QuiCQ 15/11/2024

Shooting Star

“I always believe that the sky is the beginning of the limit.”

— MC Hammer

Yesterday was all a bit in the sign of mean reversion, as investors decided that:

Europe may be not THAT a place to invest

US markets may have gotten a bit ahead of themselves

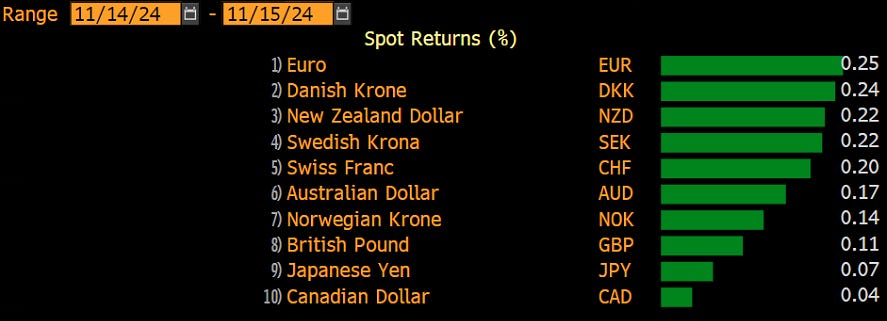

The Dollar’s rally may need a pause/consolidation:

And yields (US Tens) are at a crucial pivot “make or break” point:

Back to the stock market for a moment, where internals show that despite the US weakness still nearly 100 stocks hit a new 52-week high versus only 13 a new 52-week low, whilst the rallying European market showed a much more balanced (25/29) new highs/new lows ratio. In conclusion, I would make a bullish leaning conclusion for both areas.

Of course, was Jerome Powell’s speech on the Economic Outlook at an event in Dallas in focus, where the Fed chair noted that there is no need to hurry rate cuts with a strong economy and that he sees inflation on a ‘sometime-bumpy’ path toward the 2% target.

Overnight China retail sales beat forecast, though real estate data showed no improvement. Hence it seems the market is focusing more on the later, as the CSI300 is one of the larger Asian markets the only one down (-1.75%) this early Friday.

Last minute addition - UK economic data came in weaker across the board:

Have a great weekend!

Japanese candlestick learnings teach us that a shooting star formation happens after an extended rally a candle has a large upper shadow (high intraday high), but a small lower body, meaning that the asset under observation after a strong intraday rally closed nearly where it had opened. Often, it is interpreted as a trend-reversal signal.

This is what we got on the US Dollar Index (DXY) yesterday, with the addition that it occurred right in the vicinity of the previous high from exactly a year earlier ago:

Stay tuned…