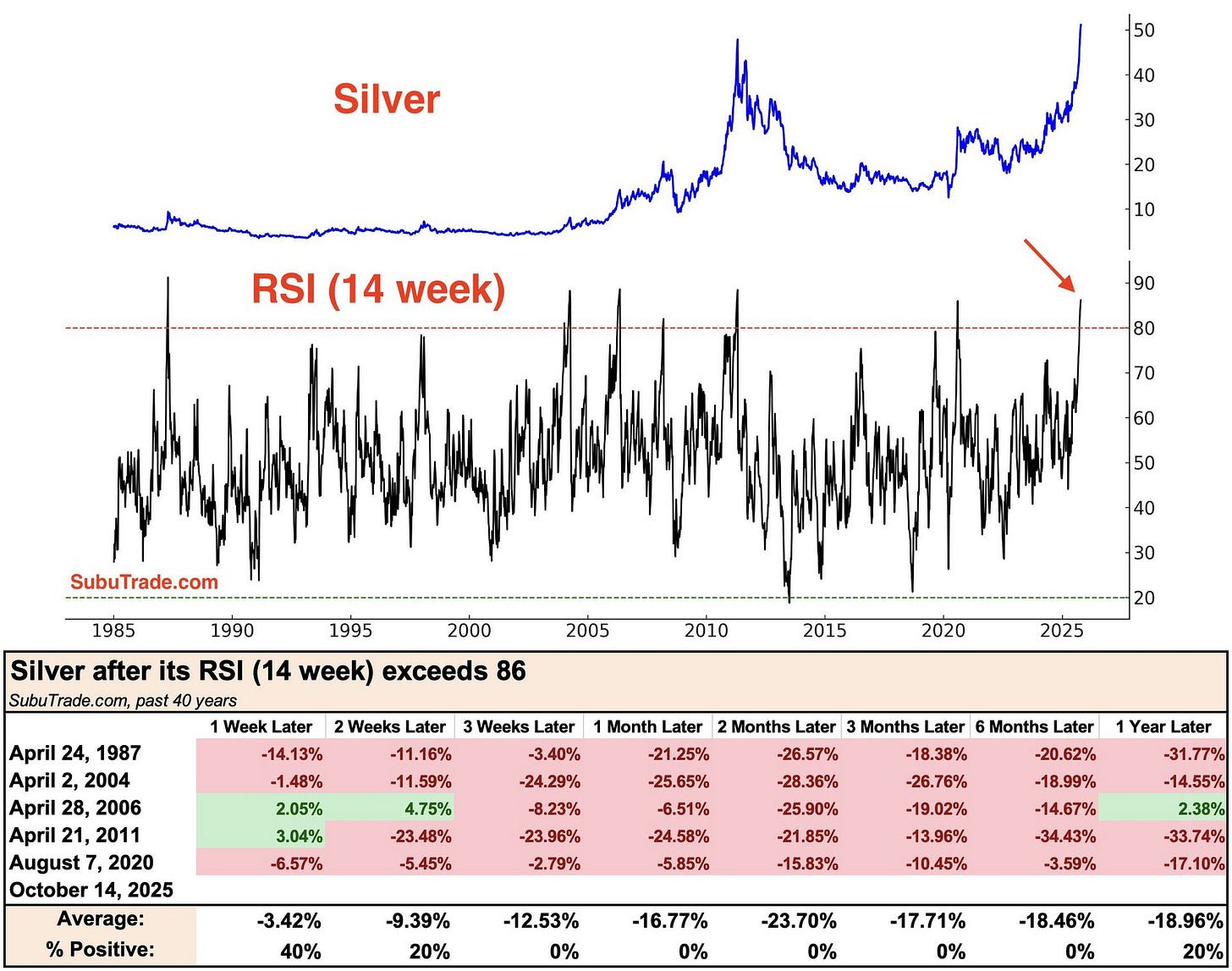

Today’s chart of the day needs little comment other than the opposing:

Trees don’t grow into the sky

Read today’s Quote of the Day above again.

Small caps breaking out suggests the market is truly leaning into a lower rates narrative.

Combining these two quotes perhaps captures both silver and gold's story - gravity and irrationality at play?